Back when

Canada's population was growing

– growth in consumer demand and labor supply in the country – at first glance, the economy looked good.

But in reality, rising interest rates and unemployment were creating conditions for Canadian households that were “functionally indistinguishable from a recession,” he said.

economists in their report yesterday.

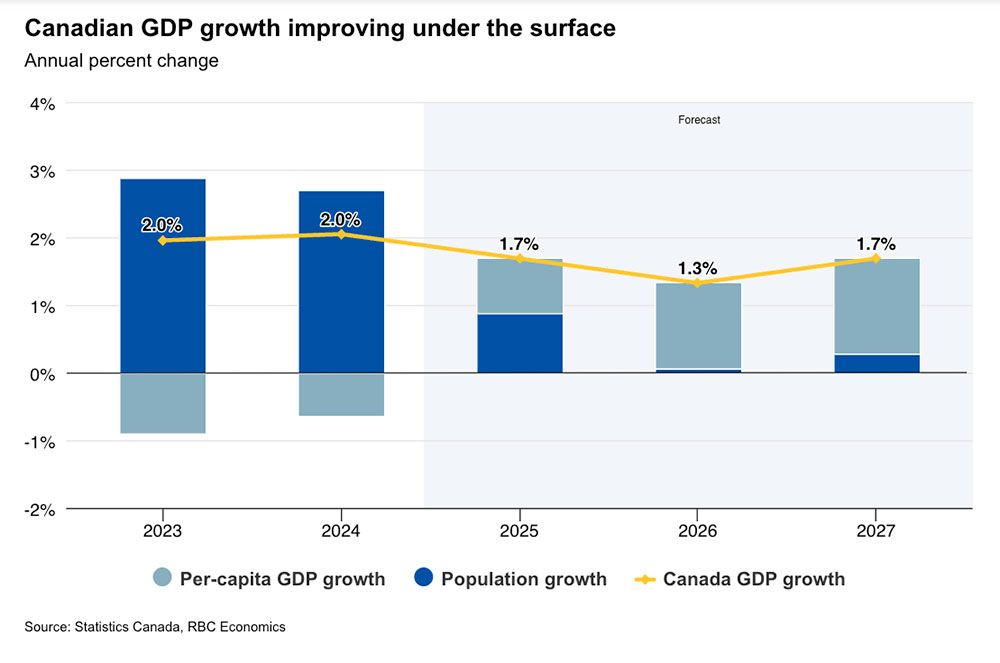

Even before the trade war rocked Canada's economy, gross domestic product per capita was falling, even as

grew by 2 percent in both 2023 and 2024 – a situation RBC calls “historically unique.”

Canada added 2.1 million residents between 2022 and 2024, and this decades-long population boom has masked the harsher reality happening in the background.

Household purchasing power has declined under pressure from higher interest rates and even

. As consumer demand weakened, more people competed for fewer jobs and unemployment soared.

Canada may not have been in

but to many Canadians it actually seemed that way.

“The opposite is now happening,” said RBC economists led by Frances Donald.

“GDP per capita—the best measure of how individual households and workers perceive the economy—will be on track to grow in 2025 for the first time in three years.”

Restrictions on the arrival of temporary residents have sharply reduced the number of consumers and workers, but while this will reduce overall GDP growth, it should not significantly affect the rise in per capita unemployment, RBC notes.

In fact, the economy's fundamental indicators are showing “encouraging improvement,” they said.

Unemployment appears to have peaked, falling to 6.5 percent in November, down 0.4 percentage points from a year earlier.

And costs are rising. Spending growth rose 2.4 percent per capita in the second quarter of this year, the fastest pace in three years, RBC reported.

“The improvement in per capita GDP represents an important milestone,” the economists said, and they are “cautiously optimistic” that it will continue to improve.

Surprisingly, trade is among the reasons for optimism.

While economists don't expect the United States to reverse tariff increases, they also don't expect significant increases as political appetite for it wanes ahead of the November 2026 midterm elections.

