Canada seems to have

But it is predicted that the economy will go to water in the coming months, one group of economists calls for a deeper

By

In fact, much deeper cuts. While most BIG Six banks in Canada are called upon to be obtained by a central bank by 2.25 percent or higher, the capital economy predicts that it can reduce to 1.75 percent.

Canada Bank took its first step in six months in September, when it

Referring to a slower Canadian economy and weaker risks of inflation.

Many economists expect this to reduce another 25 basic points in October, but capital thinks that this will go further than it.

And

According to Stephen Brown, deputy chief of capital in North America, he raised the economy for a period of weak growth. Although capital does not expect a recession, he believes that the economy “balances on the verge”.

This predicts

This year will grow by only 1 percent, and

There will be a peak of 7.3 percent at the beginning of 2026, since the uncertainty related to the tariffs of the United States and weaker immigration weighs the economy.

While economists expect export and investment in business investments will partially bounce in the second half of the year, the costs of households will remain low.

According to Brown, inflation, on the other hand, will be a lesser problem when the federal government reduced most of its return tariffs against the United States.

According to him, about 3 percent adhered to, but the weakening of the labor market and the removal of tariffs should weaken it up to 2 percent by mid -2026.

“Both the core and the heading should look largely under control for several months,” Brown said.

“All this makes us think that this is not a question of whether the bank will cut again, but how far it will go.”

Capital “pencil” for three more abbreviations by 25 B.P. At any other meeting since October, given the emphasis of the Central Bank for caution.

Since this will lead to the fact that this rate is below the neutral range of the bank from 2.25 to 3.25 %, economists temporarily predict two increase in interest rates at the end of 2027, since the economy is restored and the level of unemployment is restored and reduced.

One substantive sign has yet to come to their forecast – this

be inserted on November 4.

The higher tone of Prime Minister Mark Karni for strictness may mean that a reduction in government’s jobs will come, Brown said, who will serve as a modest resistance to the economy, which prompted the Canada Bank to provide slightly greater support.

On the other hand, the Central Bank can see the need for slightly less support if more financial assistance is provided in the federal budget than expected.

Register here To deliver the supply directly to your mailbox.

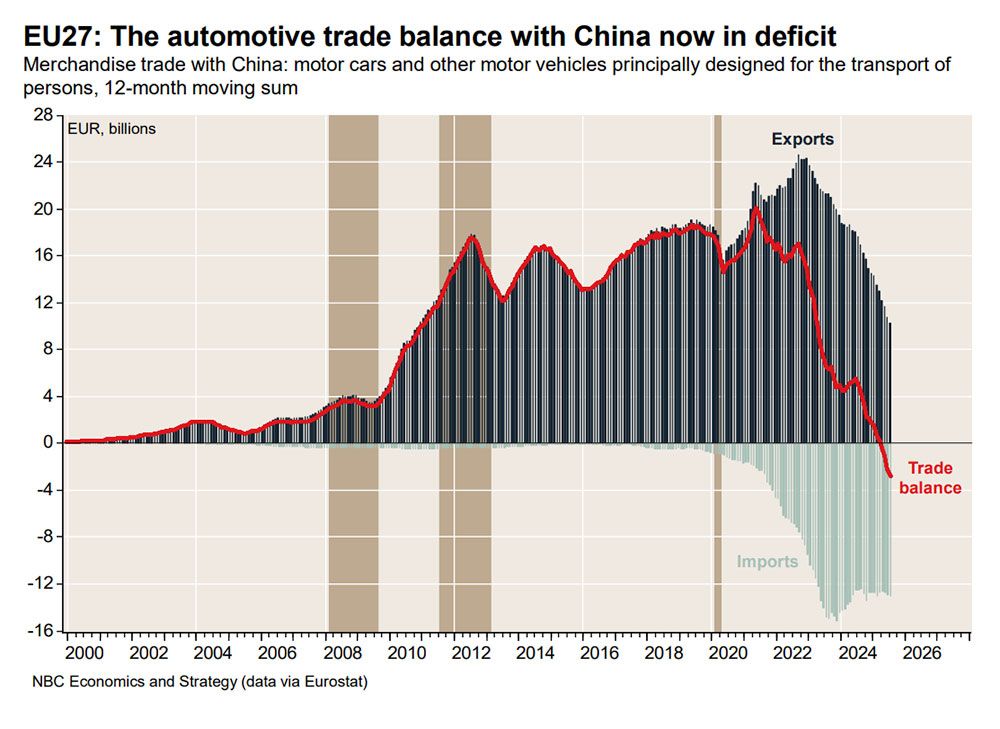

Here is the growth of a car nation. Today's schedule shows a stunning decrease in a trade excess in Europe with China in the automobile sector.

“Mass investments (and subsidies) into an electric vehicle sector in recent years have turned China from a marginal player into a leader in this area,” said the economist of the National Bank of Canada Jocelyn Pack.

In 2023, China surpassed Japan as an exporter of cars in the world with imports from China to the European Union, growing from almost nothing to 13 billion euros per year.

Meanwhile, the EU’s automobile export to China fell from about 24 billion euros a year in 2022 to only 10 billion euros today.

To curb the damage to local manufacturers, in October 2024 the EU introduced a tariff of up to 45 percent of Chinese electric cars.

“… We expect more measures aimed at protecting local manufacturers, both in the European Union and in other jurisdictions,” Paka said. “New fronts can still open in the World Trade War.”

- Canadian markets are closed for the national day of truth and reconciliation

- The clock is ticking for the US Congress in order to reach the financing agreement until midnight tonight, or parts of the government will begin to close.

- Today's data: US consumer confidence conference

- Earnings: Nike Inc, Richelieu Hardware Ltd., Paychex Inc.

- General Director of Barrick Mark Brastow a sharp departure raises questions

- Temporary foreign workers have become a political point of outbreak, but they are a matter of survival for some enterprises

- Will the growth of the trip “nearby” survive in return to the office?

Over the past 20 years, the share of elderly people aged 65 and older has increased steadily, increasing from 13 percent in 2005 to 19 percent in 2025. The statistical modeling of Canada suggests that it can reach 32 percent of the population over 50 years, which makes some people ask if the Canadian pension plan will be when they resign. Financial planner

Jason Hit looks at the fact that the CPP is ahead.

Maclister on a mortgage

Want to know more about a mortgage? Mortgage strategist Robert Maclister

It can help to navigate in a complex sector, from the latest trends to financing opportunities that you do not want to miss. Plus check it

For the lowest national mortgage rates in Canada are updated daily.

Financial post on YouTube

Visit financial post

For an interview with leading experts in Canada in the field of business, economics, housing, energy sector and much more.

Today's delivery was written Pamela heaven With additional reports from the Financial Post, Canadian press and Bloomberg.

Do you have the idea of history, filing, an embargo report or a proposal for this mailing list? Write to us at the address

Field

Add our website and support our journalism: Do not miss the business – the numbers that you need to know – add Financialpost.com on your bookmarks and subscribe to our information ballots Here