Canada

The stock market has performed well this year, but investors need to look across the Atlantic to find the real stars of the financial sector, says one adviser.

“The real story of outperformance belongs to European financial companies, which led the way amid rising rates and restructuring efforts,” Craig Basinger, chief market strategist at Purpose Investments Inc., said in a note.

Canadian banks rose about 40 percent on

in 2025, but these gains pale in comparison to the 90% gain of their European peers and the 60% gain of bank shares in the United Kingdom. U.S. financials rose only 23 percent due to worries about regional banks and worries about commercial real estate.

There are several keys to European banks' success in markets this year, including changes in interest rates.

“The (European Central Bank's) bias is increasingly shifting toward a neutral-hawkish stance,” Derek Holt, vice president of Scotiabank Economics, said in a note.

This central bank held

three times since June, and policymakers are expected to raise their forecast for the eurozone economy next week.

Major restructuring funding, especially in Germany, is expected to boost the region's economy as the industrial giant is poised to make 52 billion euros worth of military purchases next week, according to a Bloomberg report.

Macro factors aside, stocks

doesn't represent a good deal for Basinger.

“Clearly, despite economic growth challenges around the world, valuations matter,” he said. “The starting points of low valuations for international banks represent significantly higher upside potential.”

This has Basinger worried about where the Big Six will go next, as they trade at P/E ratios that have deviated from their long-term average, making them “historically expensive.”

He said Canada's banks are also trading at a 20 per cent premium to the average of their global banking peers. Bank yields are also getting “increasingly lower,” he said, highlighting Royal Bank of Canada's yield, which currently stands at 2.85 per cent, its lowest since 2007.

By comparison, Canada's 10-year bond yield is 3.4 percent.

“Canada tends to be at a higher level, but at current levels Canadian banks are trading richer than U.S. banks,” he said.

Still, other analysts like the Big Six's prospects.

“Major Canadian banks delivered another stronger-than-expected set of results in the fourth quarter, slightly pushing up expectations heading into earnings season,” said Mike Rizvanovich, an analyst at Scotia Capital Markets.

He and other analysts raised their price targets for all of the Big Six banks.

But Basinger believes foreign banks offer better opportunities.

“Simply put, the risk/reward profile for Canadian banks is less attractive from a relative valuation perspective,” he said.

Register here to have Posthaste delivered straight to your inbox.

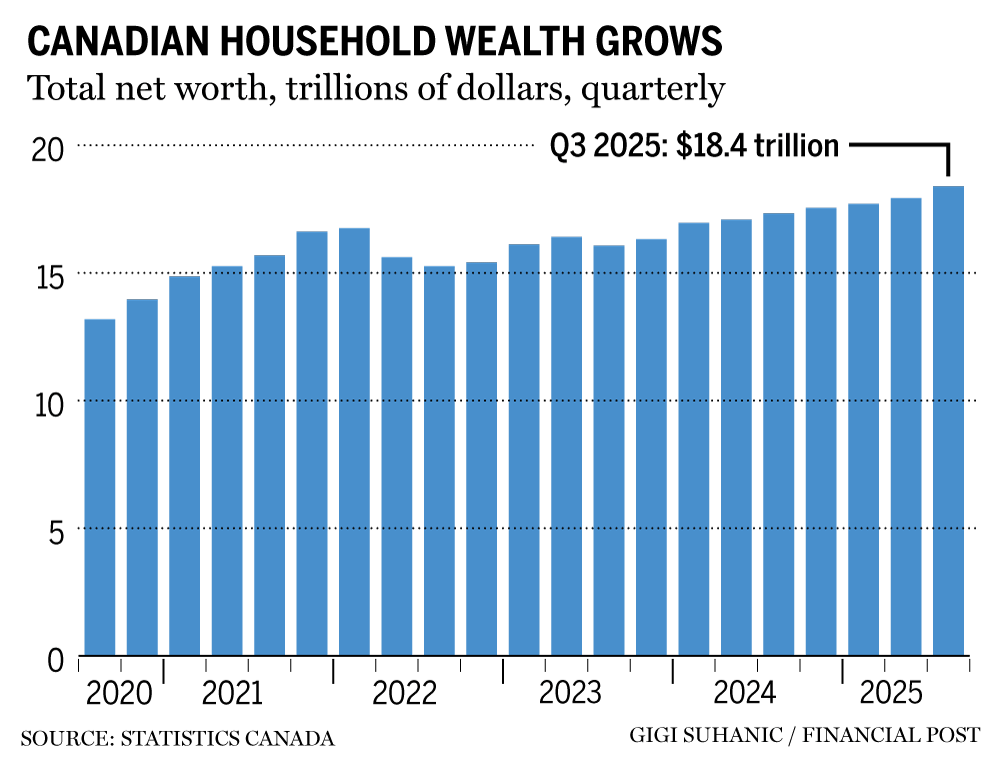

Canadian households increased their total wealth to another record high of $18.4 trillion in the third quarter of 2025, marking a two-year streak of eight straight quarters of net worth increases.

Household net worth has increased by 2.6 per cent (or $460.5 billion) since the second quarter of this year, the largest increase in collective household wealth since the first quarter of 2024, according to the latest Statistics Canada data. national balancereleased Thursday. — Send to Louis, Financial Post

Read the full story Here.

- Federal Transport Minister Stephen McKinnon will make an announcement on the next steps for the high-speed rail line.

- Today's data: Statistics Canada releases wholesale sales excluding oil and building permits for October and capacity utilization for the third quarter.

- Canada's oil industry aims to keep costs steady as global producers brace for a tough year

- Who is Mark Wiseman? Career of the man expected to become Canada's new ambassador to the United States

- Economy forces Canadians to look for cheaper cars as stocks tilt toward luxury

To encourage taxpayers to report all of our income, Canadian

imposes penalties for failure to comply with this requirement. Under the Act, if you fail to report at least $500 of income in the tax year and in any of the three preceding tax years, you may be subject to a federal penalty for “repeated failure to report income.” Tax expert Jamie Golombek tells us what happened to one taxpayer after she failed to report her income twice in three years. Keep reading

.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

Are you worried about whether you will have enough money for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you struggling to make ends meet? Write to us at

with your contact information and the nature of your problem, and we will find some experts to help you write a story about family finances (we won't mention your name, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus, check him out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Gigi Suchanichwith additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here