This year has been full of surprises, ranging from a roller coaster ride

To

this sent markets to crazy highs in the second half of the year.

As 2025 comes to a close, Douglas Porter, chief economist at BMO Capital Markets, looks back at some

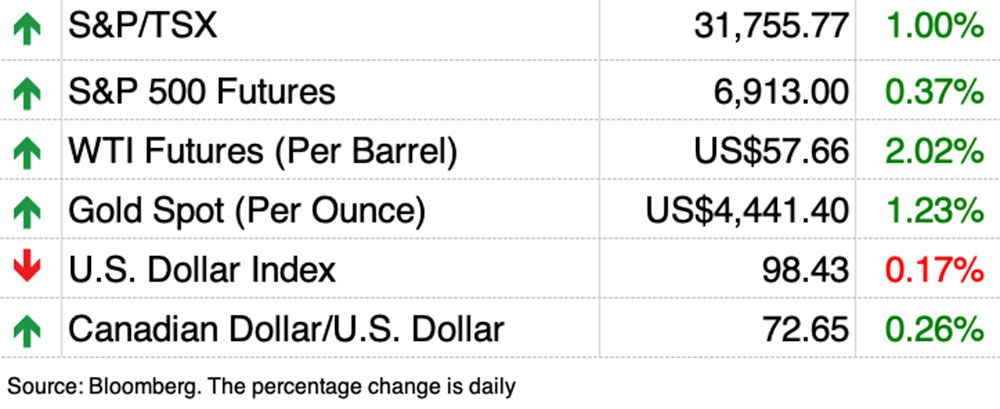

Unstoppable rise in stocks

Trump's liberation day in April, which introduced

on countries around the world, bringing markets to the brink of disaster. The major U.S. indexes lost nearly 20 percent, the technical threshold for a bear market, until the momentum suddenly reversed course.

Since then

rose 35 percent in one of the strongest six-month expansions since 1950.

Particularly surprising were the actions of Canada and Mexico, the two countries initially hit hardest by Trump's sanctions, Porter said.

The S&P 500, despite recession fears and without the impact of the US technology sector.

Rising gold prices certainly helped, but even without bullion, the TSX still beat the major U.S. averages, he said.

China continues to trade

In 2025, China's exports grew 5 percent and its trade surplus exceeded US$1 trillion, despite being the main target of Trump's tariffs, which at one point reached 100 percent.

Exports to the United States fell 19 percent, but China offset this with sales to Europe and other Asian countries.

Currency stars

rose this year despite trade headwinds, but was no match for the euro, which rose nearly 14 percent, its best year in more than two decades.

According to Porter, these results were achieved despite severe trade pressure from the United States, financial and economic problems, and the European Central Bank cutting rates more than the Federal Reserve.

The Mexican peso gained almost as much, recovering from a slump in 2024.

All that glitters

50 records this year, up 70 percent to peak just below $4,500 today. But it wasn't the strongest commodity, or even the most expensive precious metal, Porter said.

That title goes to silver, whose 140% rise this year has brought it to within a penny of $70 today. Platinum, up about 124 percent, comes in second.

Work, work, work

At the start of the trade war, the forecast was grim.

as industries braced for the impact of the tariffs, but in the end Canada's labor market exceeded expectations.

the country received thousands of new jobs

in November than expected, pushing the unemployment rate down to 6.5 percent. It was the second straight monthly decline in the unemployment rate, which peaked at 7.1 percent in September.

“Perhaps the most surprising statistic of the year was that the number of unemployed Canadians was lower than at the start of the trade war a year ago,” Porter said.

Register here to have Posthaste delivered straight to your inbox.

