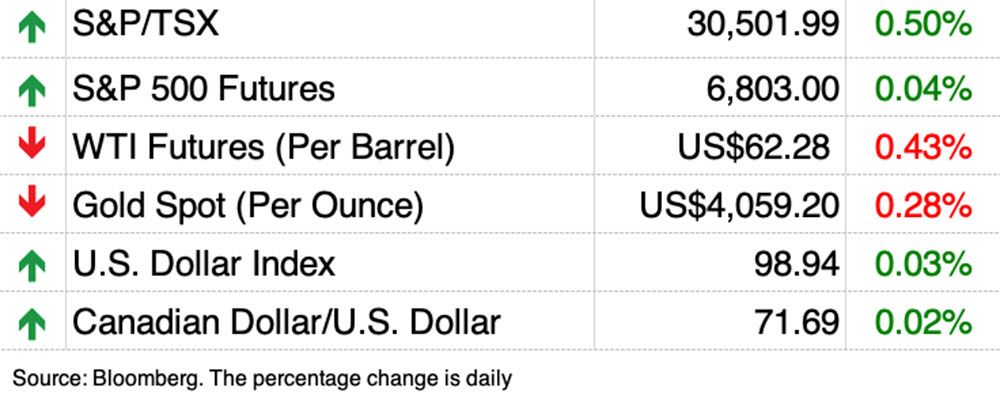

It has languished in the shadow of a stronger US dollar lately, but analysts say better days are ahead for Canada's economy and its currency.

The Canadian dollar has been trading at around 71 US cents since late September, a four-month low, but analysts at BofA Global Research see two catalysts that could turn the tide.

They believe the Canadian dollar will rise in the coming weeks and reach 73.52 US cents by the end of the year. A Reuters poll of currency strategists shared that forecast and showed the Canadian dollar even higher to 74 US cents within 12 months.

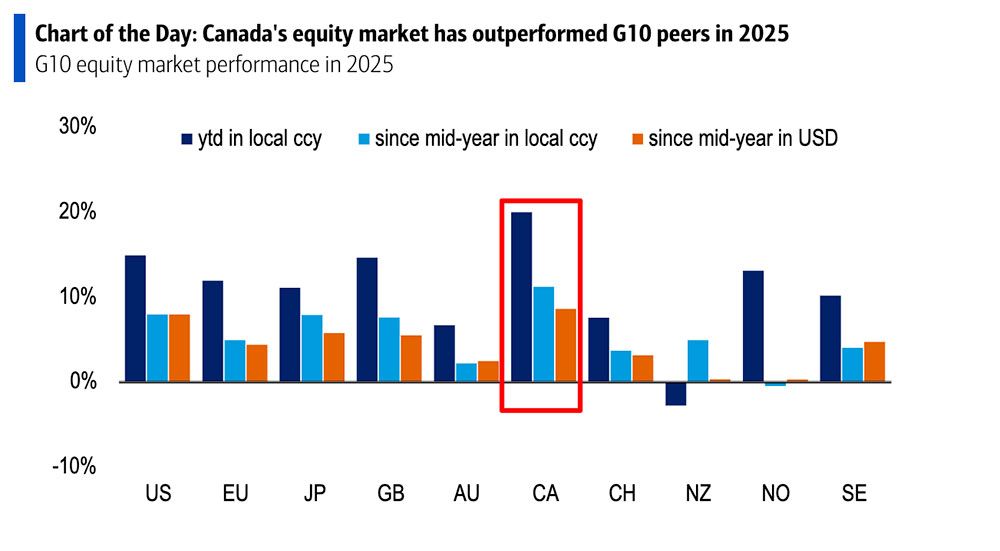

The outstanding performance of the Canadian stock market is one of the reasons why

is bullish on the Canadian dollar. Has not only

US markets have also outperformed the rest of the world this year.

It's true that the market appears to be out of step with Canada's weaker economy, but BofA analyst Howard Du sees two reasons for the gap. The TSX rally was driven largely by precious metals mining in the materials sector, and Canada's stock market represents a smaller share of the economy than its counterpart in the United States.

Despite this, Du said the stock market's outperformance should ultimately support the economic recovery. More than 75 percent of the time over the past 50 years, he said, the TSX Index's rise of 20 percent or more was accompanied by above-average economic growth.

the November 4 filing could provide another tailwind for the Canadian dollar.

