The province, whose economy is expected to lead the country in the next few years, also has the highest

in Canada, according to a report released today.

TransUnion Credit Industry Analytics Report

found that geographic disparity in credit performance in Canada increased in the third quarter, with Alberta lagging behind.

The province's delinquency rate rose from 2.21 per cent last year to 2.31 per cent, the sharpest increase in the country, topping Canada's rate of 1.77 per cent.

Jump in delinquencies due to higher growth

in the province and is reversing an improving trend seen in recent years, TransUnion reports.

Since many of its resources are protected from tariffs,

He is expected to lead the country this year and next. Bank of Montreal economists expect the province's real gross domestic product to grow 2.1 per cent this year and 2.3 per cent in 2026, well above forecasts for nationwide growth of 1.2 per cent and 1.4 per cent.

However, the province, which experienced massive

In recent years, it has had one of the highest unemployment rates in Canada, at 7.8 percent.

Ontario and Quebec are two other provinces that have seen their credit metrics deteriorate over the past year.

Ontario's unemployment rate rose to 7.9 per cent in September.

tariffs on cars, steel and aluminum

damaged the industry and manufacturing sector of the province.

The delinquency rate on loans rose to 1.9 percent, and in Quebec, which was also hit by tariffs, it rose to 1.26 percent.

The report shows a growing gap not only between regions, but also between those who are financially secure and those who are vulnerable.

Short-term delinquency rates (30 days or more) have fallen, but late-stage delinquencies (90 days) are rising, which TransUnion says shows those who fall behind are experiencing greater hardship.

“This contrast highlights the critical dynamics of the recovery,” the study said.

“While overall delinquency rates may appear stable or improving, the financial health of the most vulnerable consumers is worsening, and there is a gap between those who have managed to stay on top of things and those who are falling deeper into delinquency,” he said.

have returned to pre-pandemic levels, suggesting rising costs of living are adding pressure to all Canadians, the report says. But there was an even sharper increase in balances for consumers with substandard credit, “signaling that financial pressures are disproportionately affecting higher-risk borrowers.”

A recent survey conducted

Canadians' financial struggles revealed that 48 per cent of those surveyed feel they can no longer maintain their standard of living.

The growing pressure is reflected in TransUnion's consumer finance industry indicator, which fell six points in the third quarter compared with the same period last year, signaling a deterioration in the overall health of the Canadian credit market.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

Register here to have Posthaste delivered straight to your inbox.

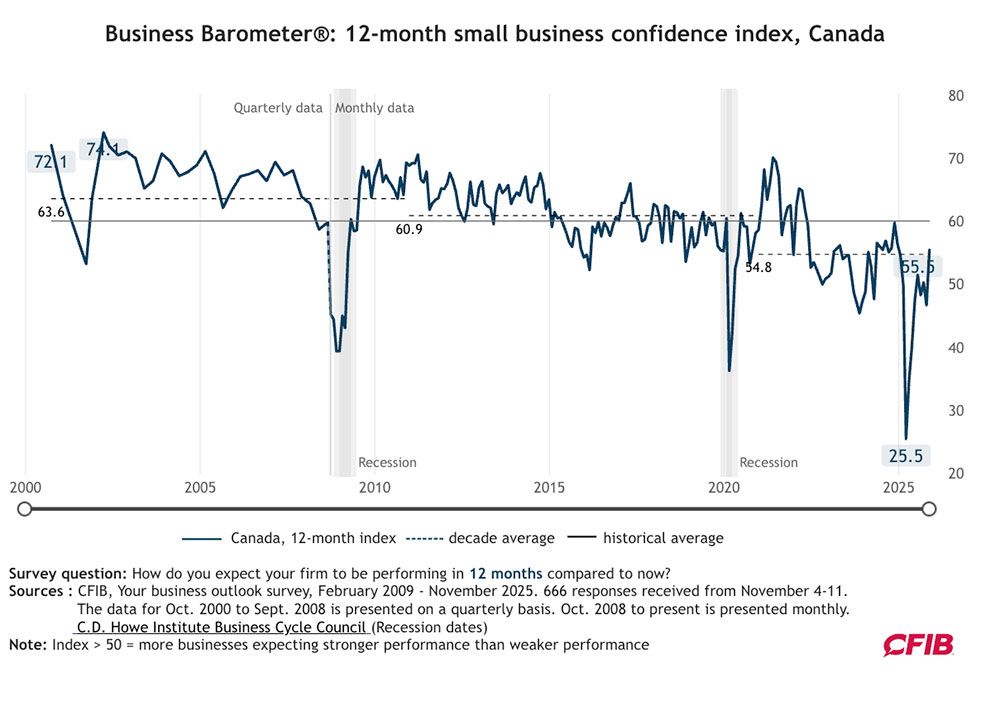

Canadian business outlook improved this month, data shows

Canadian Federation of Independent Business.

The business barometer for the 12-month outlook moved into positive territory, reaching 55.5. (Anything above 50 means more businesses expect strong results than weaker ones.)

Confidence among retailers jumped 14 points to 57, the best reading this year but still below the historical average.

The survey was conducted between Nov. 4 and Nov. 11, following the federal budget, and showed businesses liked what they saw from Prime Minister Mark Carney's pro-growth agenda, said Robert Kavcic, senior economist at BMO Capital Markets.

“Ultimately, we still need certainty in the trade dossier to really allow businesses to operate with capital expenditures and hiring programs (where plans remain very restrained),” Kavcic said.

“If we can somehow achieve this in the coming months, along with lower rates and fiscal stimulus, the Canadian economy could turn around.”

- Today's data: US Retail Sales, Producer Price Index and Consumer Confidence Conference Board

- Earnings: Best Buy Co. Inc., HP Inc., JM Smucker Co., Dell Technologies Inc.

- Problems at The One Show Your Condo Pre-Sale Purchase Isn't as Secure as You Think

- Mark Selby: Canada must act before critical minerals window closes

- From gold giant to boardroom meltdown as Barrick contemplates a breakup

At 61, Julia is happily retired, single and focused on her next chapter. After a year of renting, she wants to buy her next home when her lease expires next July. She also wants to make sure that she is saving money in the most effective way to maintain a comfortable lifestyle. Family Finance offers tips on how Julia can defer QPP and OAS benefits for as long as possible while still purchasing a home.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here