The Montreal venture capital firm plans to launch a sixth venture fund and a “larger” Discovery Fund II to support emerging managers.

One of Canada's most successful venture capital (VC) firms is expanding its investment team by promoting two of its executives to partner roles as it prepares to raise funds in 2026.

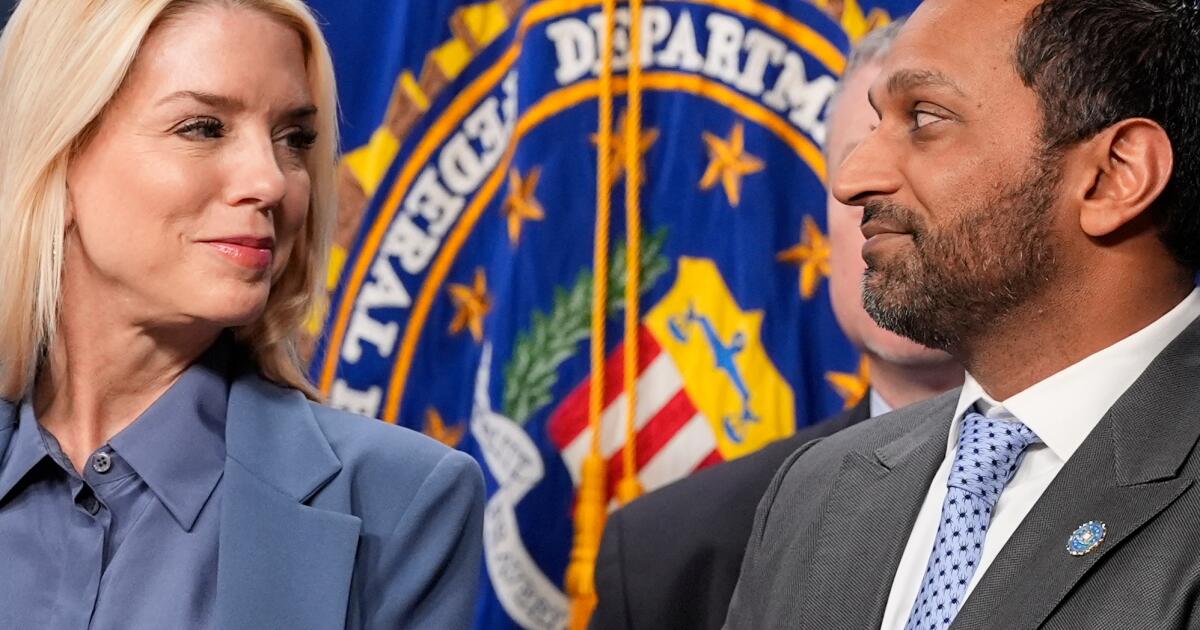

Montreal Inovia Capital announced today that he will be promoting Corey Jeffery and Taha Mubashira. At the same time, the company said it intends to launch a sixth venture fund focused on companies between seed and Series B, as well as a second Discovery fund designed to invest in other venture funds and directly in early-stage companies.

“We are seeing a paradigm shift where the competitive chessboard is shaking.”

Taha Mubashir,

Inovia Capital

Founded in 2007, Inovia Capital has more than US$2.5 billion (C$3.5 billion) in assets under management and investments in Canadian unicorns such as Cohere, Wealthsimple and Hopper.

In a statement, Inovia partner Karamdeep Nijjar said both investors earned their spots through “deal execution, thesis development and trust in the founders.”

Mubashir, who has been a principal since February 2022, will now be a partner in the venture capital team. His new role will allow him to continue supporting companies in cybersecurity, infrastructure and FinTech – a “Venn diagram” where he brings unique expertise, he told BetaKit in an interview on Wednesday.

Mubashir said the strategy and size of Fund VI will be “very similar” to his Fund V. The same will happen with software, especially in artificial intelligence companies.

“AI will continue to be a trend that will impact Foundation VI,” Mubashir said. “We are seeing a paradigm shift where the competitive chessboard is shaking.”

Mubashir spent nearly a decade at PSP Investments, where he primarily worked with growth and emerging companies. He said his interest in venture capital was sparked by some experimental growth-stage PSP bets made on software giants Snowflake and Palantir. At Inovia, he helped invest in portfolio companies such as Montreal-based Flare and sustainability reporting platform Novisto.

Director and VP of Technology Jeffrey will now become a partner in Inovia's venture capital team, which invests from seed to Series B. Jeffrey is part of the transition from Google to Inovia, joining former Google CFO Patrick Pichette (now a partner in London) and former head of engineering at Google Canada. Steve Woods (now CTO and Partner at Inovia).

In an interview, Jeffrey told BetaKit that his first test of Inovia was actually done at Canadian AI darling Cohere. Series C. Working alongside Cohere's co-founders at Google, he played a unique role in the company's rise: he created a list of promising students from which the godfather of artificial intelligence, Geoffrey Hinton, could choose when Nick Frost's choice as a Google Brain employee.

Jeffrey and Woods also developed Inovia's thesis on investing in artificial intelligence (AI), and the firm continues to support AI infrastructure projects such as the Montreal Project. Botpressand new applications of artificial intelligence, such as a legal technology startup. Book of Spells.

CONNECTED: Recovery in Canadian VC market still on the horizon, experts say at Startupfest

In addition to working on artificial intelligence on the venture team, Jeffrey will be a partner on the Discovery team. Inovia launched Discovery Fund I in 2023, invest in emerging North American venture capital fund managers focused on pre-seed and seed-stage startups. At the time, Nijjar told BetaKit that the firm believed it could support investments at the earliest stages by backing venture capitalists who are better suited for such deals.

So far, Inovia says the program has supported 31 funds in North America and Europe, including Garage Capital, Luge Capital and Telegraph VC, which have facilitated the exits of 52 funds and 37 unicorns.

Inovia is looking to raise funds from limited partners (LPs) as first-time managers struggle to extract value. The company was looking to fill a gap in the market for new managers in 2023 as economic conditions worsened and investors avoided betting on emerging fund managers. Two years later, the landscape for venture capital fundraising may have become more frosty: according to Business Development Bank of Canadathe proportion of new managers fell to its lowest level in a decade, and only 17 funds raised a total of $2 billion in 2024, representing declines in dollars raised and average fund size compared to last year.

The new Discovery Fund will have a larger target size as it seeks to expand the program, Jeffrey said. Its investment allocation of approximately 80 per cent in funds and 20 per cent in direct companies will be the same as Inovia seeks to “double down on great young managers” in Canada and beyond.

He acknowledged that the Canadian venture capital fundraising landscape is in a difficult position because investors are not seeing enough returns to invest in a second fund. boom 2021 led to a wave of inflated valuations and a fundraising frenzy, many of which have now dwindled.

“If your starting point was in the middle of 2021, it's difficult,” Jeffrey said.

With its extensive track record, Inovia hopes to anchor and de-risk some of these early-stage deals for other investors. “We enjoy playing that role of putting an institutional stamp on an emerging manager and helping them unlock follow-on capital.”

Artistic image by Madison McLauchlan for BetaKit. Photos courtesy of Inovia Capital.