Bubble warnings have been gaining momentum at an alarming rate lately as US stocks continue to rise turbulently.

Since April

The rate was 35 percent, one of the best performances since the 1950s, despite a troubling backdrop of trade and geopolitical tensions and rising public debt.

This began to unnerve everyone from the Bank of England to Jamie Dimon.

Last week he warned: “Financial stability risks remain elevated. Valuation models show risk asset prices well above fundamentals, raising the risk of a sharp correction.”

How sharp is the correction? IN

article for The Economist magazine

It warned that the world was becoming dangerously dependent on US stocks, said former IMF chief economist Gita Gopinath.

compared to the dot-com boom of the late 90s. When the crash occurred in 2000-2002, US$5 trillion was wiped out in market capitalization.

She estimates that a correction of this magnitude today would wipe out more than $20 trillion in wealth from American households, equivalent to about 70 percent of the United States' gross domestic product in 2024.

The impact will be felt around the world, including in Canada, where I

investors poured money into US stocks

and bonds at unprecedented rates this year.

Royce Mendez, head of macro strategy at Desjardins Group, said that while such a correction would hurt Canadians, the economic impact here would not be as severe as south of the border.

He estimates that a correction in stocks related to the scale of the dot-com crash would result in a loss of wealth for Canadian households equivalent to about 45 percent of GDP.

The reasons for this are that Canadian portfolios tend to favor domestic stocks, which are less exposed to the technology sector, and Canadian households hold a smaller share of their wealth in public stocks, he said.

“Canadians tend to access fixed income through mutual funds, while Americans are more likely to own bonds directly,” he said.

But before we get complacent about that, Mendes warns that while Canadians are less vulnerable to a correction in stocks, they are heavily invested in another risky asset class.

Real estate makes up about 40 percent of household assets in Canada, compared with 25 percent in the United States, and its value has been falling over the past two years.

“Falling home prices in many provinces have limited wealth accumulation in Canada,” Mendes said, with household wealth rising just 7 per cent since 2022, compared with a 16 per cent gain for American households.

This is something

we have to watch, he said.

“Most homeowners still have significant equity, but that stock is shrinking month by month,” he said. After years of decline, stabilizing house prices should be a priority for monetary policymakers as they seek to restore the economy to full health.”

Register here to have Posthaste delivered straight to your inbox.

Canada

in August but then likely fell sharply in September, which could weigh on economic growth in the third quarter, economists warn.

Auto sales were the main driver of the August recovery, but excluding them, spending rose just 0.7 per cent, well below forecasts, said National Bank of Canada economist Kyle Dahms.

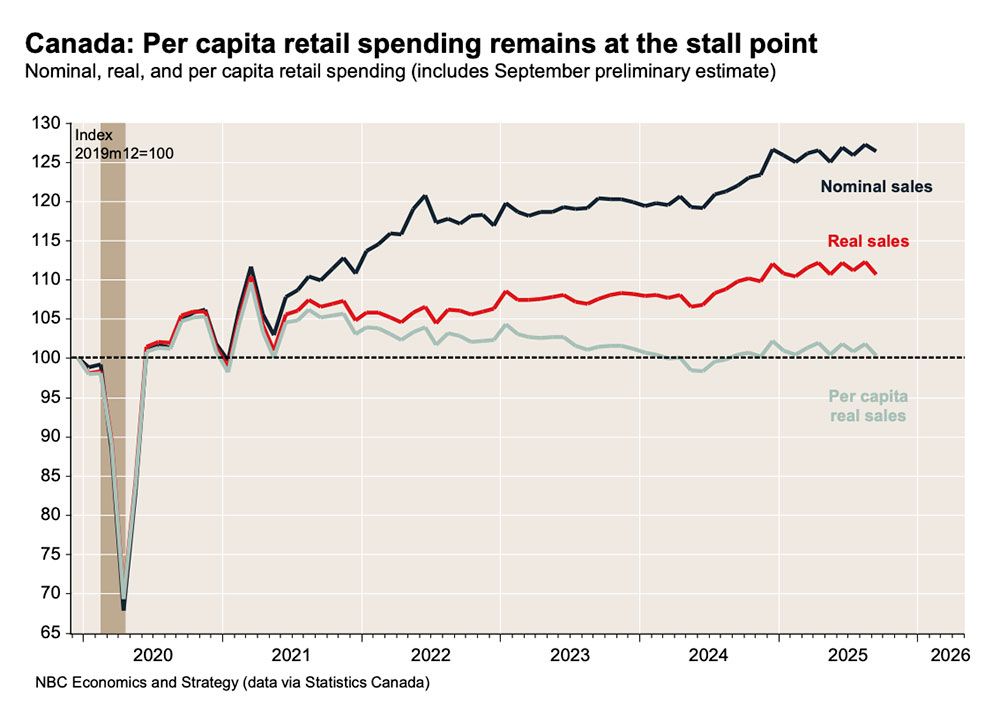

Statistics Canada estimates September sales fell 0.7 per cent, and today's chart shows spending per capita, or per person, has been flat for some time.

- Prime Minister Mark Carney is attending the ASEAN summit in Malaysia as part of a nine-day trip to the region.

- Today's data: US inflation data for September

- Earnings: Procter & Gamble Co., General Dynamics Corp.

- The electric vehicle supply chain in Canada is weakening. Will dreams of turning the country into a powerhouse continue?

- New data shows excessive TFSA contributions are leaving thousands of Canadian taxpayers in trouble with the CRA

- Pay Attention to These Key Signs of a Stock Market Bubble

Excessive contributions to tax-free savings accounts (TFSAs) continue to be a major problem for thousands of Canadians, as well as a source of increased tax revenue for the Canada Revenue Agency (CRA) as it tirelessly pursues punitive tax collections in the courts. Tax expert Jamie Golombek talks about the rules and penalties.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here