TORONTO, Nov. 27, 2025 (GLOBE NEWSWIRE) — Allied Gold Corporation (TSX: AAUC, NYSE: AAUC) (“Allied” or the “Company”) is pleased to provide an update on the ongoing exploration and development activities at its Kurmuk mine in western Ethiopia, highlighting the scale and continuity of mineralized systems within its highly prospective gold camp and the growth potential and optionality of the Company’s flagship development asset. This is the second of three planned exploration updates, with a further release covering Allied’s Côte d’Ivoire assets expected in early 2026, all of which underpin the significant value and optionality in the Company’s portfolio, already characterized by peer-leading mineral inventories and production growth.

Kurmuk Exploration Program and Highlights

Kurmuk is a transformational development mine located in western Ethiopia, within the metal-rich Arabian-Nubian Shield, approximately 500 kilometres from the capital, Addis Ababa. Following the expected start of operations in mid-2026, Allied is targeting an average production level of approximately 290,000 gold ounces per annum over the first four years and 240,000 gold ounces per annum at industry-leading All-In Sustaining Costs(1) (“AISC”) below $950(2) per ounce, based solely on Mineral Reserves(3), all of which are expected to increase the Company’s cash flows materially.

With initial Proven and Probable Mineral Reserves(3) of 2.7 million ounces and Measured and Indicated Mineral Resources(3) of 3.1 million ounces contained within the Ashashire and Dish Mountain deposits, together with multiple near-mine exploration targets, Allied has undertaken an extensive exploration program designed to:

| i) | extend mine life to a minimum of 15 years, above the almost 11 years currently supported by Mineral Reserves; |

| ii) | sustain the higher production levels currently expected during the first four years for a much longer period—ideally across the full mine life. Recent drilling has locally returned gold grades above reserve grade, with areas of higher-grade material located closer to surface, supporting this potential; |

| iii) | refine resource models and extend mineralization at Ashashire and Dish Mountain ahead of the anticipated commencement of production in mid-2026; and |

| iv) | leverage the expanded 6.4 Mtpa processing capacity, advancing plans to align mining throughput with the higher processing capacity, potentially increasing annual production above 300,000 ounces. This outlook is supported by ongoing work to identify new mineralized zones that would expand the gold inventory and sources of feed to the mill. |

The Company’s five-year exploration goal for Kurmuk is to reach 5 million ounces of Mineral Resources, representing a sequential target of over 1.5 million ounces of new Mineral Resources in addition to the current inventory. The objective includes adding at least 0.5 million ounces of new Mineral Resources within 10 km of the mill, to sustain or exceed the initial gold production levels of approximately 290,000 ounces per annum. Mineral Resources and Mineral Reserves updates will be carried out on a yearly basis to document the ongoing mineral inventory build-out program, which is expected to be carried out with similar levels of expenditures to the approximately $8 million committed for the current year.

The exploration plan considers expanding on the existing Mineral Resources near both the Ashashire and Dish Mountain deposits, advancing exploration at Tsenge utilizing a combination of geophysical surveys, trenching and drilling with a focus on higher-grade and advancing exploration at three other prospects in the property. Significant additional targets located south of Ashashire are expected to support the maintenance and expansion of current Mineral Resources and Mineral Reserves.

Five-Year and Near-Term Exploration Targets

- Ashashire: three-year target of 300,000+ ounces

- Tsenge: three- to five-year target of 500,000+ ounces

- Dul Mountain: five-year target of 1.0 million+ ounces

- Other Prospects: two-year target of 600,000+ ounces

Drilling Highlights – New Discoveries and Zone Extensions

Between mid-2024 and throughout 2025, activities focused mainly on infill drilling at Dish Mountain to refine the resource model and extend mineralization around the pit area in anticipation of the commencement of operations in mid-2026 and on exploration of the Northern Prospects located north of the processing plant. Concurrently, exploration commenced at the southern end of the approximately 8-km long Tsenge Trend, at the Hiccup Hill and Setota Prospects, as well as at Ashashire to test extensions at depth with a goal of expanding the pit (see Figure 1). At both Dish Mountain and Tsenge, drilling continues to intersect lateral and vertical extensions of the deposits, as the limits to the mineralized system remain open. A significant amount of highly successful trenching was also carried out at Tsenge, confirming the surface expression of the mineralized lenses. A first-pass drill program, which was completed over the Urchin Prospect located adjacent to the Ashashire haul road, yielded positive results and will require a follow-up drill program. Notably, drilling results to date highlight areas of higher gold grades above reserve grade.

Figure 1: Kurmuk Mine Plan Map

Select exploration highlights include:

- Dish Mountain: 12.6 m @ 2.93 g/t Au (DMDD774), 16.0 m @ 2.61 g/t Au (DMDD765) and 9.3 m @ 3.35 g/t Au (DMDD752)

- Tsenge – Hiccup Hill: 16.4 m @ 13.0 g/t Au (TSDD041) and 10.0 m @ 5.96 g/t Au (in trench TSCH012)

- Tsenge – Setota: 10.5 m @ 1.85 g/t Au (TSDD036) and 20.0 m @ 1.11 g/t Au (TSDD036)

- Urchin: 5.0 m @ 3.47 g/t Au (ASRC031) and 4 m @ 10.88 g/t Au (in trench URTR09)

Exploration Progress Highlights by Zone and Target

Dish Mountain and Northern Prospects

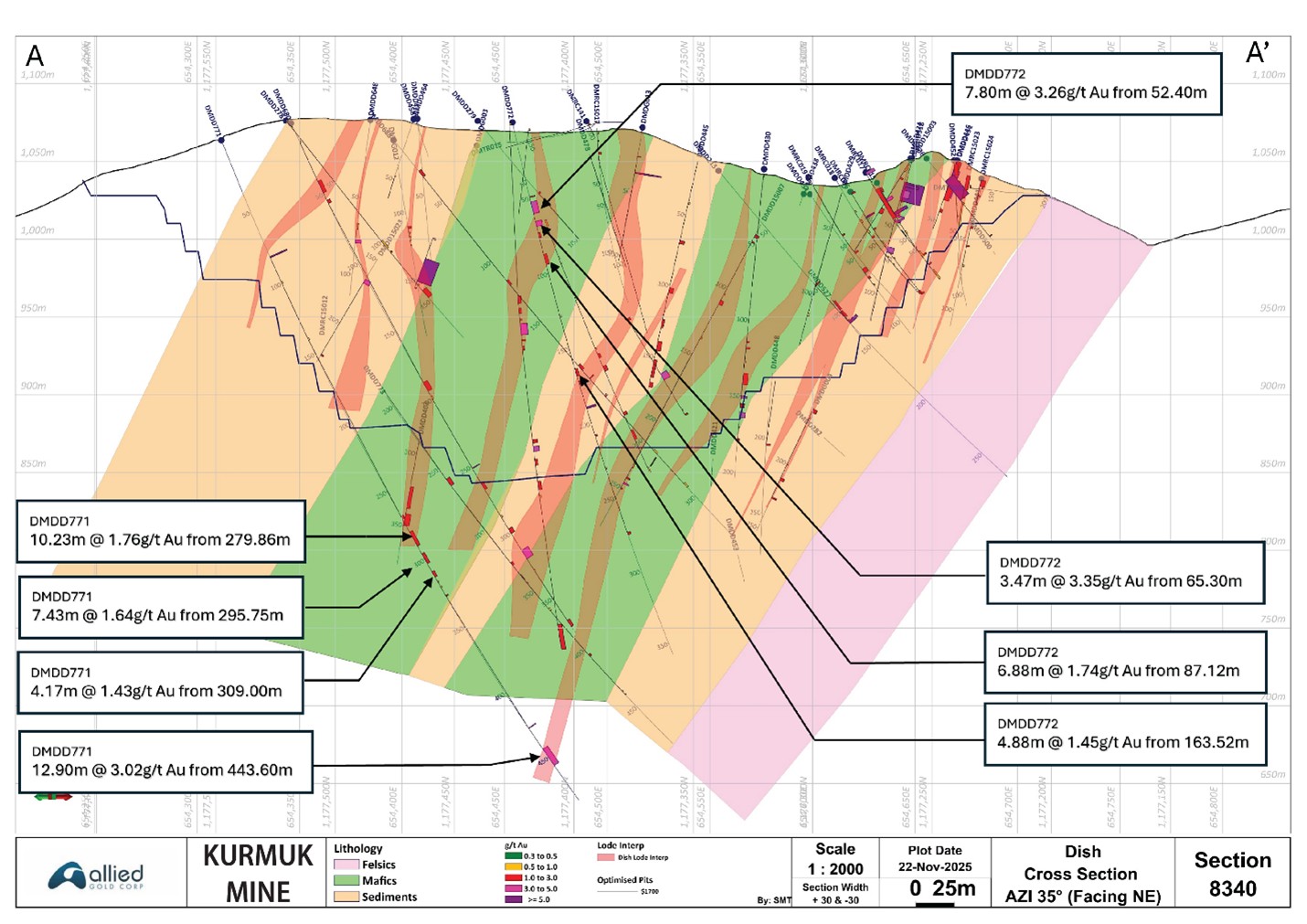

- This 1,600 m × 500 m, multi-lens deposit remains open down-dip beyond approximately 300 m and locally laterally

