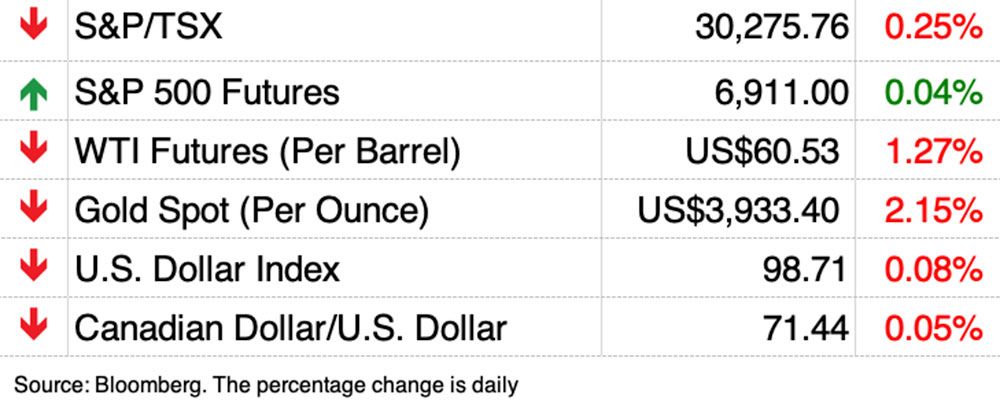

is losing ground, prompting some economists to “significantly” cut their forecasts for the currency.

Desjardins Group had predicted the Canadian dollar would reach 74 US cents by the end of this year, but has now cut that forecast by three cents to 71.

“Our forecast for USDCAD at the end of the year is 1.35. [74 U.S. cents] now seems unlikely,” Desjardins chief economist Jimmy Jean and currency strategist Mirza Shaheryar Baig said.

“We have revised our forecasts and now expect the Canadian dollar to remain soft over the next two quarters before gradually strengthening towards the end of next year.”

After reaching 74 US cents in June, the Canadian dollar began to decline not only against the US dollar, but also against other major currencies.

“This was not just a US dollar story,” the strategists said. The Canadian currency fell 6 percent against the Mexican peso, 5 percent against the euro and 3 percent against the yuan.

The CEER index, a weighted average of the Canadian dollar's bilateral exchange rate against the currencies of its major trading partners, is near a nine-year low, they said.

Desjardins suspects two key drivers are clipping the harrier's wings. Pension fund hedging flows have decreased and

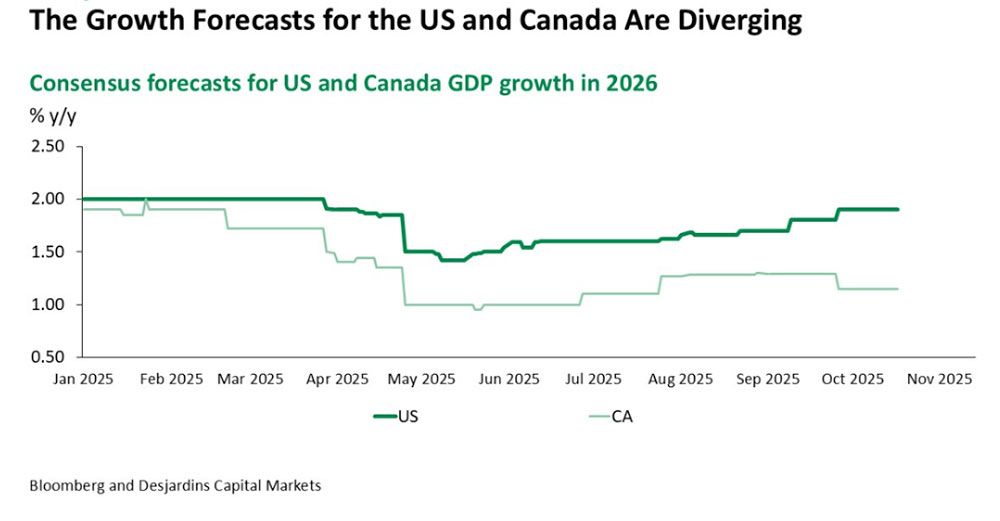

lags behind the US.

Canada's economy did not grow in the first half of the year, and Desjardins expects third-quarter growth to be less than 1 percent. Businesses remain cautious due to threat

and households are under strain as mortgages are renewed at higher rates. The rapid slowdown in population growth also played a role.

Although fiscal stimulus is expected in the coming years

its benefits won't become apparent until 2026, strategists say.

