Oil prices appear poised for a deeper fall as signs grow that

more than anyone expected.

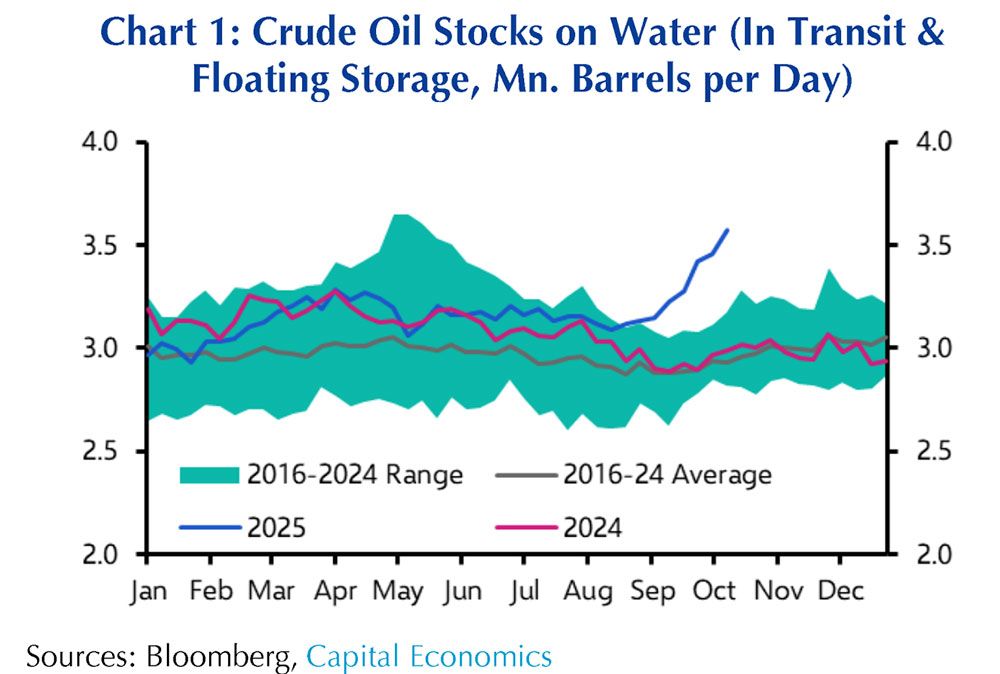

It is estimated that oil reserves currently floating in tankers around the world's oceans amount to 1 billion barrels. The last time there was such a high was during the pandemic, when a price war between Saudi Arabia and Russia sent Brent crude prices soaring to $30 a barrel, Capital Economics said.

“This means an oil glut is on the horizon,” said Hamad Hussein, climate and commodities economist at Capital.

Last week

warned that the oil glut would be larger than forecast and said the excess was starting to accumulate on ocean tankers. It forecasts global oil supply will exceed demand by nearly 4 million barrels a day in 2026, the largest annual surplus on record.

“Looking ahead, as significant volumes of crude oil move ashore onshore to major oil hubs, crude oil inventories look set to rise,” the IEA said.

The surplus was driven by falling demand and increased supply after OPEC+ reversed years of production cuts in a matter of months.

The group of oil-producing countries has increased production by more than 1.5 million barrels per day since April, Hussein said. Oil exports from Saudi Arabia alone rose 10 percent in September.

The oversupply in recent months has been masked by China's emergency stockpiles, but analysts question how long it will last and how much the country will be able to absorb.

“Beijing's accumulation trend cannot last forever,” said Rory Johnston, an oil market analyst in Canada and founder of Commodity Context. More broadly, China's oil demand has fallen sharply since it became the world's leader in 2023.