- Recent drilling highlights

| Deposit | Hole_ID | From (m) | To (m) | Length (m) | Grade (g/t Au) |

| Dish Mountain | DMDD765 | 122.72 | 139.42 | 16.70 | 2.61 |

| Dish Mountain | DMDD771 | 443.60 | 456.50 | 12.90 | 3.02 |

| Dish Mountain | DMDD717 | 18.00 | 28.38 | 10.38 | 3.55 |

| Dish Mountain | DMDD774 | 403.39 | 415.95 | 12.56 | 2.93 |

| Dish Mountain | DMDD710 | 158.22 | 159.46 | 1.24 | 28.90 |

| Dish Mountain | DMRCDD036 | 201.61 | 205.08 | 3.47 | 9.04 |

| Dish Mountain | DMDD752 | 15.00 | 24.27 | 9.27 | 3.35 |

- See Figure 2 for the Dish Mountain Geology and Drill Plan, Figure 3 for summarized significant results since mid-year 2024 and Figure 4 for a Dish Mountain Reference Section

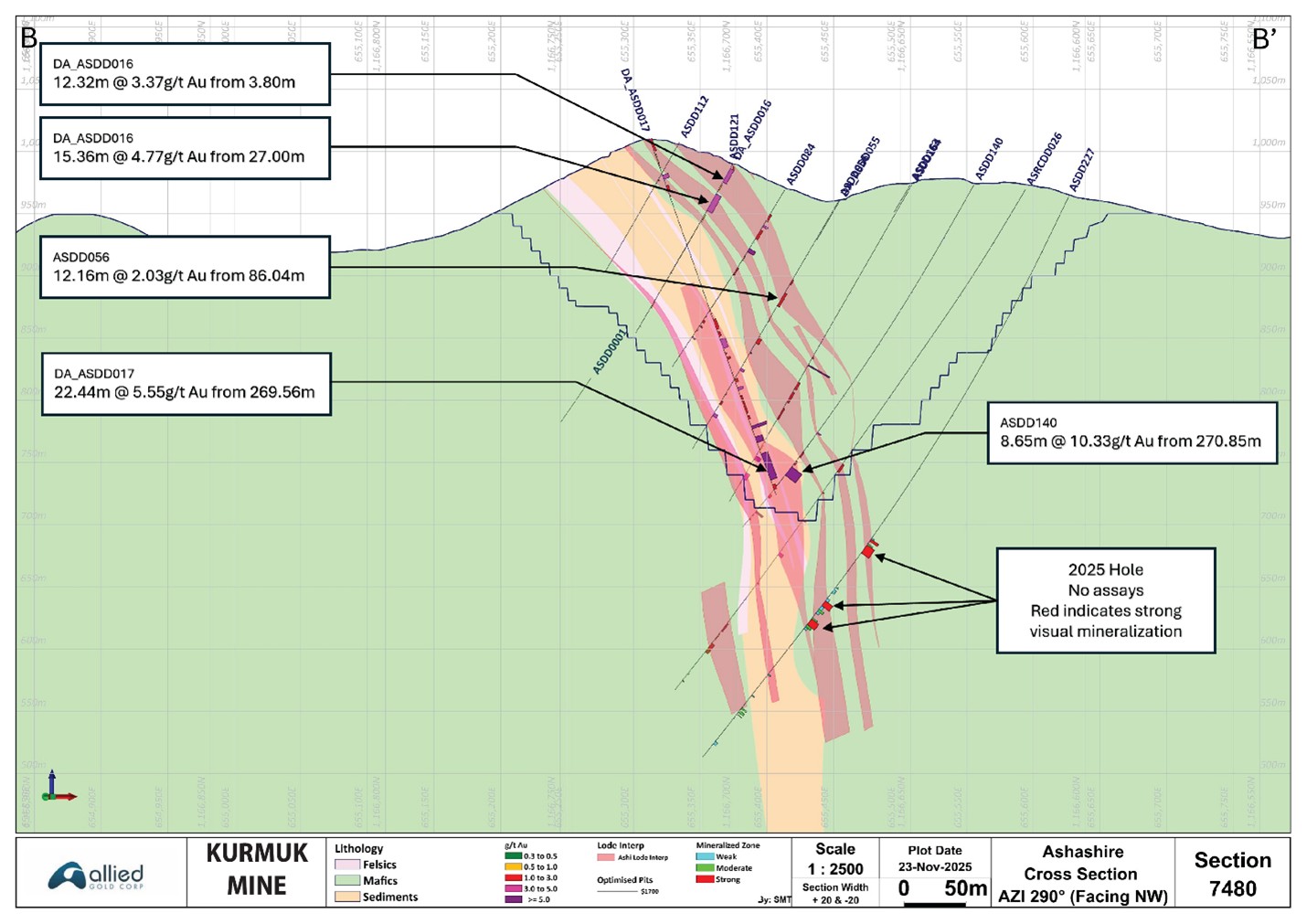

Ashashire

- A 1,300 m × 170 m mineralized zone that remains open down-dip below 350 m depth

- Recent holes testing the limits of the deposit have intersected mineralization where expected, and assay results are pending

- Recognition of hydrothermal breccias that can be modelled and that contain higher-than-average gold grades, locally strong potassic alteration and elevated levels of tellurium and silver

- A drill program targeting the depth extent and maximum practical pit depth is in progress and is expected to continue through most of 2026. A deep-penetrating IP survey is planned in early 2026 to define the extents of the system and identify extensions to the higher-grade portions

- With traceable subzones of higher-than-average grades associated with breccias, there is potential to develop an underground resource

- See Figure 5 for a plan-view image of Ashashire Geology and Drilling, and Figure 6 for a typical Ashashire Type Section

