Chip giant Nvidia beat Wall Street's earnings and upcoming sales expectations, easing investor concerns about big artificial intelligence (AI) spending that has rattled markets.

In its quarterly earnings report on Wednesday, the company said revenue in the three months to October jumped 62% to $57 billion, driven by demand for its chips used in artificial intelligence data centers. Sales of this division grew by 66% and exceeded $51 billion.

Fourth-quarter sales forecasts in the $65 billion range also topped forecasts, sending Nvidia shares up about 4% in after-hours trading.

Nvidia, the world's most valuable company, is considered a leader in the artificial intelligence boom. The chipmaker's results could influence market sentiment.

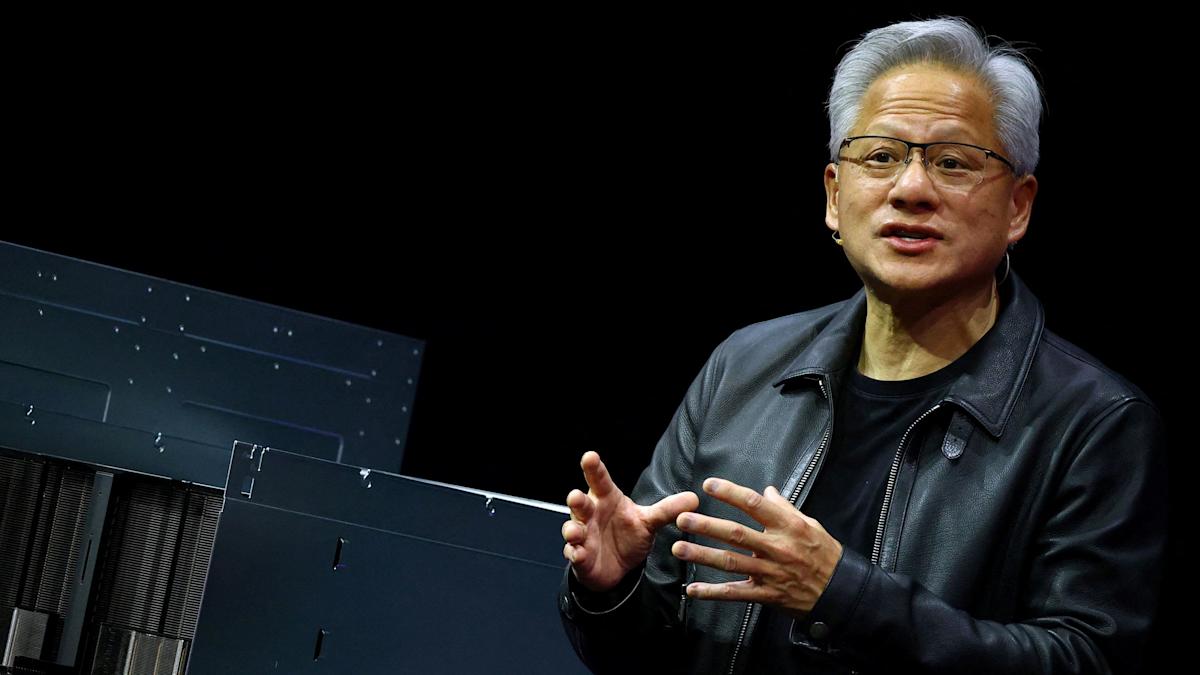

CEO Jensen Huang said in a statement that sales of its Blackwell AI systems are “off the charts” and that “cloud GPUs [graphics processing units] sold out.”

“There has been a lot of talk about the AI bubble. From our perspective, we see something completely different,” he said on a call with analysts.

“We succeed at every stage of AI development.”

The chipmaker's quarterly report drew even more attention than usual on Wall Street amid growing concerns that AI stocks are overvalued – concerns that could persist despite Nvidia's stunning results.

Those concerns sparked four consecutive daily declines in the S&P 500 leading up to Wednesday as questions arise about the returns on AI investments. The benchmark index fell nearly 3% in November.

Nvidia's performance bar was high.

Adam Turnquist, chief technical strategist at LPL Financial, said the question isn't whether the company will exceed expectations, but “by how much.”

“While AI valuations dominate news feeds, Nvidia is running its business in style,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

He said valuations in some areas of the AI sector “need a breather, but Nvidia is not in that camp.”

Huang previously said he expected orders for artificial intelligence chips worth $500 billion before next year. Investors were asking for details about when the company expects to receive those earnings and how it plans to fulfill orders.

Colette Kress, Nvidia's chief financial officer, told analysts that the company will “likely” take on more orders beyond the $500 billion already announced.