Extraordinary rise

and the subsequent stock market boom have drawn many comparisons to the dot-com bubble of the late 1990s.

The long and painful conclusion of this technology rally has led to

fell 49 percent from its peak in March 2000 to its low in October 2002. During the same period, prices for information technology and communications services fell by 82 percent and 74 percent, respectively.

Recent sell-offs in the technology sector have raised concerns that the end is in sight again, but Capital Economics is not convinced. He believes the AI bubble has another year or so to inflate.

If the rally continues and the S&P 500 reaches 8,000 by the end of 2026, as Capital projects, a decline of at least 30 percent in the index and 60 percent in the technology sectors combined is possible, said John Higgins, Capital's chief markets economist.

If that sounds like a lot, Higgins notes that the S&P 500 would be 25 percent lower today if not for the AI boom, and that's not counting the further rally Capital is forecasting for 2026.

The correction Capital envisions will be slightly smaller and significantly shorter than the dot-com crash.

One thing that will be missing is

which followed the market crash in 2001 and was largely caused by

raising interest rates.

From 1995 to its peak in March 2000, the Nasdaq rose 400 percent due to a frenzy in Internet stocks and technology companies. Concerned about inflation, the Fed began raising rates in 1999 and raised them by 1.5 percentage points in less than a year.

This time, it's much more likely that the Fed will cut rather than raise rates, and Capital doesn't expect a recession.

There will be collateral damage. While defensive industries such as consumer goods should hold up well, utilities, which are driven by the huge power demands of artificial intelligence data centers, will fare worse, Capital said.

On the other hand, as the S&P 500 becomes less focused on technology, other stocks could rise higher, as happened after the dot-com crash.

But what happens to big tech? Capital said that five years after the 2000 crash, these sectors have recovered but have not maintained their former glory compared with other cyclical stocks.

“Something similar could happen again as productivity gains from the artificial intelligence revolution begin to show up in many parts of the economy,” Higgins said.

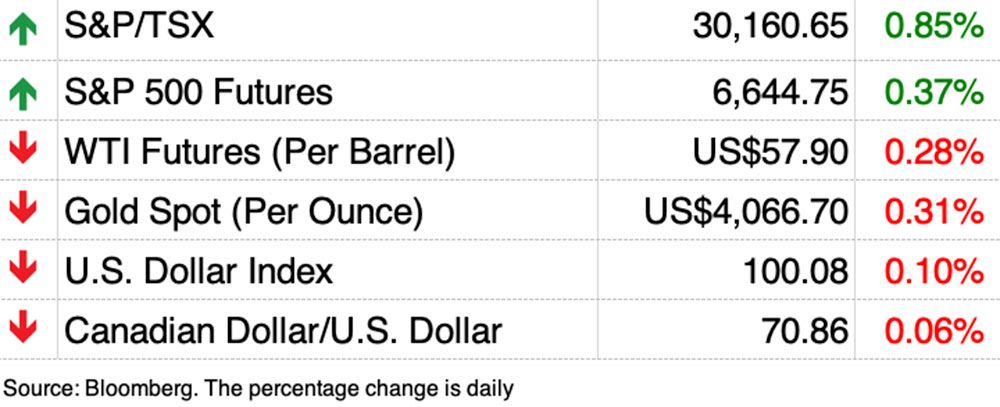

Capital may be right that the rally will continue. Technology stocks were once again leading the gainers this morning after last week's sell-off.

But economists added this caveat: “Given the stock market pullback, it is possible that the bubble may now begin to burst.”

Register here to have Posthaste delivered straight to your inbox.

Canadian consumer spending slowed to its weakest pace in a year in the third quarter amid uncertainty over the economy and tariffs.

after rising 0.3 per cent in the previous quarter, Statistics Canada data showed on Friday. September sales fell 0.7%, while preliminary estimates showed October sales were unchanged.

“Retail sales in Canada continue to remain on hold as support from lower interest rates faces headwinds due to trade uncertainty,” said Shelley Kaushik, senior economist at Bank of Montreal.

“The overall picture is one of tepid economic growth that will do little to move the Bank of Canada needle ahead of the December meeting.”

- Fireside Chat with Peter Rutledge, Superintendent of Financial Institutions in Toronto

- Ghislaine Houle, Chief Financial Officer of Canadian National Railway, will speak at the Desjardins conference in Toronto.

- Earnings: Alimentation Couche-Tard Inc., Agilent Technologies Inc., Keysight Technologies Inc.

- Is “lifetime tenancy” becoming the new normal? Data shows we're moving in the same direction

- Who is Amancio Ortega, the Spanish billionaire buying up luxury Canadian office towers?

- The inside story of Fairfax Financial's even bigger 'big sale'

The recent wave of sell-offs has investors wondering if this is the end of the market party. Professional investor Peter Hodson looks at five signs of a market correction and where we might be now.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here