In the south the picture is completely different. Robust consumer demand and business investment boosted economic growth in the first half of the year, particularly in high-tech sectors, and economists are now “significantly” improving their forecasts.

Atlanta Federal Reserve Bank GDP Now

currently estimates third-quarter growth at 3.9 percent.

There are risks to the US outlook. Trade tensions with China could escalate, the government shutdown could drag on to the point where it hurts the economy, and high-growth tech stocks could see a correction.

“The US dollar has stabilized for now but remains vulnerable if any of these risks materialize,” the strategists said.

However, another driver of the Canadian dollar's growth – pension fund hedging – has faded into the background since the summer. Desjardins said Canadian pension funds significantly increased their foreign exchange hedge ratios in the second quarter, strengthening the Canadian dollar, but they now appear to be sitting on the sidelines.

When this wave has passed, the rate differential is the gap between the Bank of Canada and US rates

– reaffirms its influence on the Canadian dollar.

Both Canada's central bank and the Fed will decide on interest rates tomorrow, and both are expected to cut them, setting rates at 2.25 percent and 3.75-4 percent, respectively.

But Desjardins believes the gap could widen further, putting more pressure on the Canadian dollar if the Bank of Canada cuts rates to 2 percent faster than markets expect, as they forecast.

The Canadian dollar was trading at 71.40 US cents this morning.

Register here to have Posthaste delivered straight to your inbox.

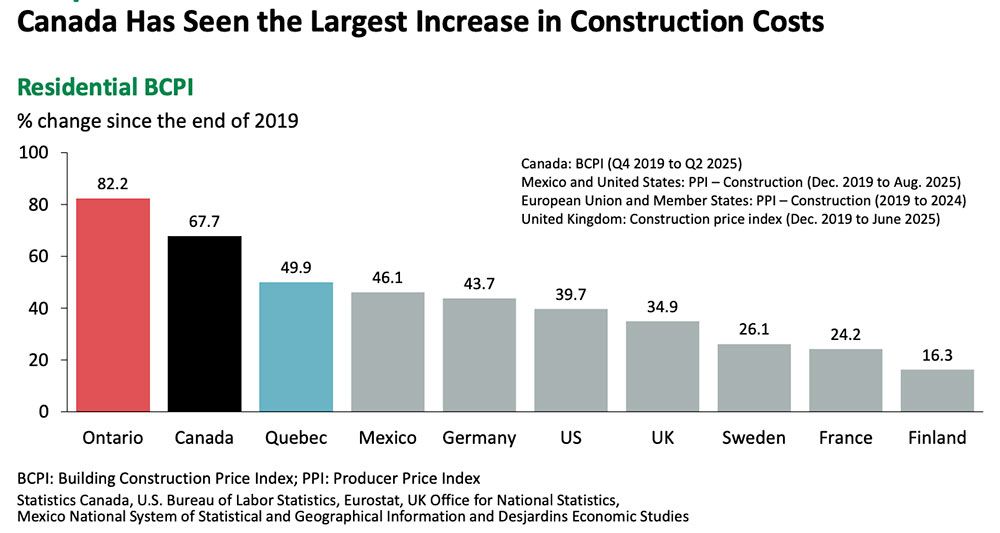

Construction costs in Canada have risen 67.7% since the end of 2019, the fastest pace among developed countries.

All major economies experienced a surge in construction costs amid a global supply shock and high commodity prices caused by the COVID-19 pandemic, but regional factors were also at play in Canada, economists at the Desjardins Group said. Skilled labor shortages, regulatory red tape and intense real estate speculation, especially in Vancouver and Toronto, contributed to rising costs.

Canada, however, is not the most expensive place to build homes. This is the case for New York, which tops the World Population Review list with a price of US$5,723 per square meter. Vancouver ranks 15th at $3,063 per square meter.

- Today's data: US Conference Council Consumer Confidence

- Earnings: First Quantum Minerals Ltd., Centerra Gold Inc., New Gold Inc., Visa Inc., PayPal Holdings Inc., Mondelez International Inc., Electronic Arts Inc.

- The Bank of Canada is expected to cut interest rates this week as forecasters see the economy weakening further.

- Canada is set to announce its new immigration targets, but what is the right number?

- How to Gracefully Exit Certain Positions in the Stock Market

The market party is in full swing, but cracks are forming, writes investment specialist Martin Pelletier. He explains how investors can gracefully exit certain stock market positions when the music stops.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here