Canadian actions broke into new maximums in recent weeks, and analysts say that this is a trend that will continue, since global investors will look outside the United States.

According to analysts from Desjardins Group, the world of post-pandemia was marked by military conflicts, growing populism and growing financial pressure in developed countries, which are usually observed only in developing markets.

Economic and geopolitical uncertainty lost investors against this background,

He acts as a “hedge against institutional fragility”, wrote Jimmy Gin, a team led by the chief economist of Desjardins.

WITH

According to analysts, he was elected president, the share of foreign countries buying the US treasury fell sharply, and investors are more interested in Canadian long -term bonds.

“Since the foreign interest in US treasury is weakening, Canada has become a winner,” wrote Desjardins Macro Strategest Tiago Figueireedo.

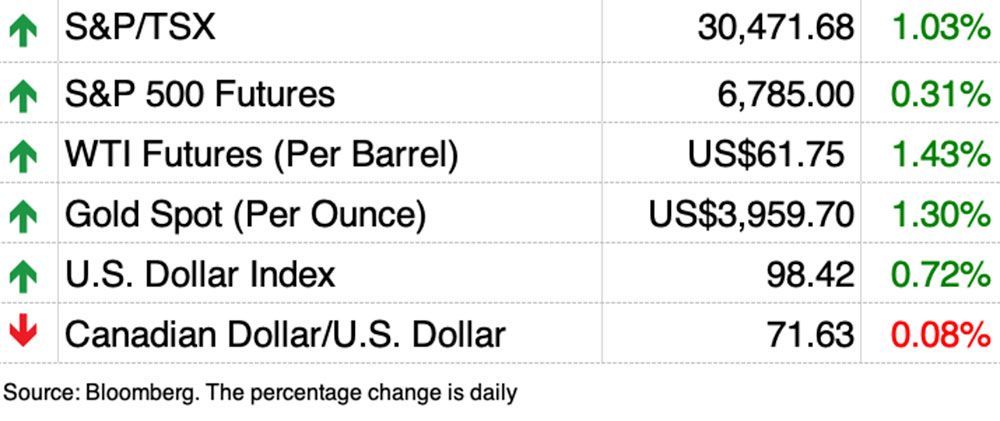

Investors today are increasingly looking for security. You just need to look at gold that today has received another record of almost $ 4,000 for ounce against the backdrop of fears that the US Federal Government extends. This traditional safe shelter increased by 50 percent this year.

Canadian actions “move in tandem with

Since investors strive to protect against potential decay in US dollars, ”analysts said.

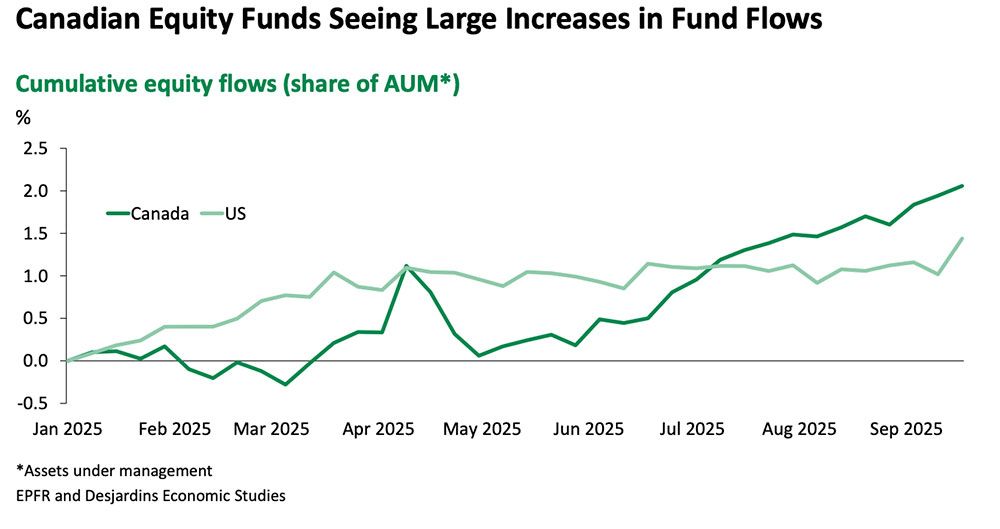

The fund enters Canadian actions, ahead of the US funds and the materials sector, which accounted for only 16 percent of TSX, drove almost a third of the return, even defeated financial indicators that have twice as many weights.

“In an environment, where institutional risks and macro are vaulted, this connection with solid assets has become a key difference for Canadian actions, even if the force went beyond the scope of goods,” they said.

And unlike the S&P 500, where the profit on several technological shares were concentrated, Canada rally was widely based on about 80 percent of TSX companies that published positive profit this year.

“This concentration – along with insufficient efficiency in wider US actions – may be one of the reasons why investors are increasingly turning to Canadian actions that offer both diversification and more balanced participation in the sector,” they said.

Canadians are one of the largest foreign owners of US shares, mainly from the internal pension funds, but more of these institutional money could start leaking north.

Planning to quickly track large infrastructure projects.

Bloomberg reports that analysts consider the main project of Ottawa as a larger positive TSX catalyst than

A decrease in bets and expects this to help the index continue to surpass the S&P 500.

“Canada has not been invested enough for many years,” Greg Taylor, Penderfund Capital Management Ltd, investment director of investment, said Bloomberg. “If we actually start to see some specific growth examples, this can lead a lot of investors' money to the country.”

Delivery

On November 4, it will be crucial for maintaining the view of investors on stability, said Desjardins analysts.