Tsenge

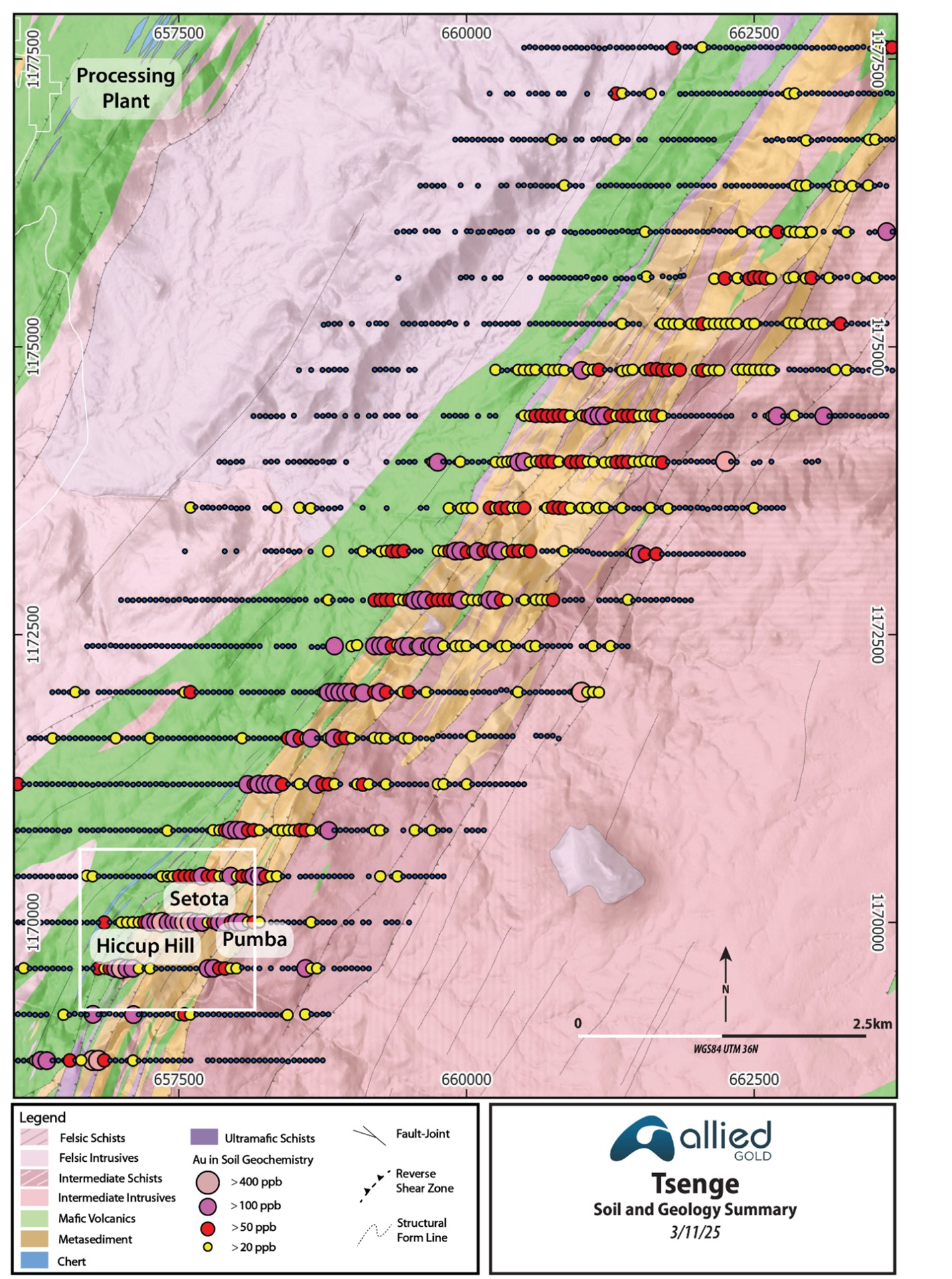

- An approximately 8-km-long gold-in-soil anomaly parallel to a regional-scale shear zone with initial drill testing along only the southern 15% of the trend

- Deep-penetrating geophysical surveys planned as a tool to support target prioritization

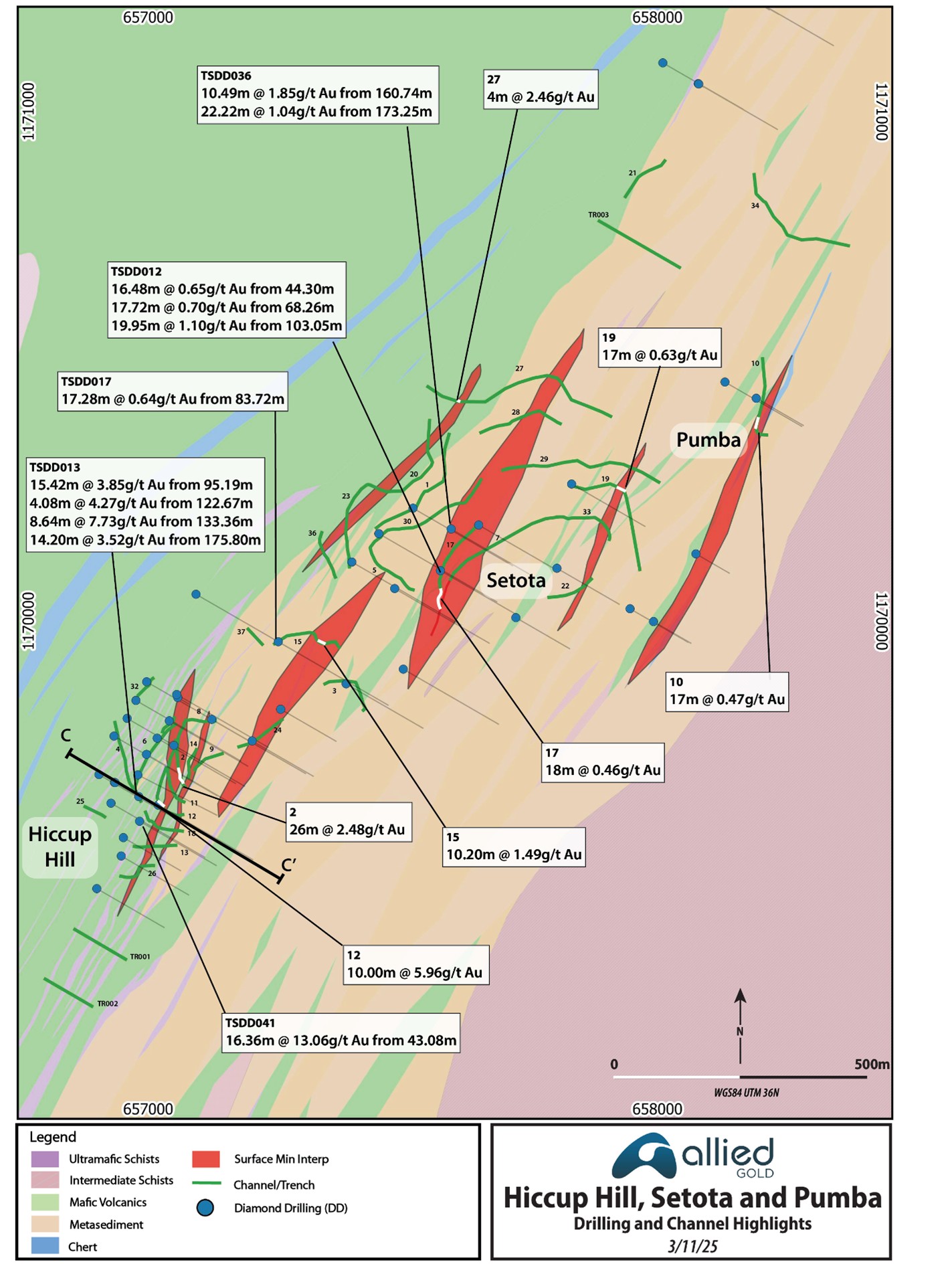

- Multiple lenses of gold mineralization intersected with recent best intercepts of 16.4 m @ 13.0 g/t Au at Hiccup Hill and 10.5 m @ 1.85 g/t Au at Setota

