Canadians have emerged surprisingly well from their pandemic borrowing binge, enduring a steep climb

unstable economy and rising unemployment.

Although

lowered its rate to 2.25 percent, it remains higher than it has been in the last 15 years, excluding the pandemic.

And the wave

from the pandemic low, has still reached its peak. CIBC Capital Markets expects the share of borrowers facing a payment shock greater than 40 percent to reach 5-6 percent of the mortgage portfolio in the second half of next year, more than double the share in 2025.

However, so far there are no signs of trouble.

which have stabilized at levels observed before the pandemic.

Observers are starting to notice tension on the fringes of the lending world.

In a report released this month, Morningstar DBRS warned that mortgage delinquencies are rising at mid-sized banks in Canada.

These smaller banks, which offer an alternative to borrowers unable to secure a loan from one of Canada's Big Six, held $67.6 billion in mortgages as of June 2025.

DBRS stated that interest rates are still high and

contributed to credit deterioration, and tariff uncertainty added to this pressure, especially in Ontario and British Columbia, where home prices fell the most.

Of the mid-market rated banks, Fairstone Bank of Canada and its subsidiary Home Trust Company, as well as Equitable Bank, show the heaviest strain, while Laurentian Bank of Canada showed resilience, according to DBRS.

By their calculations, Fairstone's mortgage impairment ratio reached 2.2% in the second quarter of 2025, up from 0.3% at the end of 2022, while Equitable's rose to 1.1% from 0.2%.

“In 2026, we expect credit pressure to continue as mortgage rates remain high and tariff uncertainty remains, weighing on overall market sentiment,” DBRS said.

Another report on

CIBC Deputy Chief Economist Benjamin Tal also warns of growing pressure on margins.

Early-stage mortgage delinquencies are now well above pre-COVID levels, and there are signs that homeowners are struggling with non-mortgage debt such as credit cards and lines of credit.

“This does not bode well for the mortgage portfolio, especially in the second half of 2026 when we expect the impact of mortgage refinancing shocks to be much more pronounced,” Tal said.

The rate of delinquencies of more than 90 days among borrowers without mortgage debt is also rising and is now 0.2 percent higher than pre-COVID.

“Given where we are in the economic cycle, we doubt that this figure will start to decline any time soon. In fact, the opposite is true,” Tal said.

Tal expects delinquency rates to rise in the coming quarters, but further credit losses should be contained by peaking unemployment and proactive measures by lenders.

Morningstar DBRS also reported that despite rising impairments, actual loan losses remain manageable.

“In our view, overall good underwriting practices, low uninsured LTVs (loan-to-value ratios) and adequate reserve levels provide an adequate cushion in this challenging environment,” the report said.

READ OUR RED INK SERIES

Governments around the world are mired in debt, and Canada is no exception. But how serious is the problem and what will be the consequences? As the federal budget deficit takes center stage ahead of the Nov. 4 budget, the Financial Post examines the state of sovereign debt in Canada and beyond in a week-long series called Red Ink. From a brief look at Canadian debt to the consequences of a US default, we'll look at some important questions about the national debt and the looming deficit.

- How rising government debt could play a major role in the next great financial crisis

- Canada is part of a small club of countries with a AAA credit rating. How long can this go on?

- Daniel Smith: Balancing your budget will be much easier if you build a pipeline

- Ottawa's new budget framework is controversial. Here's what you need to know about it

Go back Here every day for more in this series.

Register here to have Posthaste delivered straight to your inbox.

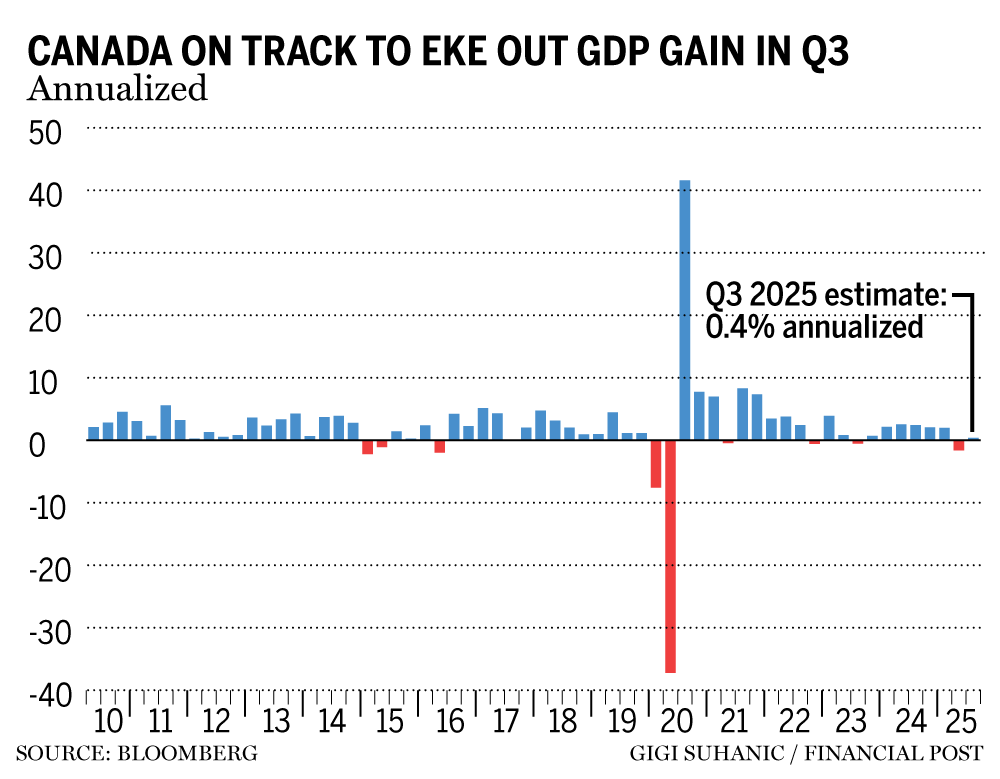

Canada's economy contracted in August

missing expectations, but growth estimates of 0.1 percent in September should keep us out of recession.

Since the second quarter was in the red, the decline in the third could be classified as a technical recession. But now it looks like the economy, although weakened by US tariffs, should achieve some growth.

While August gross domestic product numbers were disappointing, they are unlikely to be enough to force the Bank of Canada back into action.

After cutting the rate to 2.25 percent last week, the central bank said it was likely to do so if the economy performed as expected.

Statistics Canada said Friday that third-quarter GDP will grow 0.4 percent. The Bank of Canada's forecast is 0.5 percent, but Governor Tiff Macklem warned weak growth “will not be pleasant.”

- Earnings: Franco-Nevada Corp., Kinross Gold Corp., Loews Corp., Topaz Energy Corp. Palantir Technologies Inc.

- Canadian steel magnate offers $1,000 reward to whistleblowers reporting foreign steel in government projects

- Louis Tétu: Why Canada Must Get Artificial Intelligence Right

- Ottawa's new budget framework is controversial. Here's what you need to know about it

Bianca, 65, would like to retire in a year – if her investment portfolio can generate $6,000 a year after taxes.

Is this a pipe dream? Would she be better off working another year or two, especially given the high cost of living and the fact that she has a mortgage?

Family finances crunch the numbers.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here