Real estate brokers are confirming what young people already know: It's never been harder to do so.

in this country.

over the past 30 years of home ownership in this country and found that “the current cohort of home buyers faces some of the most significant barriers to date.”

Between 2011 and 2021, the homeownership rate among people aged 25 to 29 fell from 44 percent to 36 percent. The rate fell nearly 12 percent for people ages 30 to 35 and nearly 9 percent for people ages 34 to 39.

According to

As of last summer, only 47 per cent of Ontario millennials and Gen Zers believed homeownership was achievable, while 27 per cent did not believe it was at all achievable.

Although

have slowed since the pandemic housing boom, average price growth continues to outpace wage growth, making it “extremely difficult” for first-time homebuyers to enter the market, Re/Max said in a report.

A shortage of cheaper homes is driving up prices, and canceled construction projects threaten to tighten conditions in the future.

One trend Re/Max brokers have noticed is that aging empty nesters and retirees are competing with first-home buyers for smaller homes, especially bungalows.

“This competition makes it even more difficult for new bidders to win, as they must compete with buyers who are better positioned,” the report said.

Mortgage stress tests, high down payments and mortgage maintenance costs add to the problem.

But the report also highlights how home ownership has benefited Canadians over the past 30 years. During that time, home prices in Halifax rose 460 per cent, the largest increase in the country.

The Greater Toronto Area ranks second with growth of 436 per cent, while Saskatoon has the third-highest growth in the country with 377 per cent.

“But barriers are clouding the dreams of future generations,” says the Re/Max report, which calls on governments and the private sector to work together to reduce barriers.

The federal government's Build Canada Homes program, which will oversee affordable housing programs in six communities, initially “could not move forward quickly enough,” it said.

“Supply shortages are widening and the pace of new construction does not bode well for the future of Canadian housing markets,” said Don Kottick, president of Re/Max Canada.

“Chronic supply shortages will block a growing number of potential buyers.

longer term and perpetuate the affordability crisis as pricing pressures will remain almost inevitable as long as demand outstrips supply.”

Policy adjustments would also make the path to homeownership easier. Brokers recommend extending amortization periods for first-time buyers and reducing the extra two percentage points required to pass the mortgage stress test.

The report also proposes eliminating land transfer taxes on priced homes and GST/HST on new homes.

Register here to have Posthaste delivered straight to your inbox.

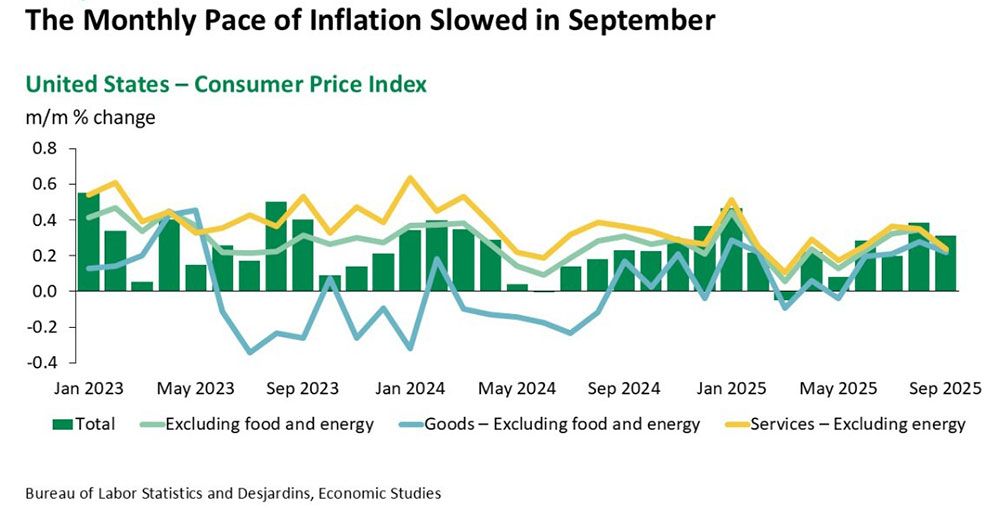

Data has been a bit thin in the United States lately due to the government shutdown, so when the September CPI came out on Friday, it caused a stir.

The S&P 500 index hit another all-time high after data showed core inflation at its slowest pace in three months, raising bets that the U.S.

will cut its interest rates by another half by the end of the year.

“The Fed now has everything it needs to decide on a rate cut. [this] week despite a lack of timely economic data due to the federal government shutdown, which is now in its fourth week,” said Scott Anderson, chief U.S. economist at BMO Capital Markets.

- Prime Minister Mark Carney attends the ASEAN summit in Malaysia

- CIBC Executive Director Victor Dodig will speak at the Canadian Club in Toronto

- Earnings: TMX Group Ltd., Celestica Inc.

- How Celestica rose from the ashes of the dot-coms to lead the artificial intelligence boom

- Many mortgage upstarts have tried to compete with the big banks. Few survived

- What are prediction markets? A booming industry that bypasses US gambling laws

As life expectancy increases and the cost of living rises, the financial and emotional challenges of the sandwich generation are growing.

A 2024 Ipsos study found that 70 per cent of Canadians aged 25-65 are concerned about the financial strain of supporting both their parents and children. Nearly two-thirds believe this caregiving responsibility could impact their career advancement or ability to remain employed.

Susan Daly, senior investment advisor and portfolio manager at Richardson Wealth, explains how to best prepare for financial, emotional and logistical challenges.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here

:quality(85):upscale()/2025/12/10/948/n/49351759/26f290426939e9f661de61.58679937_.jpg?w=150&resize=150,150&ssl=1)