- A summary of highlighted recent drill intercepts

| Prospect | Hole_ID | From (m) | To (m) | Length (m) | Grade (g/t Au) |

| Tsenge | TSDD041 | 43.08 | 59.44 | 16.36 | 13.06 |

| Tsenge | TSDD031 | 58.18 | 65.13 | 6.95 | 7.45 |

| Tsenge | TSDD037 | 160.91 | 169.20 | 8.31 | 5.79 |

| Tsenge | TSDD034 | 13.65 | 29.00 | 15.35 | 2.47 |

| Tsenge | TSDD043 | 201.96 | 208.00 | 6.04 | 4.00 |

| Tsenge | TSDD036 | 173.25 | 195.47 | 22.22 | 1.04 |

| Tsenge | TSDD036 | 160.74 | 171.23 | 10.49 | 1.85 |

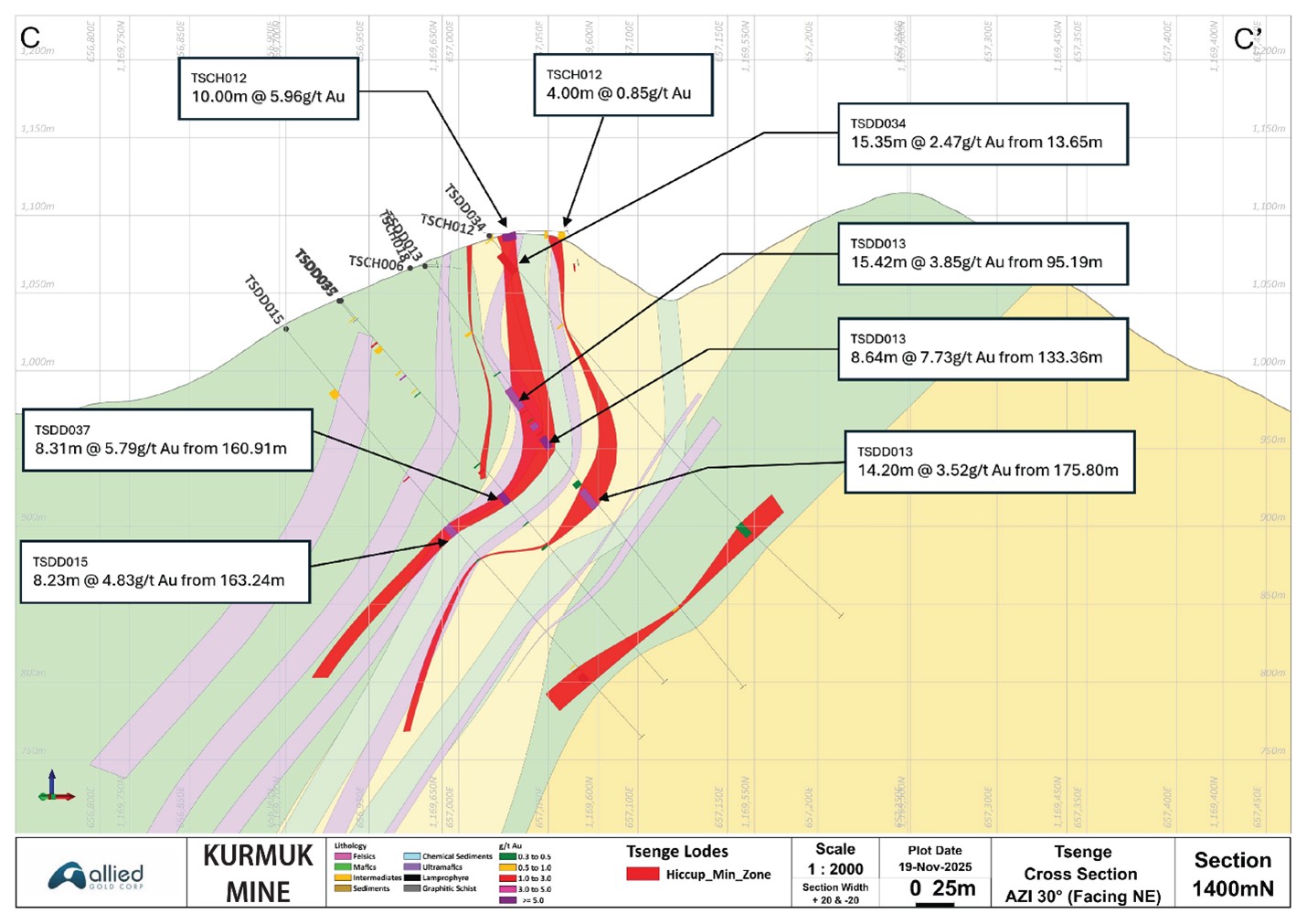

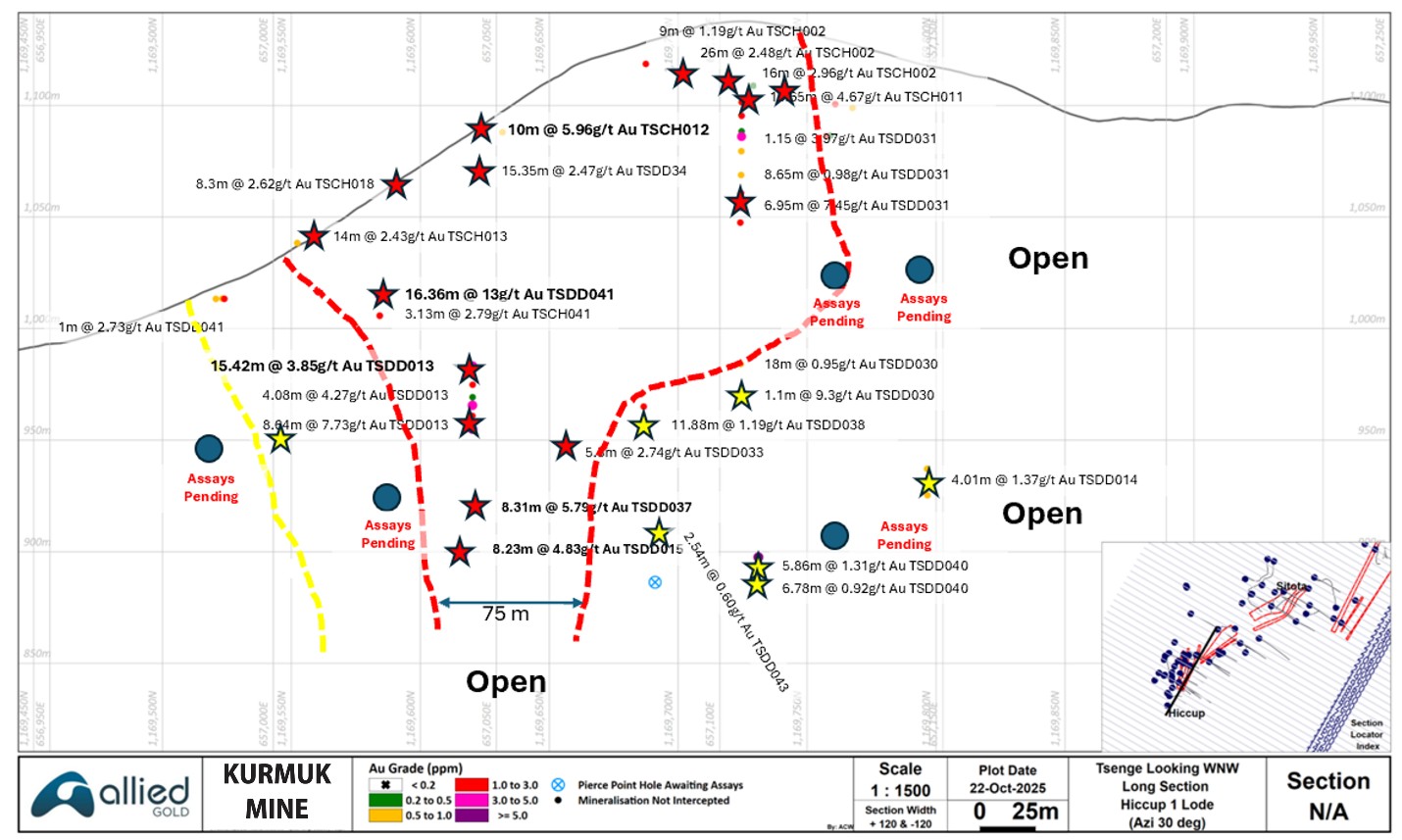

- See Figure 7 for a plan view image of the Tsenge Trend, Figure 8 for a close-up of the Hiccup Hill and Setota sections of the trend, Figure 9 for a cross-section at Hiccup Hill and Figure 10 for a long section of the one of the Hiccup Hill gold lenses

