The resilience of Canada's economy to

surprised forecasters, including

but we haven't gotten out of the forest yet.

The outlook for Canada's provinces in 2026 remains “deteriorating,” Fitch Ratings said this month after cutting its outlook from neutral for the first time in its half-year report.

“Economic and fiscal challenges continue to be somewhat negative for provinces, despite their resilience to date,” said Douglas Offerman, a senior director at Fitch.

The impact of trade tensions on the economy and fiscal performance, although less severe than the worst-case scenarios first projected earlier this year, was “significant,” the ratings agency said.

Other headwinds, such as slowing population growth and rising government service costs, are expected to persist into the new year, although lower borrowing rates will help address those concerns, it said.

The new push by federal and provincial governments to develop infrastructure and natural resources is promising, Fitch said, but is unlikely to immediately boost provincial economies. Finding new trading partners will also take time.

Meanwhile,

in the steel, aluminum, auto and forestry sectors, while Asian tariffs on agricultural products are hitting the “regional economic pillars” of Ontario, Quebec, British Columbia and Saskatchewan.

Alberta is struggling with lower energy prices, while Saskatchewan is struggling with higher health care and fire-fighting costs.

All provinces except British Columbia forecast real GDP growth below 2024 levels this year and next, according to Fitch.

Central Canada, the region hardest hit by the trade war, is expected to post the weakest growth, with BMO Capital Markets forecasting GDP growth of just 1 per cent in 2026 in Manitoba, Ontario and Quebec.

Southern Ontario is also seeing a correction in housing construction, which BMO expects to continue into the new year.

Trade and economic obstacles have led to increased spending not only by the federal government, but also by the provinces.

Senior Economist at BMO Capital Markets.

The provinces' combined deficit this fiscal year will reach 1.4 percent of GDP, “significantly higher than the 0.1 percent share in FY24/25,” she said.

When added to the federal deficit, it would rise to about 3.8 percent of GDP, the highest since the Great Recession, she said.

In the coming months, Fitch will be monitoring developments that could further weaken provincial prospects, including:

- A flare-up in trade tensions with the United States that will delay the recovery in business investment and consumer sentiment.

- Slowdown in the implementation of government investment initiatives

- Increased weakness or volatility in commodities

- Capital spending exceeds historical levels, fueling debt surge

Register here to have Posthaste delivered straight to your inbox.

Canada leads among its peers, but, unfortunately, it is in

Institute of International Finance

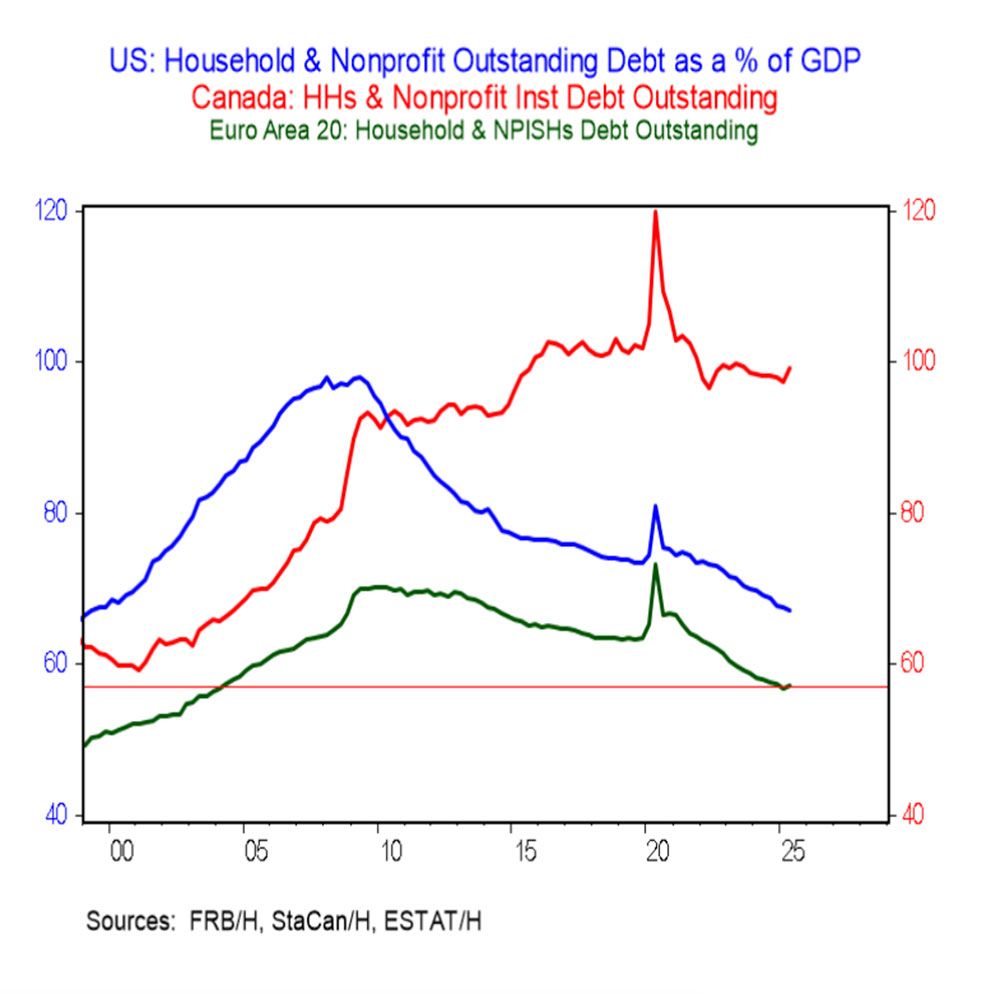

The IIF noted in its quarterly debt review last week that household debt was falling globally, falling 1.4 percentage points to 67.4 percent of GDP in developed countries in the third quarter.

The eurozone has never had very high household debt, and it now stands at about 57 percent of GDP, said BMO chief economist Douglas Porter, who brings us today's chart. Before the Great Financial Crisis, the United States had an economy with high levels of consumer debt, but the situation has declined since then.

Canada, however, has taken a different path: Household debt has risen from 80 percent of GDP before 2009 to about 100 percent over the past decade, “and has shown no real signs of abating,” Porter said.

“Among 25 advanced economies, only Australia has a higher household debt/GDP ratio than Canada (about 118 percent),” he said.

- Today's data: Canadian Inflation Rates, Existing Home Sales, New Home Construction and Industrial Products Sales, US Empire Manufacturing Index, NAHB Housing Market Index

- For Canadian snowbirds, the “stay or go” dilemma is getting complicated.

- Howard Levitt: Why remote workers continue to win labor law disputes

- Trump's tariff revenues fall for first time since February

Amid boycotts and anger over the trade war, as well as U.S. President Donald Trump's musings about making Canada the 51st state, Canadian snowbirds feel forced to choose between their country and their winter homes – second homes full of family, friends and fond memories. Harry Marr of the Financial Post

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here