“Missing middle”

— the kind that people can afford and that offers more space than a squished condominium — are starting to pop up in greater numbers, according to a new report from

Canada Mortgage and Housing Corporation

(CMHC), possibly giving hope to young families looking for a home where they can stretch their legs.

“Missing middle” refers to low-density housing such as suites in detached homes, row houses, stacked townhomes, multiplexes and low-rise apartments of four storeys or less. Typically, “these housing types are often under-represented in new supply,” which is why they are referred to as “missing,” CMHC said in its report on the sector released on Thursday.

CMHC said this type of accommodation is critical to solving Canada’s

.

“It broadens housing choices for families who can’t afford single-detached homes and find high-rise apartments do not offer enough space for their needs,” the report said. “Missing middle” housing is also key to solving the housing crisis because it can be built in existing neighbourhoods, often faster and for less money.

The federal housing agency tracked “missing middle” housing in six major Canadian cities —

,

, Edmonton,

, Ottawa and Montreal — and found that between 2023 and 2024, construction of these types of homes rose 44 per cent after only rising by about five per cent from 2018 to 2023, based on historical housing starts data.

But don’t start celebrating yet.

“There’s been a steady increase in missing-middle housing starts across Canada’s six major cities, but this masks significant regional differences,” the report said.

Here’s a look at the cities that are getting it right and those that still have some work to do.

Calgary and Edmonton are the “missing middle” superstars, accounting for 67 per cent of starts for this kind of housing, CMHC said, with both cities experiencing “rapid growth” in recent years.

Both of these Alberta cities have traits conducive to these types of builds, including plenty of land, more accommodative regulations and a rising population as interprovincial migrants flock west. The latter has increased demand for rental units, which are also on the rise.

“Favourable policies and incentives have further facilitated this development along with broader increases in overall housing starts,” CMHC said.

Row-home construction in the suburbs accounts for a lot of the “missing middle” supply in the Prairies, especially in the Calgary and Edmonton suburbs. CMHC also found that more infill construction is occurring in their downtowns.

Moving to the centre of Canada, Ottawa and Montreal accounted for the next largest share of total “missing-middle” construction in 2024, at 21 per cent.

CMHC attributed this increase to the 2022 rise in interest rates, which it said encouraged developers to build smaller projects because they require less capital and can be easier to finance.

“Following the 2022 interest rate hikes, these starts have helped cushion the downturn in overall development activity in these cities. Smaller projects may be more feasible in a challenging development climate,” CMHC said.

In Montreal from 2018 to the second quarter of 2025, apartments of four storeys or less were the most-built among the different types of “missing middle” housing.

The CMHC expects the trend to continue, given Montreal’s history of favouring this type of construction.

Rowhomes dominated the sector in Ottawa, given the availability of land, favourable zoning bylaws and

compared to detached homes.

The “missing middle” laggards of the group are Toronto and Vancouver. In the latter, this type of housing construction fell 56 per cent between 2018 and 2024, with developer sources telling the housing agency that the cost of land, especially in the downtown core, made building such lower density homes financially unfeasible.

In Vancouver, where housing affordability is the most stretched of the six cities, accessory housing has become a popular way to help pay for the cost of a home. Data over the last two decades bears that out, as the number of single detached homes with accessory dwellings swelled.

Toronto appears to be getting its house somewhat in order. There, low-density infill conversions, called a “necessity” by CMHC, increased fourfold compared to single and semi-detached starts in the first half of 2025.

“Unlike high-rise construction, which is concentrated in the downtown core, infill conversions are happening across the city. These projects are adding density to neighbourhoods that were previously limited to single- and semi-detached homes,” CMHC said.

Introducing FP West: Energy Insider, a new subscriber-exclusive newsletter from the Financial Post Western Bureau. Get behind the oilpatch’s closed doors with exclusive insights from insiders every Wednesday morning. Sign up now.

Sign up here to get Posthaste delivered straight to your inbox.

