doesn't like

but in one corner of the U.S. economy, it may be helping create it.

For the first time since a global pandemic locked down the world in 2020, the number of international travelers coming to the United States is projected to decline, with a boycott by Canadians cited as the main reason.

The US Travel Association predicts

that travel to the United States this year will fall to 85 percent of 2019 levels and foreign tourist travel spending will fall 3.2 percent, a loss of US$5.7 billion compared to last year.

“Significantly fewer visits from Canada are the primary driver of this decline, and the volume of visits from countries other than Canada is expected to remain flat,” the report said.

“As international outbound travel continues to grow, the tourism trade deficit will reach nearly $70 billion in 2025.”

Outraged

and his comments about Canada being the 51st state, many Canadians boycotted travel to the US.

Last month, 30 percent fewer people crossed the border into the United States in vehicles than a year earlier. This is the 10th straight month of decline.

Statistics Canada reported Wednesday

. Air travel to the United States is down 24 percent.

Canadians traveling to the US by car, October

important for America. Last year, the industry contributed $2.6 trillion to the economy and supported more than 20 million jobs.

According to the International Trade Administration, every 40 foreign visits support one U.S. job.

The U.S. Travel Association expects international travel to rebound in 2026 as America hosts the World Cup with Canada and Mexico and celebrates its 250th anniversary. Los Angeles will host the Summer Olympics in 2028.

But he warns the US risks further cuts to international travel, with potential increases in visa fees, longer wait times for visas and “negative perceptions of the US in key markets”.

WITH

It won't be long before retailers and tourism operators are likely to feel the pain of their absent neighbors.

Traditionally, many Canadians travel to the United States each year to shop, but if current trends continue, that number will decline this year.

Introducing FP West: Energy Insider, a new exclusive newsletter from the Financial Post Western Bureau. Every Wednesday morning, go behind the closed doors of the oil field and get exclusive information from insiders. Register now.

Register here to have Posthaste delivered straight to your inbox.

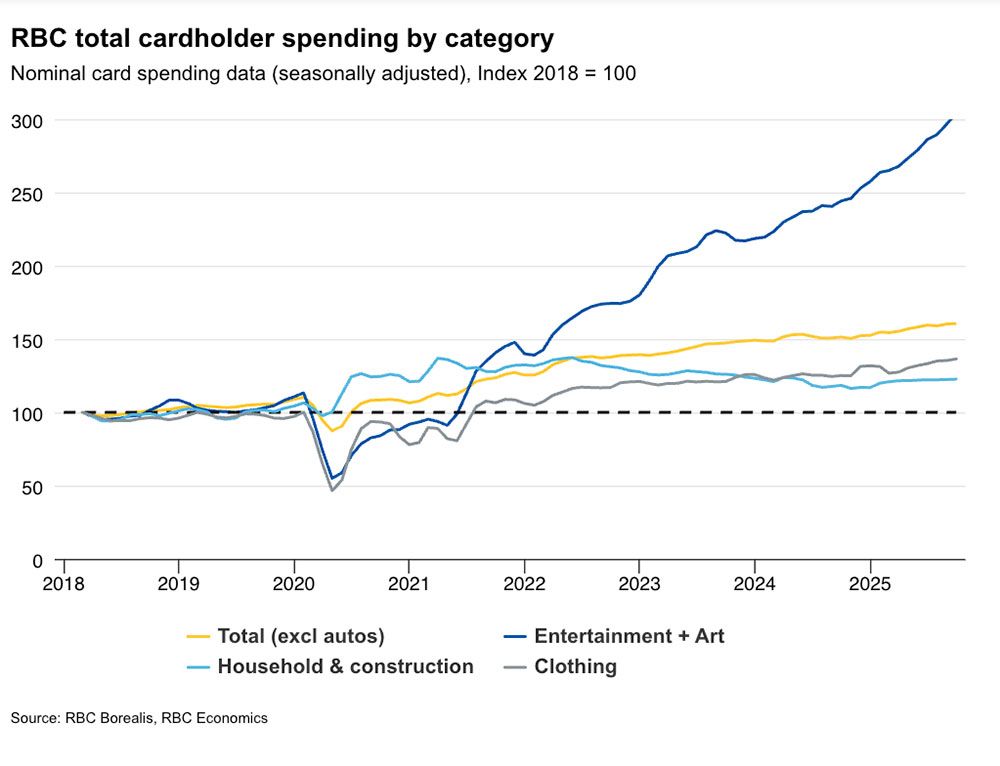

In October, the Toronto Blue Jays cut Canadian entertainment spending.

According to

Royal Bank of Canada Consumer Spending Tracker

Most of last month's spending came from entertainment and the arts, and nearly all of the growth came from Ontario, which hosted four of the seven World Series games. The Jays lost to the Los Angeles Dodgers in the final game of the series.

“The Blue Jays in the World Series delivered a notable boost in discretionary spending, particularly in Ontario, highlighting consumers' appetite for experiences even amid economic headwinds,” said RBC economist Rachel Battaglia.

Along with the Jays, spending on entertainment and the arts as a category has risen sharply since the province relaxed online gambling rules, she said.

- Prime Minister Mark Carney to make announcement on nation-building projects

- Earnings: AtkinsRealis Group Inc., Brookfield Corp., Hydro One Ltd., H&R Real Estate Investment Trust, Stantec Inc., Peyto Exploration & Development, South Bow Corp.

- This TFSA mistake is costing Canadians' millennials and Gen Z a fortune, says TD

- Bank of Canada considered waiting longer for interest rate cuts, discussions show

- New energy projects and proposed data centers offer hope for Canada's natural gas industry

Donald Trump's trade war and rising unemployment have Canadians cautious about spending ahead of the holiday season, and that's putting pressure on major retailers to ramp up their deals. Commerce giants like Amazon.com are running Black Friday deals early and offering deeper discounts, according to analyst Bruce Winder. Find out more about l.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here