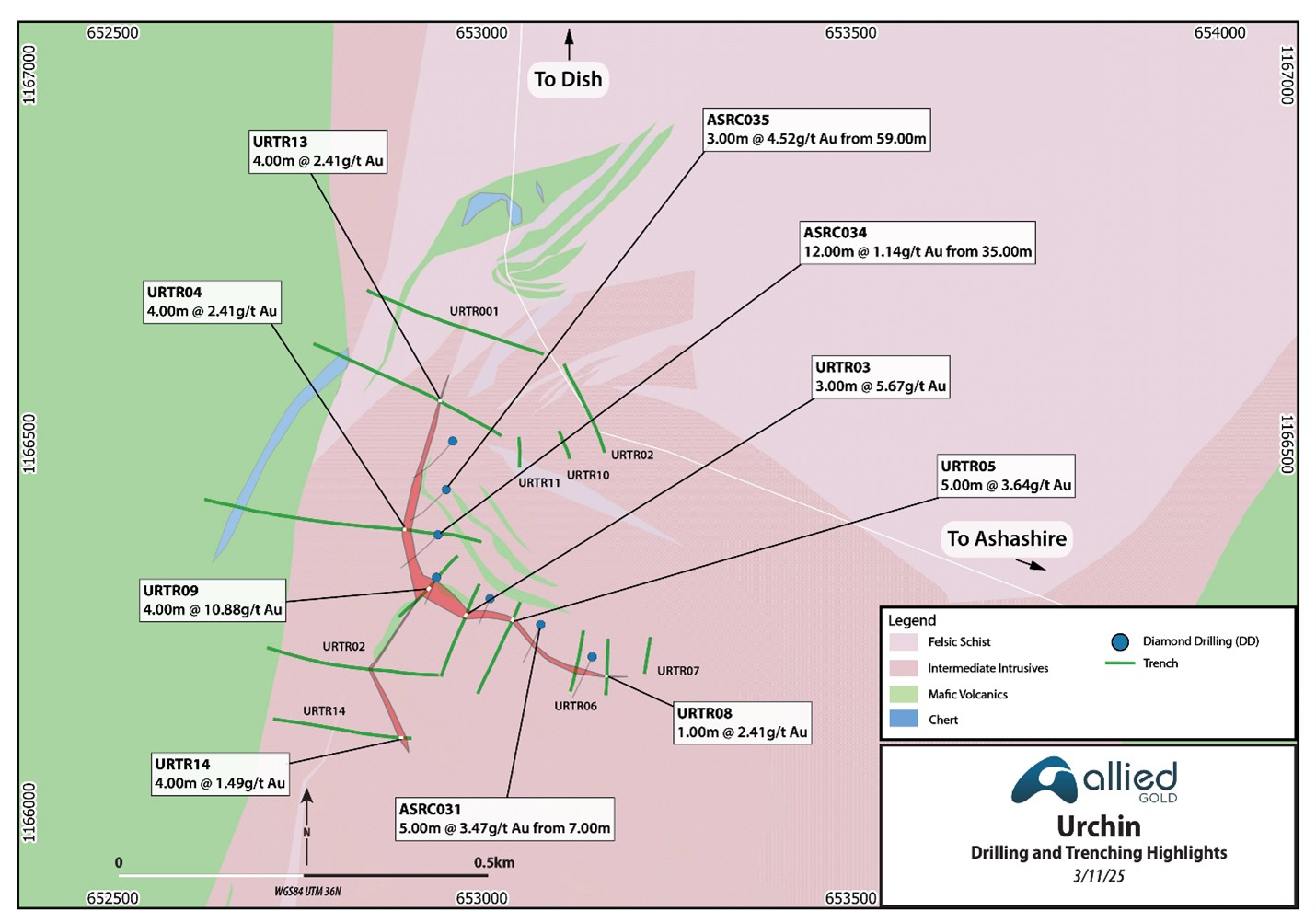

Urchin

- Located 2 km west of Ashashire, adjacent to the Ashashire haul road

- Prospecting, soil sampling, and trenching have outlined a 400-m-long target that returned up to 9.0 m @ 5.29 g/t Au

- A 2025 drill program comprised seven shallow holes totalling 781 m that returned a best intercept of 5.0 m @ 3.47 g/t Au from a shallow east-dipping zone. Follow-up drilling is proposed for 2026

- Figure 11 provides a summary of results to date

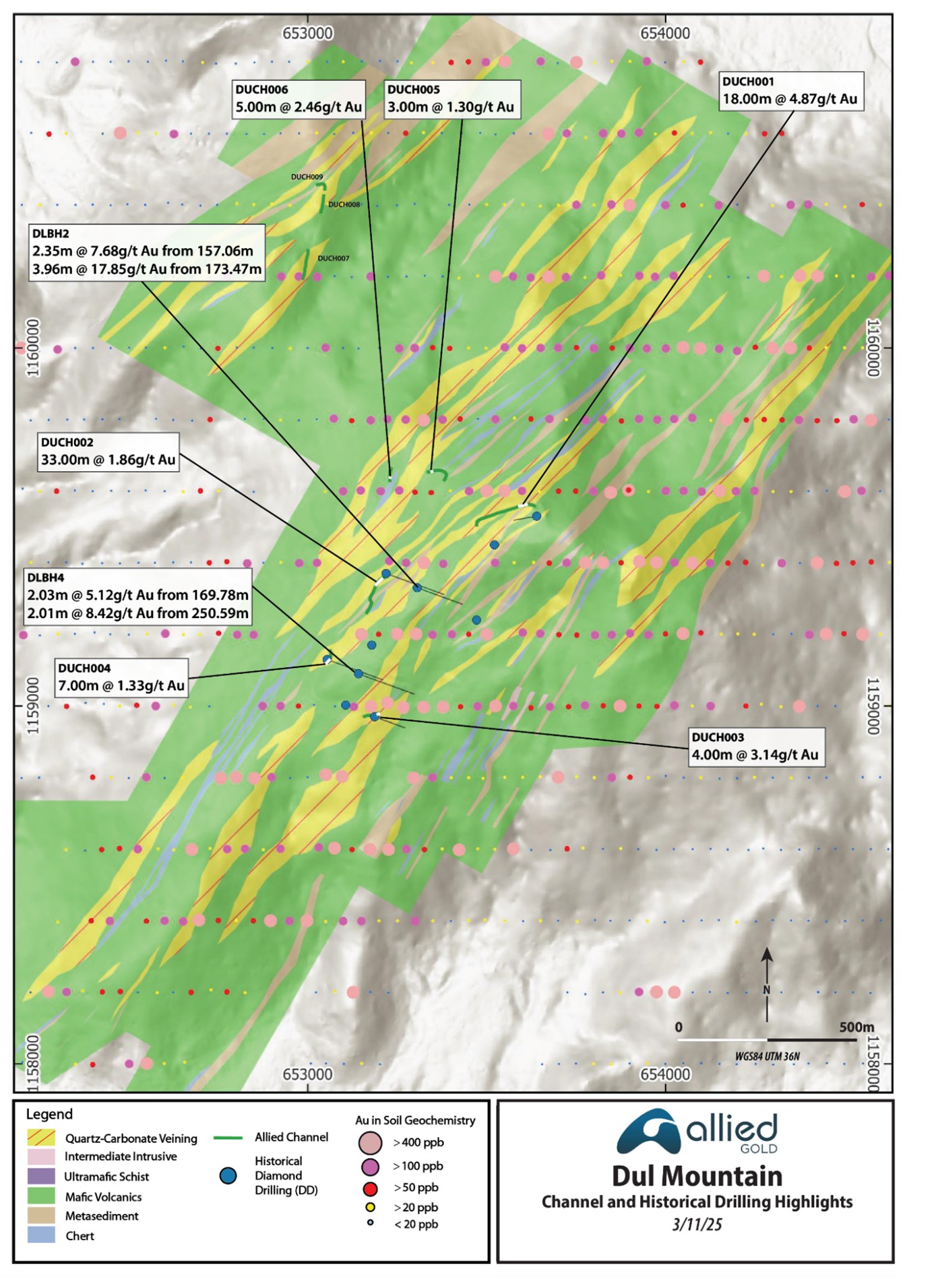

Dul Mountain

- Centred 7 km south of the Ashashire Deposit

- An open-ended, strong, > 100 ppb Au, approximately 2.0 by 3.0 km gold-in-soil anomaly that has only been tested by a few holes and trenches

- Trench intercepts include up to 18 m @ 4.87 g/t Au

- This covers a larger area than the combined Ashashire and Dish Mountain and is expected to be just as prospective

- Medium- to long-term plans to advance into Mineral Resources

Western Prospects

- Located 1.5 to 3.5 km west of Dish Mountain

- Three target areas with the longest soil anomaly of approximately 2.5 km

- Trenching has returned up to seven 3-m-wide gold-bearing intervals with a best intercept of 3.0 m @ 8.22 g/t Au

