Natalie ShermanBusiness reporter

Warner Bros. Discovery

Warner Bros. DiscoveryThe battle in Hollywood to buy Warner Bros Discovery promises to be a blockbuster.

Paramount Skydance, backed by the billionaire Ellison family, has been courting Warner Bros for months, hoping to join forces with the iconic Hollywood name as the media company struggles to compete with the likes of Netflix and Disney.

So far, Warner Bros has rejected these proposals. The company then announced a deal to sell the most valuable part of its business—its studio and streaming divisions—to Netflix instead.

Undeterred, Paramount chief executive David Ellison launched a hostile takeover bid, suing directly to shareholders.

What is a hostile takeover?

In corporate transactions, a hostile takeover is when a company moves to acquire another firm without the consent of the target company's management, usually by offering to buy shares of the target company.

It is different from a friendly takeover, which is mutually agreed upon by the boards of directors and shareholders of both companies.

What do we know about these two proposals?

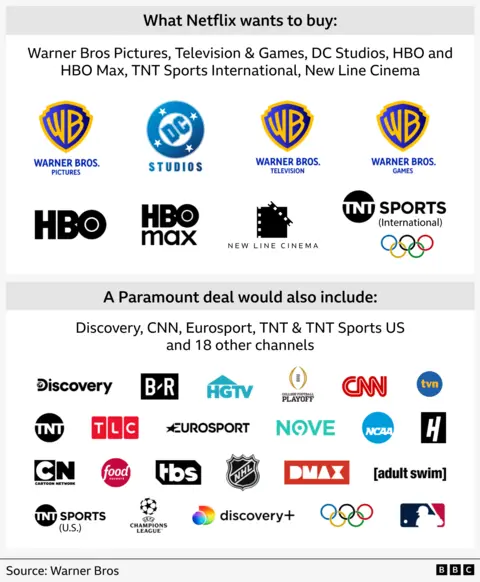

Netflix's offering includes the Warner Bros studio and streaming networks, and the rest of the company can be spun off as an independent company.

His proposal values the assets, which include brands such as Warner Bros, New Line Cinema and HBO Max, at $82.7 billion, including debt.

Netflix is offering to pay $23.25 per share and give existing Warner Bros investors a stake in the new company – a combination of cash and equity they say is worth about $27.75 per share.

Paramount, by contrast, says it wants to control the entire company, including the traditional pay-TV networks, which are considered to be in declining business.

Under the terms of the deal, the entire company is valued at $108.4 billion.

Paramount is proposing to pay $30 a share in an all-cash offering, which it says gives shareholders more certainty than Netflix's plan.

In both cases, the target completion date is many months away.

Why do Paramount and Netflix want Warner Bros?

Warner Bros, which dates back roughly a century, has a vast library of content ranging from classics like Looney Tunes and Casablanca to Friends, Superman and Harry Potter. Its HBO division is known for “prestige” television, including “The Sopranos,” “Sex and the City” and “Succession.”

But the iconic firm has come under pressure as online streaming disrupts the film and TV industries.

For Netflix, the largest player in the streaming industry with more than 300 million customers, buying its film and streaming division will strengthen its movie offerings while preventing any potential competitors from getting their hands on Warner Bros. content.

Paramount, on the other hand, is looking for a partner that will give it the ability to compete with industry giants like Netflix and Disney.

The takeover would build on Mr Ellison's purchase of Paramount, which he built into his Skydance film studio this summer.

On the streaming side, it hopes to add HBO Max's roughly 120 million streaming customers to Paramount's 79 million.

Analysts say the tie-up could also benefit struggling traditional pay-TV networks by giving them greater leverage in business negotiations and opening up opportunities for cost savings.

Paramount's traditional networks include brands such as Nickelodeon, CBS and Comedy Central, while Warner Bros will bring CNN, Food Network and a range of sports offerings.

Who is most likely to win?

Both deals raise competition concerns and are expected to face criticism from regulators in the US and Europe.

Netflix's plan has prompted warnings that it will give the dominant streaming player even more power over actors and writers while putting further pressure on local movie theaters.

But a combined Paramount-Warner Bros. company would also leave it with control over much of its sports and children's entertainment, raising potential concerns among advertisers and local TV distributors.

Paramount's plans to have CBS and CNN under the same parent company are also under scrutiny because of the potential impact on the news business and the Ellisons' ties to Trump.

Analysts say approval will likely depend on how broadly regulators decide to define the market and whether players such as YouTube are considered part of the competition.

Netflix is relatively new to deal making.

Some have also speculated that Paramount could be in a stronger position thanks to the relationship between Trump and the Ellison family, including tech billionaire and Republican mega-donor Larry Ellison. Trump's son-in-law Jared Kushner is also one of Paramount's financial partners.

But Trump himself has expressed little confidence in his views.

While he has praised the Ellisons in the past, on social media Monday he took aim at their ownership of Paramount, prompted by a 60 Minutes interview the company aired with former Trump ally turned critic Marjorie Taylor Greene, a Republican spokeswoman.

He previously noted potential concerns about a Netflix merger given the company's size, and also praised the streamer's bosses.

How might the deal affect consumers?

It's not clear.

Neither Netflix nor Paramount have given detailed insight into how they will incorporate Warner Bros. into their current offerings or take advantage of the opportunity to launch new kinds of streaming packages.

In terms of pricing, Netflix's expanded offerings could allow the company to charge customers more money. But if viewers find themselves paying for one streaming service rather than two, it could cost them less.

More than 70% of HBO Max customers in the US also subscribe to Netflix, according to analysts at Raymond James.

Why is Trump's son-in-law Jared Kushner involved in the bid?

Paramount's offer includes financing from Jared Kushner's investment firm Affinity Partners, which he founded in 2021.

Forbes estimates President Trump's son-in-law to be worth more than $1bn (£750m) and analysts say investors could view his financial support as an encouraging sign.

Kushner and other Saudi and Qatari sovereign wealth fund financiers who backed Paramount's bid agreed not to take on any controlling roles (such as board seats) in exchange for their investment.

But experts say Trump's ties to his family could raise ethical concerns about whether the president's influence could tip the scales.

One entertainment lawyer says that even if politics weren't part of the picture, regulators would still be asking tough questions.

Reporting contributed by Danielle Kaye and Pritti Mistry.