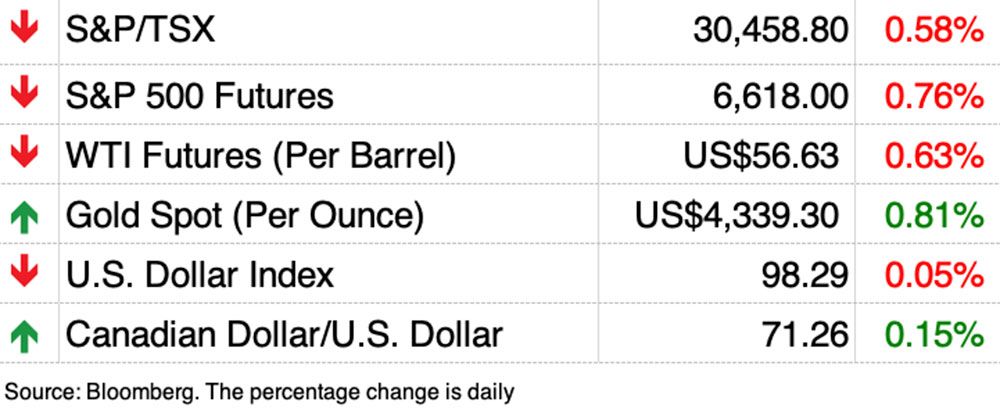

West Texas Intermediate Prices

have fallen to below $60 in recent months (it was $57 today), down from a $70 to $80 range in 2023-24 and a high of $120 in 2022.

But Capital Economics predicts the price could fall to US$46 by the end of next year as the full effect of OPEC+ production increases hits the market.

“This decline is driven by the simplest economic concept: there is too much supply relative to how much the world consumes,” Johnston said.

Falling prices will eventually correct market imbalances, either by increasing demand or, more likely, by reducing global producers, he said.

U.S. shale oil producers will likely be the first to blink, he said.

It only costs $60 to drill a new well, and projects have already been canceled because they are not profitable.

Canadian

you can get by with less, but it will still be tight. Alberta's energy regulator estimates the sustainable oil price to be between $50 and $78 per barrel.

Johnston said the decline in oil prices over the next year or so would likely be temporary, an “echo” of the man-made tensions of 2023 and 2024.

Only once “a new market equilibrium has been established will we begin to get a clearer picture of what the end of the decade – and perhaps the end of oil demand growth itself – will look like for the global oil industry,” he said.

Register here to have Posthaste delivered straight to your inbox.

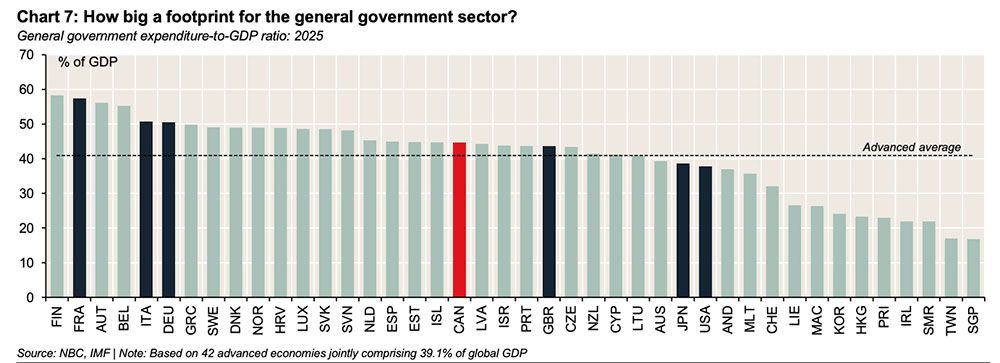

The government in Canada is not small, but it is not the largest either, as an International Monetary Fund comparison shows. Canadian government spending as a share of gross domestic product exceeds the average for developed economies, said National Bank of Canada economist Warren Lovely.

But that is lower than in parts of Western Europe, where government spending may not be as resilient due to demographic pressures and stretched balance sheets.

- Bank of Canada releases surveys of business outlook and consumer expectations

- Today's data: Canadian industrial product price, raw material price index

- Earnings: PrairieSky Royal Ltd., Steel Dynamics Inc.

- LNG Canada tanker traffic falls short of expectations amid gas glut in Western Canada

- Harry Marr: Beware of Edmonton – people from Toronto and Vancouver are coming to your houses

- 12 Tips to Make Your Debt-to-Income Ratio More Acceptable for Lenders

Retired at 52, with no corporate pension and less than $250,000 in RRSP, Ryan turned to FP Answers for help. Our experts say there is hope, but Ryan must act strategically to weather unemployment and prepare to catch up on his retirement savings.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here