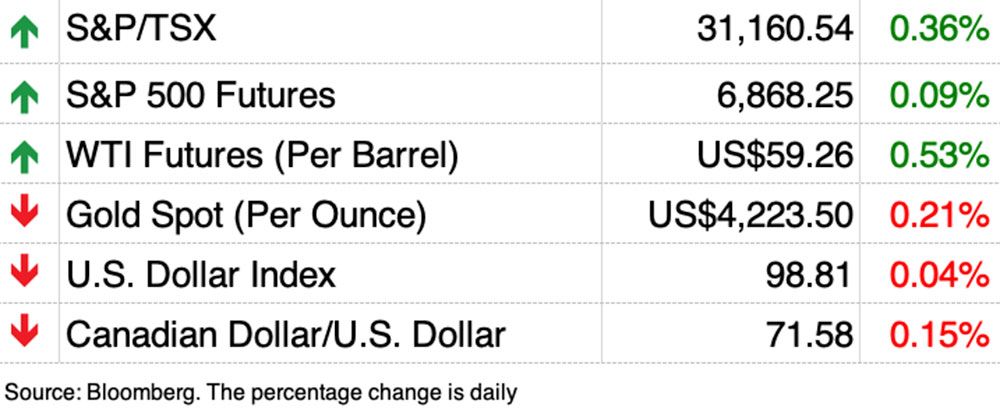

Canada's main stock market has had a pretty good year, and much of that momentum has come from the yellow metal.

Gold stocks benefiting from historic growth

currently represent more than 12 percent of market capitalization

The composite index represents its highest share ever and is well above the historical average of 4.8 per cent since the mid-1970s, National Bank of Canada strategists said.

Year to date, the TSX boasts a 30 percent return and is on track to match the record annual return of 35.1 percent set in 2009. For the first time since 2016, the Toronto index is ahead of the S&P 500 in a rising market, Bloomberg reports.

Banks and commodities companies outperformed the index, with banks delivering a 37 percent year-to-date return and commodities, including gold stocks, a whopping 95.3 percent.

But strategists led by Stefan Marion say it's not just gold that could support the TSX next year.

They believe that

The November 4 speech signaled a more hands-on approach to conventional energy as part of Canada's industrial strategy, a policy shift that was reinforced by

signed by Alberta and Canada later that month.

This agreement will allow the province to develop its fossil fuel industry without federal emissions shortfalls.

“We view this agreement as fundamental to making Canada an investment destination again,” the strategists said.

“The fact that the oil and gas sector is no longer viewed as a worthless asset could significantly reignite investor interest in the S&P/TSX energy complex and, over time, facilitate a new wave of foreign direct investment in Canada.”

National's asset allocation remains underweight in equities, particularly in the US, where analysts believe high valuations and volatility will make it difficult to generate profits.

Canada, however, must continue to move forward even though estimates have risen above long-term averages, with National recommending an overweight in energy equipment and services, as well as oil, gas and consumable fuels.

“Investors increasingly recognize that the Nov. 4 federal budget is consistent with Ottawa's commitment to business,” they said.

“Further progress in trade negotiations between Canada and the United States – an outcome we believe is likely in the coming months – should provide another catalyst for domestic equities.”

Register here to have Posthaste delivered straight to your inbox.

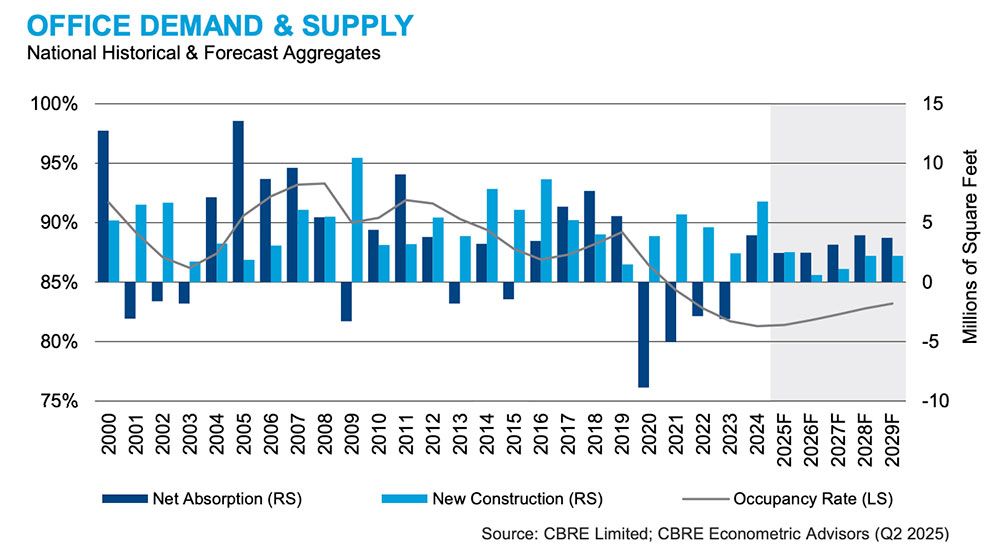

Workers are returning to offices in Canada's largest cities, brightening prospects

.

Office leasing in downtown Toronto surged in the third quarter, gobbling up about 1.5 million square feet of prime Class A space, according to real estate company Morguard.

“This strong performance is largely due to the return to offices of the country's largest banks and public sector,” the report said.

Calgary, London and Halifax also reported positive net absorption figures as demand for office leasing in the country outstripped supply.

Canada's office vacancy rate fell 30 basis points to 18.4 percent, with the average vacancy rate for Class A downtown space falling to a “relatively healthy” 16.1 percent.

Morgard expects rental demand to increase early next year as more workers return to the office for more days.

“In some cases, tenants will have to expand to accommodate their returning employees,” the release said.

- Today's data: Canada Ivey Purchasing Managers' Index, US Initial Jobless Claims

- Earnings: Canadian Imperial Bank of Commerce, Bank of Montreal, Toronto Dominion Bank, BRP Inc., Dollar General Corp., Hormel Foods Corp., Hewlett Packard Enterprises Co., Kroger Co.

- Why Carney's fiscal anchors raise questions about Canada's fiscal soundness

- RBC chief warns of economic uncertainty as bank profits exceed expectations

- Retired couple's net worth could rise from $1.75 million to more than $5 million in 30 years, expert says

'This is the new slavery': Temporary farm workers are underpaid, abused and injured

Broken bones, rashes from pesticide exposure, unpaid labor, substandard housing. It's a price often paid by tens of thousands of migrants who come to Canada as temporary farm workers. Read the investigation

When people think of philanthropy, names like Bill Gates or Warren Buffett often come to mind, but philanthropy isn't just for the super-wealthy.

Ordinary Canadians who want to make a difference can also give in a variety of ways.

The desire to give is commendable, but figuring out where to start and how much to give without affecting other financial priorities can be challenging.

Diane Orlik, senior investment advisor at Richardson Wealth, offers some tips on how to integrate philanthropy into your financial plan.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here