For some time this year, it seemed that every day, in the oval office, another executive order was signed. And how could we forget about the shock and horror of the “Liberation Day” when the US President

He published wide new tariffs for countries around the world.

Since he took office, Trump has released the onslaught of trade measures, unprecedented since the Second World War. Average

Tariff rate of the United States

The import is from 17 to 19 percent. This is compared with two percent at the beginning of the year and the highest since the 1930s.

So can we expect relief when Trump's term ends in 2028?

Probably not, says the economist of the National Bank Angela Katsraz

According to him, the world is unlikely to see a return to the level of free trade, which prevailed in recent decades, because the support of protectionist measures has grown in the United States – even along party lines.

When Joe Biden entered into possession after the first term of Trump, he retained many of the tariffs of his predecessor for China and even expanded them. Bidens

The rewarded preferred domestic industries with subsidies and forced Canada and other countries to increase their own subsidies in order to remain competitive.

Future presidents are also unlikely to want to abandon the authorities, which Trump claimed, claimed Katsoras.

The trade body in the United States has already transferred from Congress to the executive power before taking office, but the president invested this overload, using emergency powers to introduce tariffs.

“The next president, regardless of the party, will not want to abandon all the class powers gathered by Trump for the presidency,” Ryan Young said from the institute of a competitive enterprise, is quoted in the report.

Also, industries that have not received benefits from tariffs that can easily leave. “After the tariffs are imposed, industries that benefit, usually lobby for them to keep them in place,” Katsoras said.

As for the legal problems that the White House tariffs faces, if the Supreme Court ultimately makes a decision against them, there are many legal options, instead can use Trump.

“Regardless of the legal result, these options in combination with the negative economic impact of uncertainty will continue to exert pressure on trading partners in negotiations,” he said.

And the last, but no less important, tariffs receive a lot of money for the government, deep in debt. According to the budget management of the Congress, tariffs introduced by Trump can increase US government revenues by $ 4 trillion over the next 10 years. Since politicians are introducing tariffs than increasing taxes, future administrations will be less likely to eliminate them.

“For example, the national sales tax will probably be considered political suicide in the United States,” Katsoras said.

So where will this go to Canada?

Right now, the country's position is enviable among American trading partners. American tariffs for Canadian imports on average amounted to less than 5 percent, while other countries are faced with an average level of 10 percent, which can increase to 18 percent by the end of the year, which gives Canada a competitive advantage.

To maintain this advantage, Canada will have to correspond to the US policy regarding trade and “other geopolitical priorities,” Katsraz said. This was already noticed when Ottawa followed the United States, a 100 percent tariff for Chinese electric cars and recently abolished the EV mandate.

“Like small neighboring countries, forced to comply with China and small states for member, forced to comply with the EU, Canada often has no high choice, except to follow Washington's leadership,” he said.

Despite this, the point is that “a return to the era of free trade, visible in the recent past, remains unlikely – emphasizing the need in Canada to reconsider its industrial strategy,” he said.

Register here To deliver the supply directly to your mailbox.

It seems that Canada is going

this time.

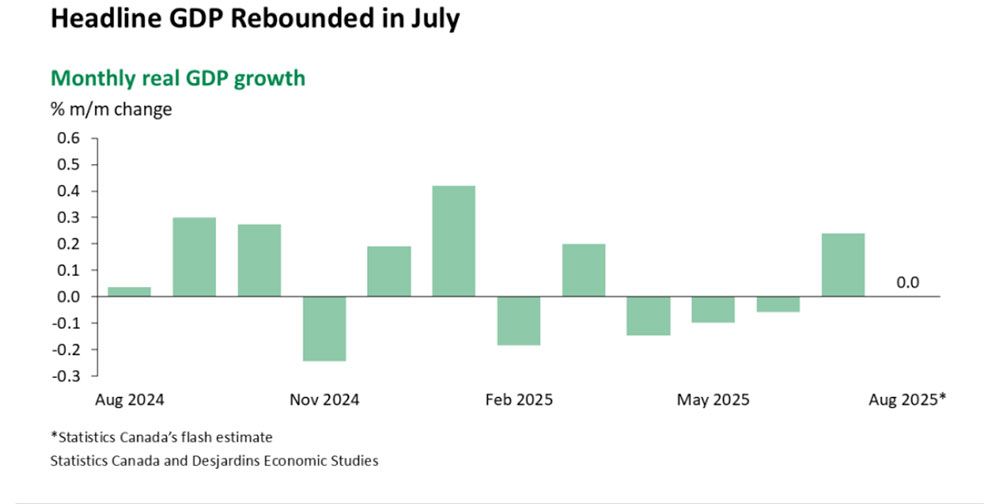

Gross internal product has grown

We learned 0.2 percent in July on Friday, and preliminary reading does not offer growth in August. According to economists, if the September reading will take place at zero or better, the third quarter will register a profit, although probably below 1 percent.

There are still a lot of space to improve, and most are waiting

Cuts again.

Not only did Desjardins Group Economists predict that the Central Bank will reduce its interest rate in October, but also says that this rate should fall to 2 percent to support the economy. The Canada Bank reduced its rate to 2.5 percent by September 17.

- Today's data: The United States is waiting for sales of houses

- Earnings: Carnival corporation

- Who is Mark Leonard, the recluse founder of the Constellation software, which some call Warren Buffete from Canada?

- Howard Levitt: In the “clogging”, Canadian postal workers are simply struggling with the inevitable

- How long are potential buyers of Condo Condo Toronto to wait for transactions with fire sales?

A 72-year-old football player is looking for ways to reduce property taxes that he will leave to his four children. He headed his non -core savings account (TFSA), but is currently at the age when he has to do annual registered pension income (RRIFs), which increase his pension income and increase his taxes. FP reflectors have some strategies, including family tax shelters.

Maclister on a mortgage

Want to know more about a mortgage? Mortgage strategist Robert Maclister

It can help to navigate in a complex sector, from the latest trends to financing opportunities that you do not want to miss. Plus check it

For the lowest national mortgage rates in Canada are updated daily.

Financial post on YouTube

Visit financial post

For an interview with leading experts in Canada in the field of business, economics, housing, energy sector and much more.

Today's delivery was written Pamela heaven With additional reports from the Financial Post, Canadian press and Bloomberg.

Do you have the idea of history, filing, an embargo report or a proposal for this mailing list? Write to us at the address

Field

Add our website and support our journalism: Do not miss the business – the numbers that you need to know – add Financialpost.com on your bookmarks and subscribe to our information ballots Here