It seems like it's everywhere, but there's a new way to make predictions that opens up betting opportunities in areas where the practice is still illegal.

allow users to place bets on almost any outcome, and this is an exchange of opinions between users on either side of the outcome, rather than placing a bet at a casino or bookmaker.

This form of betting is in a legal gray area in most of Canada, but it is legal in the United States, so it opens the door to players in the 12 states where online sports gambling is still illegal.

The industry is gaining momentum

with billions in weekly transactions and is now signing major sponsorship deals with sports leagues.

Here's what you need to know about these markets, how they work and why they're so controversial.

What is a prediction market?

Prediction markets offer yes/no options

politics or popular culture that you might think about, including the New York City mayoral election results, the World Series winner, or even how many times “Robotaxi” is said during Tesla Inc.'s earnings call.

Essentially, players are buying a share tied to the outcome of the event. Prices range from zero to $1, with a correct result paying out the remaining dollar.

For example, as of Thursday afternoon, Yes stock for the Toronto Blue Jays winning the World Series was trading for 32 cents on the stock market.

market forecasting platform Polymarket

which means 68 percent of players choose “No.”

If the Blue Jays end up winning the World Series, those who chose “Yes” would receive a full dollar for every share they purchased, meaning a profit of 68 cents per share. Those who choose “No” will receive nothing because every share they receive goes to the winners.

Prediction markets are often considered more accurate than traditional polls, in part because users have a financial incentive to choose who they think will actually win the election.

During the 2024 presidential election, polls showed the race for the presidency between Donald Trump and Kamala Harris was practically a coin toss, but Polymarket had a 58 percent chance of Trump winning.

Who are the big players?

There are two major players in this market: Polymarket, owned by Blockratize Inc., and Kalshi Inc.

In October, InterContinental Exchange Inc., the parent company of the New York Stock Exchange, announced it would invest up to US$2 billion in Polymarket, valuing the platform at US$8 billion.

Earlier this month, Kalshi received funding that valued his platform at US$5 billion, more than double the valuation from four months ago.

There is a potential third major player, DraftKings Inc., that is also looking to enter the market.

DraftKings, known for its online sports gambling, announced this week that it is purchasing Railbird Exchange Inc., a prediction marketplace platform, to create an upcoming app called DraftKings Predictions that will open its services to people in all 50 U.S. states.

DraftKings, however, said it would not immediately offer sports forecasting contracts.

DraftKings Acquires Railbird to Drive Future Growth in Prediction Markets

Today, @DraftKings announced the acquisition of Railbird, a federally licensed exchange designated by the CFTC. The acquisition supports DraftKings' broader strategy to expand into prediction markets… pic.twitter.com/nrWicK9cUa

— DraftKings News (@DraftKingsNews) October 21, 2025

How popular are prediction markets?

The popularity of the US prediction market has grown under the Trump administration and the transition to more

relaxed regulatory environment

.