“If Canada can remain“ the cleanest dirty shirt in the laundry basket, ”when it comes to the stability of the G7, the fiscal stability of the G7, Figueireido has more opportunities for federal and provincial bonds.

Register here To deliver the supply directly to your mailbox.

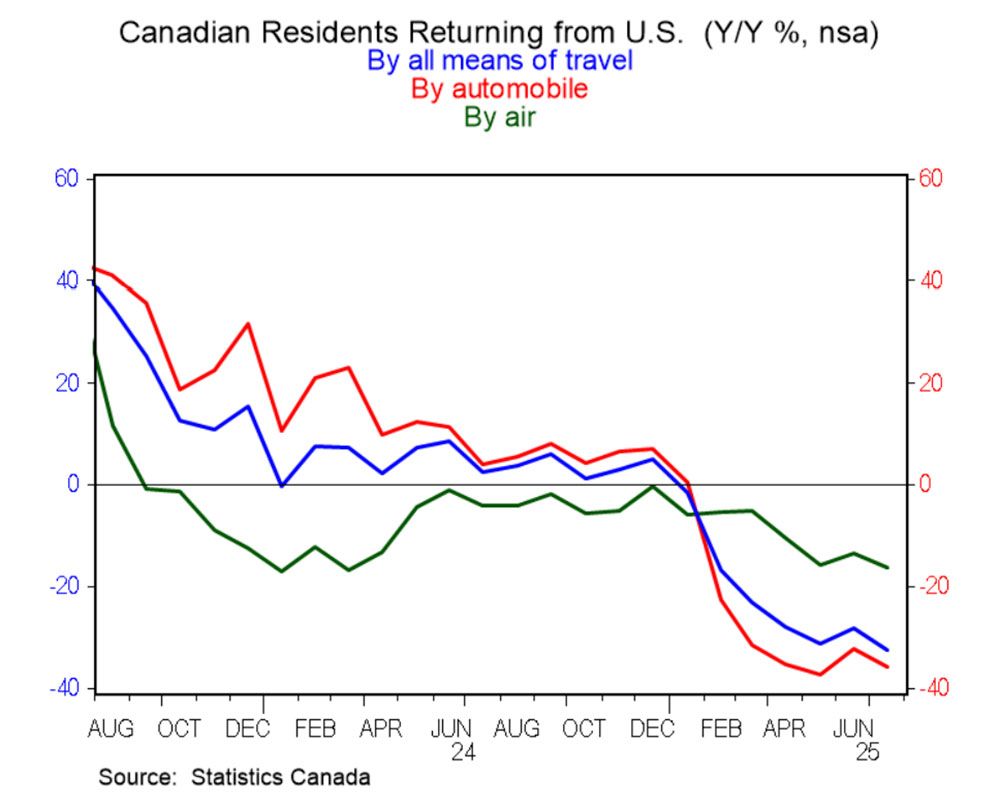

The desire of Canadians to travel to the United States is currently increasing the economy, said Sal Guatieri, senior economist BMO Capital Markets.

The latest data about the trip showed that return trips fell by more than 32 percent last year until July, “without any signs of rotation,” he said.

The return by car fell by almost 36 percent, while traveling in the air fell 16 percent.

This year, the Americans made 3 % of trips to Canada in Canada, but this was compensated by a jump in visits to other countries, which grew by more than 8 percent.

The movement “Buy Canada” does not seem to let go, assuming that consumers will again provide timely support to the economy in this quarter in accordance with the previous one, ”Gutieri said.

- Prime Minister Mark Carney will go to Washington today to meet with US President Donald Trump on Tuesday.

- Earnings: CONTELLATION BRANDS INC.

- Sales of houses in Toronto are growing after a decrease in interest rates, but prices are still falling

- Five provinces raised their minimum wages this week. This is how your region develops

- The agreement that the agreement on the premes will surpass the will for death?

As the festive season approaches, the spirit of the return is in the air. The presentation feels good, and regardless of whether you do from compassion, a sense of duty or desire to support a family, neighbors, public groups or local charitable organizations, your generosity matters, writes Credit Consultant Mary Castillo. But when charity will affect your finances, it's time to summarize. Castillo offers some

About the ways to be generous, not at risk of financial health.

Maclister on a mortgage

Want to know more about a mortgage? Mortgage strategist Robert Maclister

It can help to navigate in a complex sector, from the latest trends to financing opportunities that you do not want to miss. Plus check it

For the lowest national mortgage rates in Canada are updated daily.

Financial post on YouTube

Visit financial post

For an interview with leading experts in Canada in the field of business, economics, housing, energy sector and much more.

Today's delivery was written Pamela heaven With additional reports from the Financial Post, Canadian press and Bloomberg.

Do you have the idea of history, filing, an embargo report or a proposal for this mailing list? Write to us at the address

Field

Add our website and support our journalism: Do not miss the business – the numbers that you need to know – add Financialpost.com on your bookmarks and subscribe to our information ballots Here

![[À VOIR] Sophie Grégoire semble confirmer l’idylle entre Justin Trudeau et Katy Perry dans sa vidéo à propos de «l’endurance de l’amour» [À VOIR] Sophie Grégoire semble confirmer l’idylle entre Justin Trudeau et Katy Perry dans sa vidéo à propos de «l’endurance de l’amour»](https://i1.wp.com/m1.quebecormedia.com/emp/emp/a41ad330-f2c3-11ee-9285-c7fb67b18d5c_ORIGINAL.jpg?impolicy=crop-resize&x=0&y=156&w=1200&h=675&width=1200&w=150&resize=150,150&ssl=1)