Bank of American believes that, unlike some other advanced economies, Canada can afford to step up fiscal stimulus “without attracting the attention of global bond vigilantes.”

“The latest levels of long-term government bond yields, central government debt-to-GDP ratios, interest obligations and overall fiscal deficits suggest Canada's fiscal position is not in the same league as the US, UK or France, which have faced negative fiscal shocks this year,” Du wrote.

Analysts believe that a large-scale fiscal expansion plan will be announced on November 4, which will serve as a catalyst for the Canadian dollar to rise against the US dollar.

There are risks to their prognosis. A global risk shock that extends the US dollar's rally could send the Canadian dollar off course. Another risk could be a deeper cut in interest rates.

.

BofA expects Canada's central bank to cut the rate to 2 percent, but if tariff tensions escalate or the economy remains weak, it may have to cut the rate further. They say this will widen the gap between Canadian and US rates and put pressure on the Canadian dollar.

Register here to have Posthaste delivered straight to your inbox.

Canada

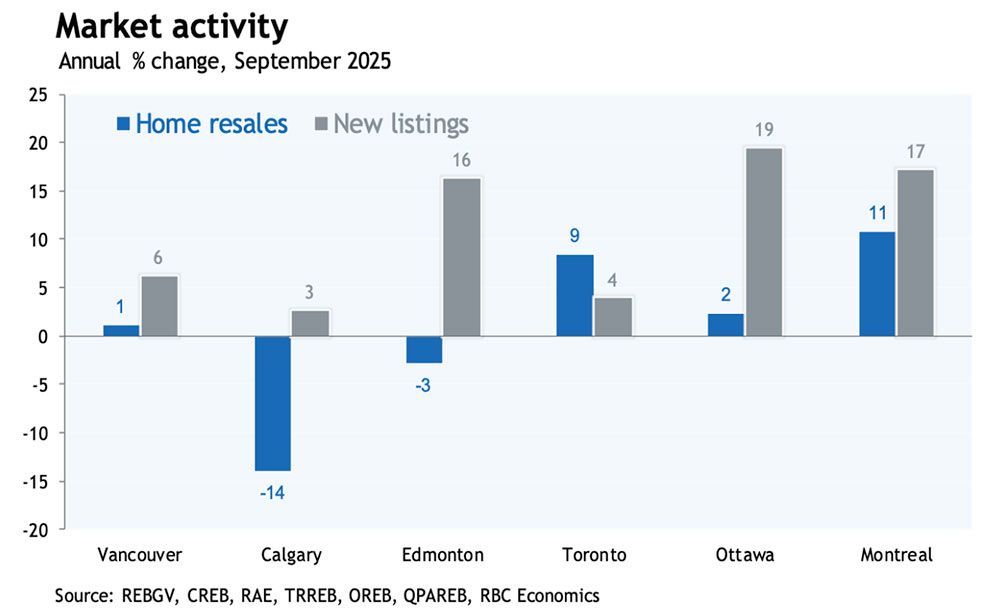

Economists say the recovery remains “uneven and fragile” ahead of the fall season.

While September data from local real estate boards showed improvement in Winnipeg, Regina and Toronto, home sales fell in other major markets such as Calgary, Vancouver, Montreal and Halifax, Robert Hogue said.

assistant chief economist.

“There is still little urgency to buy despite growing confidence among buyers as worst-case economic scenarios appear less likely,” he said.

Shoppers have more choice in Ontario, British Columbia and parts of Alberta, but may have to expect even lower prices.

- Bank of Canada Senior Deputy Governor Carolyn Rogers speaks at the Canada Club in Toronto

- Earnings: Aritzia Inc., Delta Air Lines Inc., PepsiCo Inc., Richelieu Hardware Ltd.

- Cenovus increases offer for MEG Energy to $8.6 billion as takeover battle winds down

- Trump adds second Canadian company to growing US government portfolio

- Empty nesters wonder if they've saved enough to retire and when they should take CPP and OAS

Katie and Trevor, both 50 years old, have two financial goals they want to achieve before they retire. They want to pay off the mortgage on their primary residence and accumulate $500,000 in easily accessible investment income. Find out what the experts are doing

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here