- Canadian Club Toronto hosts event featuring conversation with Canadian Prime Minister Mark Carney

- Economic Club of Canada hosts “The Federal Budget Unpacked” with keynote address from Conservative leader Pierre Poilievre

- Today’s data: Statistics Canada releases jobs numbers for October.

- Today’s earnings: Enbridge Inc., Emera Inc., Milestone Pharmaceuticals Inc., Canadian Utilities Ltd., Atco Ltd., Algonquin Power & Utilities Co., Docebo Inc., Endeavour Silver Corp., Onex Corp., Illumin Holdings Inc., Canopy Growth Corp., Ensign Energy Services Inc., Boralex Inc., Constellation Software Inc., Cipher Pharmaceuticals Inc., Dorel Industries Inc.

- Canada’s new immigration targets likely higher than headline number

- More Canadian natural gas headed to Europe as Tourmaline inks supply deal with British Gas owner

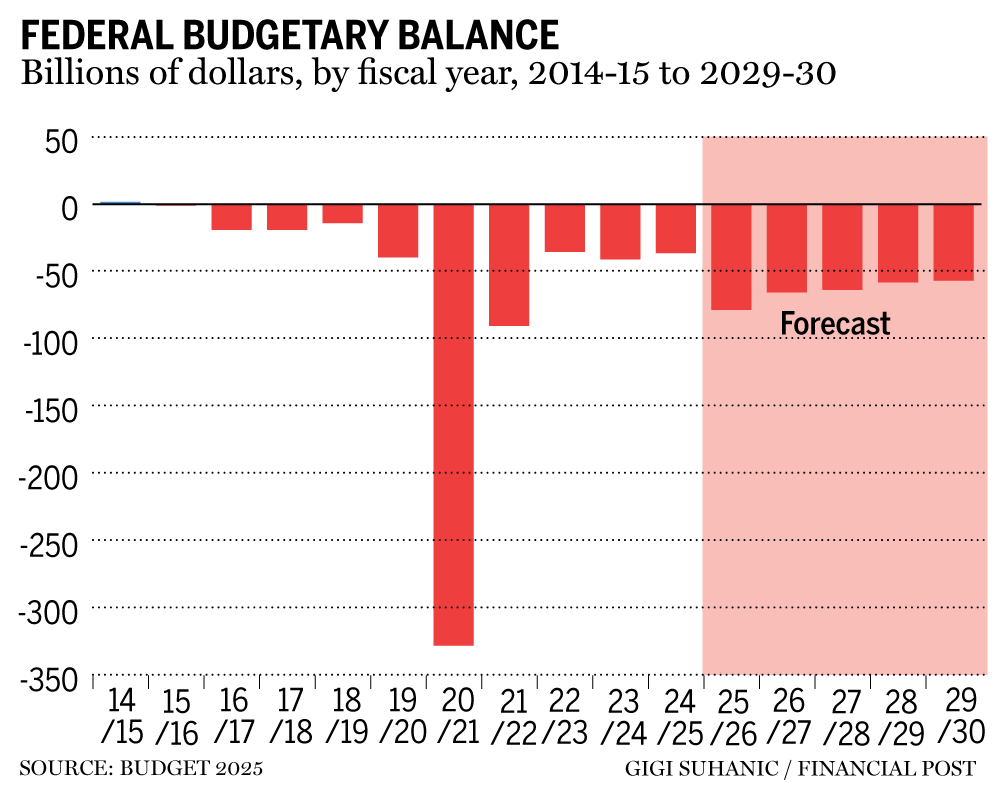

- The good, the bad and the ugly of Canada’s budget 2025

- Three Canadian startups advance to stage two of U.S.-backed quantum computing program

Ontario-based Jason*, 41, and his wife Julia*, 38, have worked hard, built up significant wealth and are

, ideally within the next year or two but definitely by 2032, when Julia hits age 45. The plan is to make their money last as long as possible by moving to a lower-cost country such as Malaysia, Vietnam or Thailand. Find out

if they can make their dream happen.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here