Saving

Canada-United States-Mexico Agreement (CUSMA)

The exemption is critical, but RBC says it's just as important for U.S. importers.

Register here to have Posthaste delivered straight to your inbox.

Canada

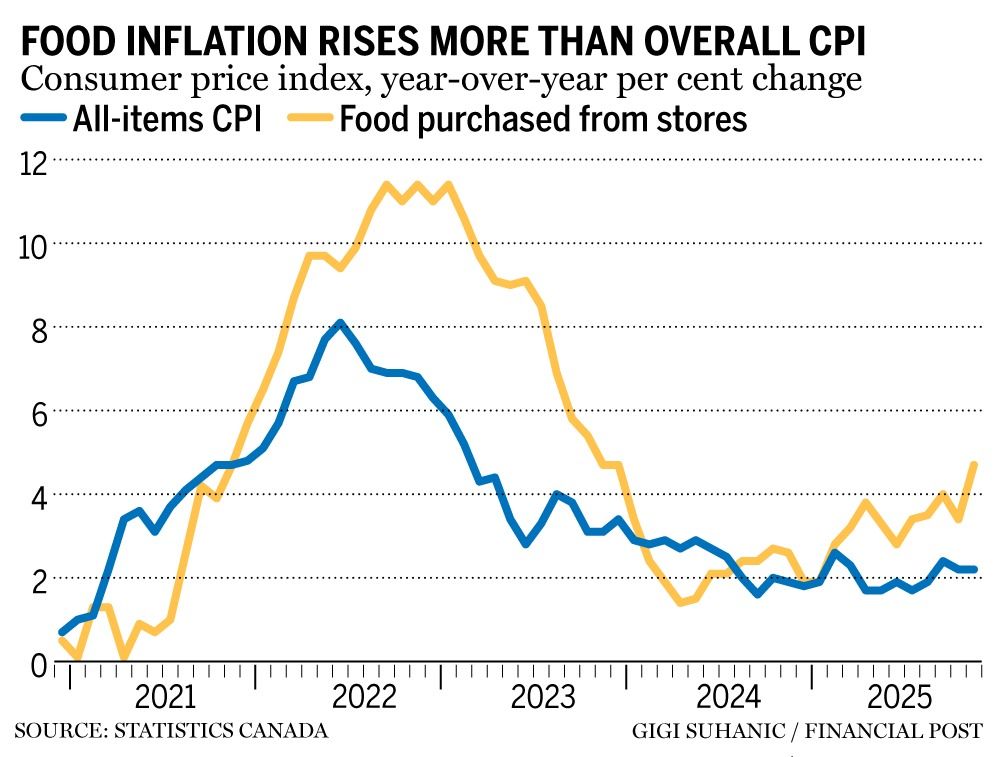

except for food prices, which are rising at the fastest pace in two years.

Prices for food purchased at stores rose 4.7% year-on-year in November, the fastest pace since December 2023, while headline inflation remained steady at 2.2%.

“To put the impact of rising food prices into perspective, headline non-food inflation is a modest 1.85% year over year,” Douglas Porter, chief economist at BMO Capital Markets, wrote after the data was released Monday.

“Meat, coffee, sugar/chocolate and now fruit prices are the main drivers of the resurgence in food price inflation.”

- Bank of Canada Governor Tiff Macklem to speak at the Montreal Chamber of Commerce

- Today's data: US Retail Sales and Jobs Report

- Earnings: Lennar company.

- How Immigration Minister Lena Metlege Diab is striking a balance in one of Ottawa's most sensitive cases.

- The Fed's rate cut was a clear signal to investors

- Harry Marr: How raiding your TFSA before the end of the year could save you thousands

No one should raid their tax-free savings account for a frivolous reason—it's not meant to be used as a bribe. But if you're going to withdraw money strategically, the clock is ticking.

This is due to a unique feature of the accounts that restores contribution space at the beginning of the calendar year after withdrawals. Harry Marr's Financial Post tells us how raiding your TFSA before the end of the year could save you thousands.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here