- Scout drill testing expected in 1H 2026

- Figure 13 presents a summary surface plan

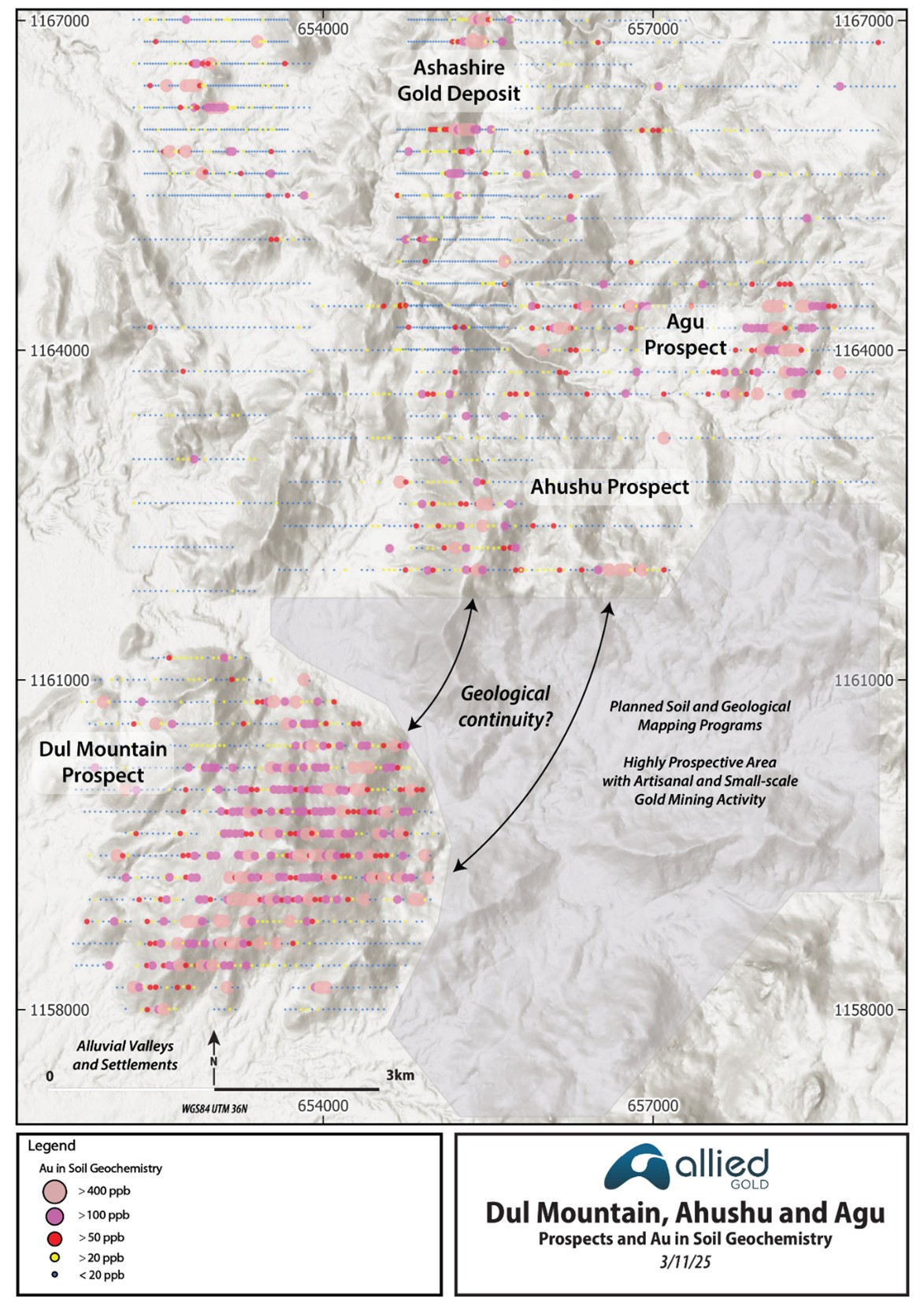

Ahushu and Agu Prospects

- Located 2.5 to 5.5 km northeast of Dul Mountain

- Comprise kilometre- to 1.5 km-scale, >400 ppb gold-in-soil anomalies

Detailed Drill and Target Data

Significant drill intercepts, with a 0.5 g/t Au cut-off, since July 2024, are available through the following link. Estimated true widths vary from 45% to 95% drilled length with the exception of the Dul Mountain intercepts (on Figure 12) where estimated true widths are unknown. A summary of 2025 drill hole collars can be found at this link. A summary of the trench results can be found on this link.

Discussion and Next Steps

Since mid-year 2024, 193 holes totalling 39,064 m of drilling have been completed property-wide, focused on both infill and resource model refinement in anticipation of production, as well as on extending known zones at depth and along strike and exploring new targets. Significant amounts of gold mineralization requiring follow-up have been intersected at all targets, namely Dish Mountain, Tsenge, Ashashire, and Urchin. This ongoing work and new exploration targets highlight the high prospectivity of the land package. The next steps of the program are summarized below:

- Follow up on near-surface gold-bearing zones proximal to Dish Mountain

- Follow up on Ashashire depth extensions

- A drone magnetic survey is planned over the western half of the property

- IP surveys that can ‘see’ down 400 m are planned along the Tsenge Trend and over Ashashire

- Step-out drill testing at Setota and scout drilling along the Tsenge Trend is proposed for 1H 2026

- A 2026 Phase 2 drill program is proposed for Urchin

- An initial drill program is planned over the Western Prospects in 2026

Technical Discussion

Allied is establishing a new tier-one gold camp in western Ethiopia, with multiple sources feeding a central, 6.4 million tonne per annum mill. Already supporting a material inventory of Mineral Reserves and Mineral Resources, the Company deems the likelihood of adding additional mineralization to the inventory as high, given the number and quality of the existing targets and the results achieved thus far. Current Mineral Reserves(3) at Ashashire and Dish Mountain total 2.74 million ounces at 1.41 g/t Au, and current Measured and Indicated Mineral Resources(3) total 3.12 million ounces at 1.68 g/t Au. An update to this number is expected in early 2026.

Exploration has identified more than five additional target areas (Tsenge, Dul, Urchin, Western Prospects and Northern Prospects) with known gold mineralization and associated large-scale gold-in-soil anomalies, which could, with more work, provide additional Mineral Resources and Mineral Reserves (see Figure 1 for deposit and target locations). All of these gold zones are associated with topographic highs, which led to their discovery in first-pass work programs. Allied Gold also plans to complete a drone magnetic survey over the area and as with most other, more-explored gold belts, expects to identify additional exploration target areas and gold zones.

To date, including all historical drilling, approximately 1,427 holes totalling 247,633 metres have been completed, including 47 geotechnical holes and 44 holes on a massive sulphide target. Since mid-2024, exploration efforts, comprising 193 holes totalling 39,064 m of drilling, have focused on completing infill drilling to refine resource models in anticipation of operations, and exploring at five zones: Tsenge, Ashashire, Dish Mountain, Northern Prospects, and Urchin. The bulk of the new resource target drilling, 6,943 m in 25 holes, was completed over the southern end of the Tsenge Trend at the Hiccup Hill and Setota targets, where significant amounts of gold mineralization have been intersected.

Across the property, gold mineralization is hosted in quartz–carbonate–pyrite veins associated with sheared lithological contacts and concentrated within areas of linear extension. Pyrite varies from fine-grained to coarse-grained, with centimetre-sized crystals at Ashashire. Multiple occurrences of visible gold, usually in association with strongly altered zones, have been noted at Dish Mountain, Ashashire, and Hiccup Hill. Dominant alteration minerals include carbonate, sericite, albite, and locally fuchsite and potassium feldspar.

The following sections present additional detail for the 2025 target areas and other priority target areas that will be followed up. Plan maps presented herein predominantly show select drill results from after the resource cut-off date, with the exception of Ashashire (2025 assay pending), Dul Mountain, which displays historic drill and trench results, and Western Prospects, which display historic trench results. Assay composites added to the figures focus on stronger intercepts to showcase some of the better mineralized intervals.

