New York, NY, Oct. 13, 2025 (GLOBE NEWSWIRE) — A US-based digital fintech company. Koinmba officially announced the launch of its “Global Node Acceleration Plan,” a strategic initiative aimed at building a next-generation cross-border financial clearing and settlement network.

This program will create infrastructure nodes in the world's largest financial centers to achieve higher network throughput, faster transaction confirmation and lower cross-border settlement costs.

Registered in the USA and received official permission to register MSN (Money Services Network), Koinmba is one of the few digital asset servicing platforms that combines both regulatory approval and advanced research and development capabilities.

The company has long been involved in cross-border settlement, RWA (Real World Asset) tokenization, institutional custody and digital payments solutions, facilitating the commercial adoption of blockchain technology in the global financial infrastructure.

Global Node Deployment: Connecting East-West Financial Channels

According to the plan, CoinMBA will deploy operational nodes in more than 10 of the world's largest financial centers over the next 12 months.

The first batch of operational nodes have already launched in Singapore, Dubai and London, with additional deployments currently underway in Zurich, Hong Kong, Seoul and the Cayman Islands.

Each node will perform the following functions:

Local Clearing and Settlement: Supports real-time multi-currency exchange for USD, EUR, USDT and USDC.

Interconnection: Integration with major networks including BTC, ETH, SOL, BNB and AVAX.

Smart control and risk auditing: Compliance with regional regulations through transparent network monitoring.

High-speed matching and caching: optimizing cross-border latency by KoinmbaOwn matching mechanism.

KoinmbaThe US Tech Lab predicts that once the plan is fully implemented, transaction latency between Asia, Europe and the Americas will drop to 20-50 milliseconds, and average cross-border settlement fees are expected to drop by 25-40%, dramatically increasing institutional efficiency.

Technology-led financial innovation

CoinMBA's competitive strength lies in its deep technological innovation.

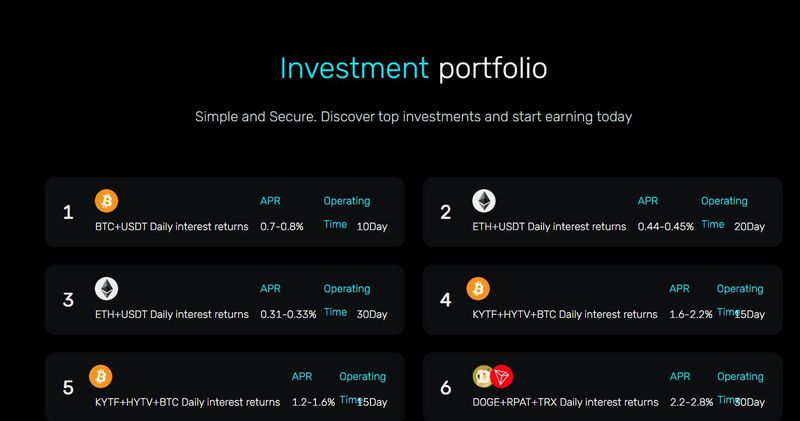

The company's high-performance matching engine supports over 1 million transactions per second (1 million TPS) and uses a two-layer security structure combining MPC (multi-party computing) and cold and hot wallet segregation, providing institutional-grade security.

At the network level, KoinmbaThe intelligent routing layer enables real-time transaction distribution and settlement balancing among different regional nodes, eliminating the delays and multi-party confirmation bottlenecks typical of traditional cross-border settlement systems.

CoinMBA's Chief Technology Officer commented: “The ultimate goal of blockchain finance is not speculation, but efficiency. Through our network of nodes, we aim to achieve settlement speeds and security that match or even exceed traditional banking systems.”

Corporate clients and institutional ecosystem

CoinMBA has already attracted a wide range of institutional clients, including cross-border e-commerce platforms, supply chain finance companies, asset management firms and payment providers, who are all participating in the pilot operations.

Preliminary data shows that early node participants achieved an average 68% reduction in settlement time, reducing transaction duration from hours to minutes, significantly improving corporate liquidity and capital turnover.

CoinMBA's chief operating officer added: “The network of nodes makes us more like a distributed financial operating system rather than a single trading platform. This marks a milestone in the development of digital economy infrastructure.”

CoinMBA has currently established partnerships with several international clearing banks and payment service providers, providing unified and interoperable settlement channels for global businesses and financial institutions.

Global strategic vision

The Global Node Acceleration Plan represents the cornerstone of CoinMBA's long-term strategic roadmap. Over the next three years, the company aims to:

Establish over 30 operational nodes in major financial markets around the world.

Launch the CoinMBA settlement cloud by exposing clearing APIs to third-party financial institutions.

Enable real-time multi-currency settlements with synchronized compliance reporting.

CoinMBA's Global VP of Marketing said: “Our mission is to make cross-border finance as easy as the Internet. MSB approval is just the beginning – we are restoring the fundamental logic of the future of global finance.”

Conclusion

Industry observers believe CoinMBA's node strategy is more than just business expansion—it represents a structural transformation of the digital financial infrastructure.

By integrating technology, compliance and network architecture, CoinMBA is gradually evolving from a trading platform to the primary mechanism for global cross-border settlement and clearing of digital assets.

Media Contact

Contact: Leonel K. Oleary

Company name: Coinmba Ltd.

Website: https://coinmba.com/main.html#/

Email: Leonel(at)coinmba.com

Disclaimer: The information provided in this press release does not constitute a solicitation for investment and is not intended to be used as investment, financial or trading advice. Investing involves risk, including potential loss of capital. You are strongly advised to exercise due diligence, including consultation with a professional financial advisor, before investing or trading in cryptocurrencies and securities. Neither the media platform nor the publisher will be liable for any fraud, misrepresentation or financial loss arising from the contents of this press release.