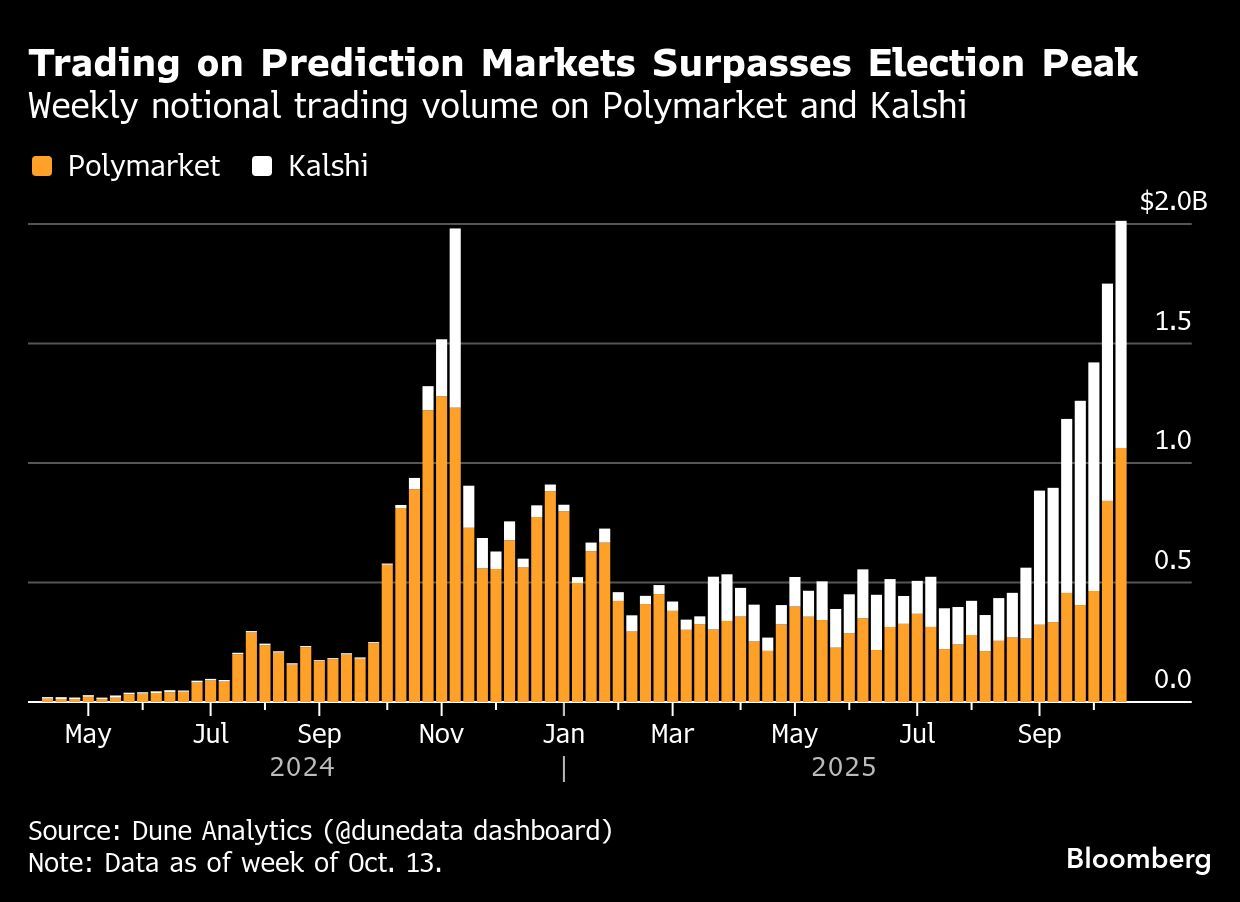

Polymarket and Kalshi's notional sales reached $2 billion for the first time last week, surpassing the previous peak during the 2024 US presidential election, according to Dune Analytics AS.

On October 22, the National Hockey League became the first major sports league to

and with Polymarket, and with Kalsha.

Why is this not covered by US gambling laws?

Because payouts often match payouts on gaming sites, regulators in several U.S. states have said the platforms violate state gambling laws.

But “Polymarket” and “Kalshi” successfully prove that these are not bookmakers at all, but financial exchanges.

Kalshi received the green light from the US Commodity Futures Trading Commission (CFTC) to operate in the country in May, and Polymarket received the go-ahead in September, so both companies can now operate in all 50 US states under federal commodity trading rules.

Several US states that regulate gambling have filed lawsuits against the markets, saying they are no different from online gambling and should be treated as such.

In April, the Maryland Lottery and Gaming Control Commission sent Kalshi a cease-and-desist letter, saying “the purchase of a contract is indistinguishable from the act of placing a sports bet.”

But judges in New Jersey and Nevada ruled in Kalshi's favor, allowing him to continue offering contracts in those states.

Is this legal in Canada?

Canadian regulations mean that trading binary options within 30 days of the event is illegal, although there is little to no enforcement.

In 2017

Canadian Securities Administrators

(CSA) has made it illegal to “advertise, offer, sell or otherwise trade binary options for less than 30 days with any person.”

At the time, CSA Chairman Louis Morisset called binary options contracts “the leading type of investment scam facing Canadians today.”

He said the CSA ban put him at the forefront of the fight against binary options scams.

“This sends a clear message that these products are not suitable for individuals due to their risky characteristics and that their trading is illegal,” he said.

However, Ontario is the only province that has taken action to enforce the ban.

In April, the Ontario Securities Commission imposed a two-year market ban and fine against current and former Polymarket operators for offering short-term binary options to Ontarians.

However, Kalshi's terms of service list Canada as a restricted jurisdiction.

only Ontario is listed as restricted.

Why are these platforms controversial?

Both Polymarket and Kalshi have faced accusations that their platforms are open to manipulation.

In August 2023, the NBA, NFL and MLB sent a letter to the CTFC stating that the lack of regulation of prediction markets would harm the integrity of their respective sports.

“In light of several unresolved issues, the NFL remains concerned that if sports betting contracts are allowed, they could potentially negatively impact the integrity and consumer confidence in our game,” Jonathan Nabavi, vice president of public policy and government relations for the NFL, said in the letter.

There were also political implications in these markets.

Prediction markets are sometimes praised for being more reliable than traditional polls, but there are concerns about foreign interference.

In 2024, four Polymarket accounts bet US$30 million on Donald Trump winning the US election, skewing the odds on the platform in Trump's favor.

Polymarket later said that the accounts belonged to a single French national with “extensive trading experience” and that there was no evidence of manipulation.

The election also prompted accusations of “wash trading” on pro-Trump platforms. Here, one user will buy and sell the same asset to artificially increase activity.

• Email: [email protected]