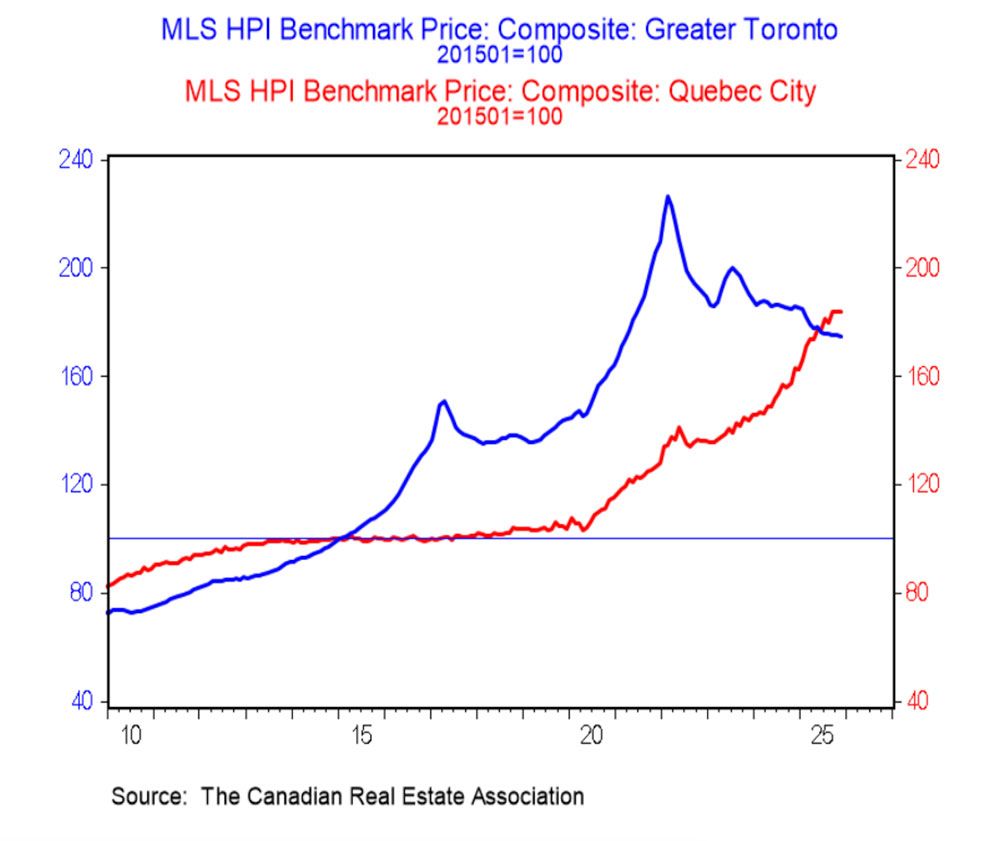

Quebec's real estate market is on fire, with benchmark prices up 13 percent in November compared to the same period last year.

The 84 per cent increase in prices since 2015 now exceeds the 75 per cent increase in the Greater Toronto Area, said Sal Guatieri, senior economist at BMO Capital Markets.

However, the cost of owning a home in the provincial capital of La Belle is much more reasonable than in central Ontario. Mortgage payments on a typical $428,100 property are only one-fifth of the median household income.

The housing correction since the Toronto market peaked in early 2022 has improved affordability, but mortgage servicing ratios are still around half of household income, Guatieri said.

- The Bank of Canada will release a summary of monetary policy discussions after it holds interest rates on December 10.

- Today's data: Canadian Gross Domestic Product October, US GDP Q3, Industrial Production, Durable Goods Orders, Consumer Confidence Conference Board

- Why Tim Hodgson believes energy is Canada's trump card in a changing world order

- The winners and losers of investors who made or busted portfolios in 2025

- Why the Bank of Canada's next move will likely be to raise

When dealing with debt problems, bankruptcy is often seen as a last resort. While this can provide a fresh financial start and be a viable option for some people, it is not a practical option for others. In fact, there are obvious circumstances where bankruptcy would be either ineffective, impossible, or detrimental to one's long-term goals. If you think you may need to file bankruptcy,

Here are some things to consider.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here