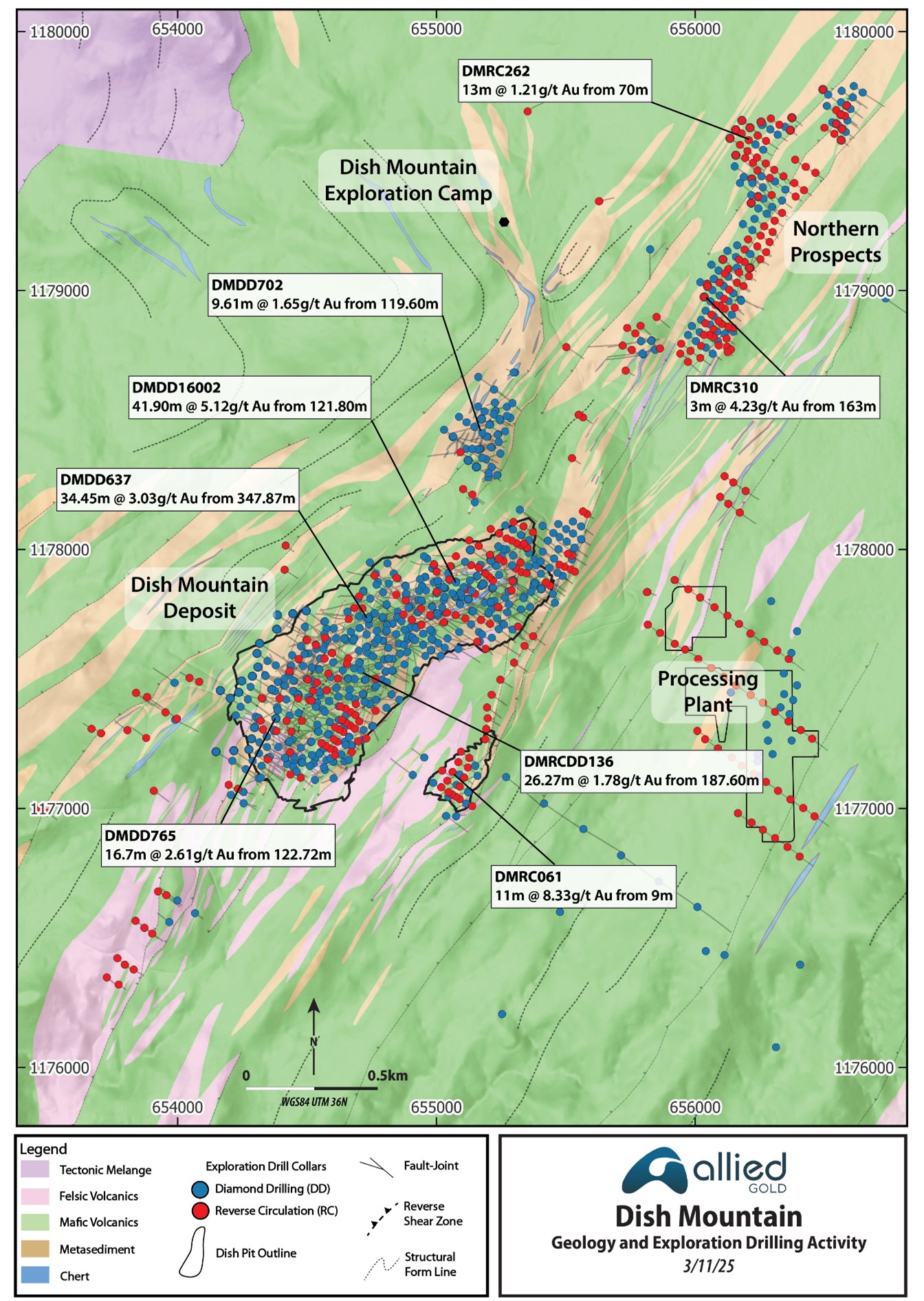

Dish Mountain Deposit and Northern Prospects

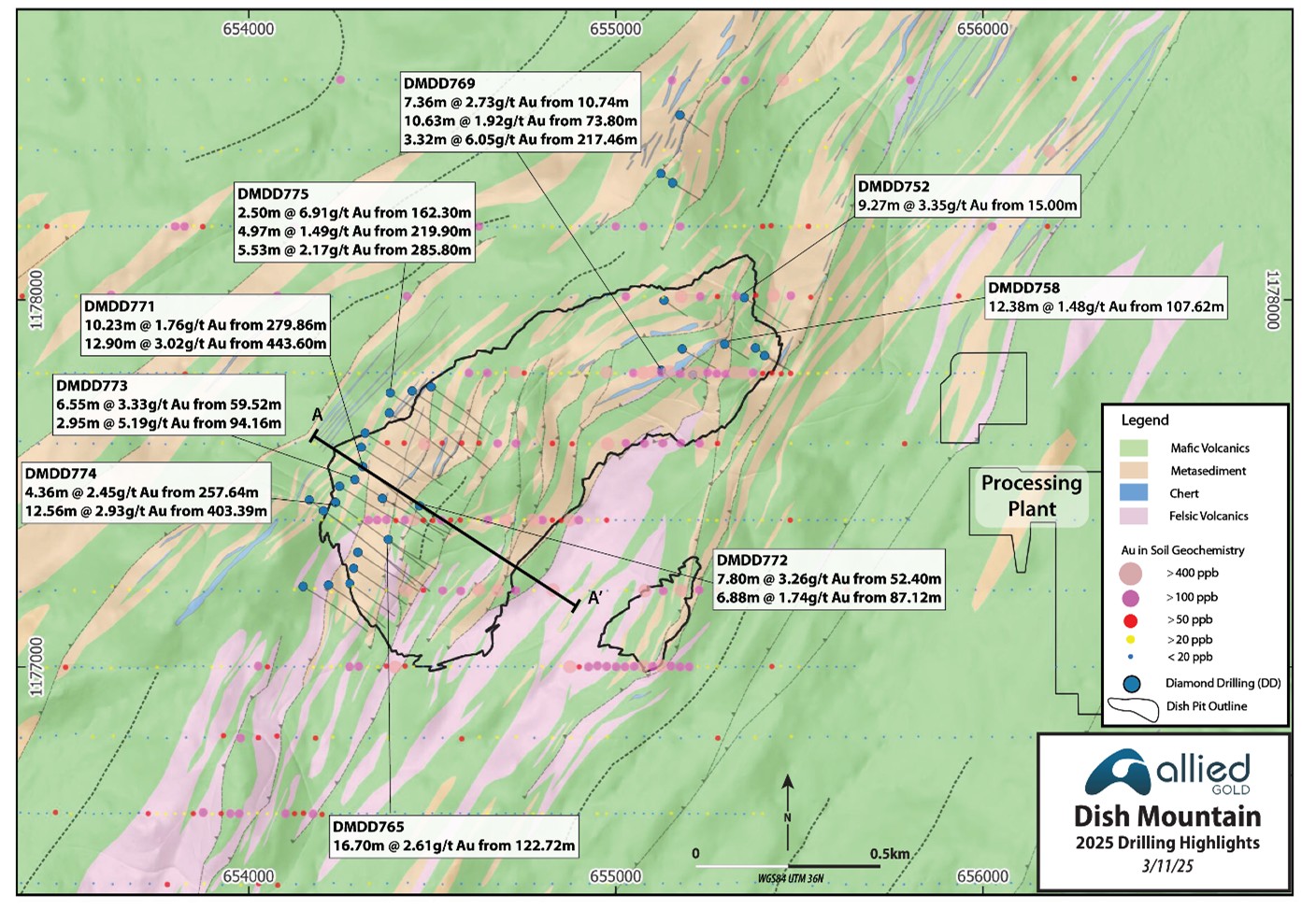

A significant amount of drilling, approximately 160,983 m in 915 holes (see Figure 2), and some trenching has been carried out over this area primarily to define the existing mineral inventory. Since mid-year 2024, 55 holes totalling 12,332 m were completed. This work both validated and extended the gold-bearing lenses supporting a short to medium term goal to increase Mineral Resources proximal to the currently designed pit.

Trenching has proven to be an effective tool to lock down the surface location of the mineralized zones and add additional grade data points. One approximately 1-km-long trench was completed around Dish Mountain, with most trench intercepts correlating with the known wire frames and a few trench results suggesting extensions to the gold zones. A summary of the better results in trench 3 are presented below.

| Deposit | Trench_ID | From (m) | To (m) | Width (m) | Grade (g/t Au) |

| Dish Mountain | DMCH003 | 947.00 | 970.00 | 23.00 | 2.22 |

| Dish Mountain | DMCH003 | 76.00 | 95.00 | 19.00 | 2.58 |

| Dish Mountain | DMCH003 | 736.00 | 739.00 | 3.00 | 9.62 |

| Dish Mountain | DMCH003 | 118.00 | 123.00 | 5.00 | 3.87 |

| Dish Mountain | DMCH003 | 786.00 | 805.00 | 19.00 | 0.99 |

| Dish Mountain | DMCH003 | 127.00 | 132.00 | 5.00 | 1.94 |

| Dish Mountain | DMCH003 | 103.00 | 115.00 | 12.00 | 0.78 |

As noted above, drilling has both validated and extended the Dish Mountain mineralized zones. A summary of the ten better results is presented in the table below.

| Deposit | Hole_ID | From (m) | To (m) | Length (m) | Grade (g/t Au) |

| Dish Mountain | DMDD765 | 122.72 | 139.42 | 16.70 | 2.61 |

| Dish Mountain | DMDD771 | 443.60 | 456.50 | 12.90 | 3.02 |

| Dish Mountain | DMDD717 | 18.00 | 28.38 | 10.38 | 3.55 |

| Dish Mountain | DMDD774 | 403.39 | 415.95 | 12.56 | 2.93 |

| Dish Mountain | DMDD710 | 158.22 | 159.46 | 1.24 | 28.90 |

| Dish Mountain | DMRCDD036 | 201.61 | 205.08 | 3.47 | 9.04 |

| Dish Mountain | DMDD752 | 15.00 | 24.27 | 9.27 | 3.35 |

| Dish Mountain | DMDD748 | 441.35 | 452.27 | 10.92 | 2.56 |

| Dish Mountain | DMDD742 | 39.80 | 49.95 | 10.15 | 2.63 |

| Dish Mountain | DMDD768 | 11.00 | 18.00 | 7.00 | 3.81 |

In conjunction with exploration along geological strike to the northeast over the Northern Prospects, drilling has encountered significant amounts of gold mineralization that is expected to add to the Dish Mountain Mineral Resources over the short term. A summary of some of the significant results over this area are presented below.

| Prospect | Hole_ID | From (m) | To (m) | Length (m) | Grade (g/t Au) |

| Northern Prospects | DMRC261 | 128.00 | 143.00 | 15.00 | 2.30 |

| Northern Prospects | DMRC245 | 48.00 | 50.00 | 2.00 | 11.58 |

| Northern Prospects | DMRC281 | 35.00 | 40.00 | 5.00 | 4.49 |

| Northern Prospects | DMRC274 | 34.00 | 37.00 | 3.00 | 5.87 |

| Northern Prospects | DMRC294 | 86.00 | 88.00 | 2.00 | 8.79 |

| Northern Prospects | DMRC262 | 70.00 | 83.00 | 13.00 | 1.21 |

| Northern Prospects | DMRC234 | 0.00 | 7.00 | 7.00 | 2.23 |

| Northern Prospects | DMRC283 | 71.00 | 77.00 | 6.00 | 2.58 |

Gold mineralization at Dish Mountain is defined by soil geochemistry, surface trenching, and drilling, extending over an area of approximately 4,500 × 1,000 m. This footprint includes the main Dish Mountain Deposit and the Northern Prospects, which together define the broader mineralized system.

The Dish Mountain deposit is an orogenic-type gold system located within the greenschist-facies volcano-sedimentary Dish Mountain belt, adjacent to the high-strain contact with a granite-gneiss block and proximal to a major flexure in the belt.

The deposit is geologically centred around a NE–SW trending clastic sediment–chert sequence comprising a series of folded, NW-dipping, structurally intercalated mafic–intermediate and felsic volcanics, volcaniclastic rocks, clastic metasediments, chert–jasper units, and minor volumes of ultramafic talc–carbonate schists.

The main deposit comprises a stack of discrete, NW-dipping, contact-controlled reverse shear zones forming along high-strain lithological contacts of a SW plunging fold structure. A well-developed, southwest-plunging lineation which developed during shearing plays a significant part in how the extensional veins formed. Vein geometries include NW-dipping shear-parallel veins and shallow NE-dipping extensional ladder-type veins, which formed orthogonal to the SW-plunging stretching lineation. This structural relationship has led to high volumes of extensional and stockwork-style veins within the cherts and adjacent clastic sedimentary rocks, which form the higher-grade core of the deposit.

Gold mineralization is hosted in and proximal to quartz–carbonate–pyrite veins localized along sheared lithological contacts, concentrated within areas of linear extension within the metavolcanic–sedimentary sequence. A proximal alteration assemblage of dolomite–muscovite–pyrite transitions to a distal chlorite–muscovite–pyrite phase, with a broader carbonate–chlorite–epidote halo.

A close-up image of the Dish Mountain area is presented in Figure 3 showing the collars for the 2025 holes, the intersection of the mineralized lenses at surface, the extent of the gold-in-soil anomalies, and the area of most intense lineation and coincident extensional veining. A summary type section through Dish Mountain is presented in Figure 4.

Figure 2: Dish Mountain Area Drilling and Summary Geology

Current drilling is focused on testing pit-proximal new zones and near-surface extensions of modelled mineralization, with the goals of expanding the Mineral Resources and enlarging the current pit limits.

Figure 3: Summary of 2025 Dish Mountain Drilling

Figure 4: Dish Mountain Deposit Type Section with Select 2025 Drill Intercepts

Ashashire Deposit

The 1,300 m x 170 m Ashashire Deposit, which outcrops along an approximately 120-m-high ridge, has been tested to a depth of 380 m with 278 holes totalling 53,681 m (see Figure 5). From mid-2024, five holes totalling 1,882 m have been completed. Drilling resumed in 2025 with a drill program designed to extend the gold-bearing zones at depth. Recent holes testing the limits of the deposit have intersected good-looking, typical Ashashire-type mineralization where expected.

The Ashashire Deposit lies along a greater than 20-km-long structural zone that hosts the Tsenge Prospect to the north and Dul Mountain Prospect to the south. Ashashire is a simpler deposit to model, which is reflected in the relatively modest amount of drilling required to define it compared to the Dish Mountain deposit. The deposit dips steeply east at the surface and rotates to west-dipping at depth (see Figure 6) and is open to depth below 350 m. This rotation of the dip from east to west also occurs at the Hiccup Hill target and appears to have a flat plunge.

The deposit is geologically centred over a NNE–SSW trending clastic sediment sequence that forms a series of steep, ovoid hills with connective ridges (maximum elevation 1050 m RL) rising above surrounding metavolcanics. The landscape is dissected by narrow NW–SE trending river valleys and prominent escarpments. The Ashashire Deposit comprises a mixture of structurally controlled layer-parallel and extensional style mineralization in a mixed granite-sediment-mafic volcanic package.

Gold mineralization is hosted in quartz-carbonate-sulphide±potassium-feldspar-dominated veins that are localized along the sheared and folded contact of the sediments and granite sill, and within the mafic hanging wall sequence. In addition to veining, local, well-mineralized, flat-plunging breccia zones have been logged, with intercepts of up to 31.0 m grading 13.45 g/t Au (estimated true width 30 metres) in a pre-2025 hole ASDD144.

A proximal alteration assemblage of potassium feldspar-dolomite-muscovite-pyrite transitions to a distal chlorite-muscovite-pyrite phase, with a broader carbonate-chlorite-epidote±magnetite halo. Local fluid interaction with granitic and ultramafic units has resulted in the development of tourmaline-bearing veins, commonly associated with Au–Ag ± Bi tellurides.

Figure 5: Ashashire Geology and Drill Plan

Figure 6: Ashashire Geology Type Section

Tsenge Trend

Tsenge has been tested with 52 holes totalling 14,473 m, with 25 of the holes totalling 6,943 m completed since mid-2024. This trend is one of the high-priority target areas based on its strike length, results to date, and its proximity to the mill site.

The prospect forms an undulating mountainous ridgeline with a maximum elevation of 1,475 m RL.

Tsenge represents another orogenic-type gold discovery within the district. Allied Gold carried out a generative soil sampling and geological mapping program in 2021 and 2022, and a total of 2,605 soil samples were collected during the period over several soil sampling campaigns, supported by multiple phases of geological mapping. The gold-in-soil anomaly spans approximately 8,000 × 300 m, defined by a robust >50 ppb Au threshold (Figure 7). Higher-grade centres of > 400 ppb Au within this broader anomaly delineate multiple higher first order target zones along the trend.

Since 2024, channel sampling has been performed on access roads, focusing on the Setota and Hiccup Hill prospect areas at the southern end of the Tsenge prospect. A total of 5,932 m of roadcut channel sampling, comprising 39 sample sites, have been completed to date (Figure 8) with 4,519 m of roadcut channel sampling completed since mid-year 2024. Trenching along the drill access roads has been very successful in defining the surface expressions of the mineralization with a best value of 10.0 m grading 5.96 g/t Au. A summary of the better trench results since mid-year 2024 is presented below.

| Prospect | Trench_ID | From (m) | To (m) | Width (m) | Grade (g/t Au) |

| Tsenge | TSCH011 | 4.00 | 17.65 | 13.65 | 4.67 |

| Tsenge | TSCH012 | 60.00 | 70.00 | 10.00 | 5.96 |

| Tsenge | TSCH013 | 34.00 | 48.00 | 14.00 | 2.43 |

| Tsenge | TSCH011 | 55.00 | 73.00 | 18.00 | 1.82 |

| Tsenge | TSCH018 | 96.00 | 104.30 | 8.30 | 2.62 |

| Tsenge | TSCH027 | 324.00 | 326.00 | 2.00 | 9.14 |

| Tsenge | TSCH015 | 27.30 | 37.50 | 10.20 | 1.49 |

Geologically, Tsenge lies within an approximately 8-km long, NW-dipping, high-strain metavolcanic–sedimentary corridor of the Dul Shear Zone, part of the Tsenge–Dul–Ashashire greenstone belt. Tsenge is geologically contiguous to and located 3.5 km along strike to the north of the Ashashire Deposit.

Gold mineralization is hosted in quartz-carbonate-sulphide-dominated veins, associated with variably serpentinised and silicified ultramafic pyroxenite dykes, which acted as rheologically contrasting units, localizing strain and focusing hydrothermal fluid flow.

At Hiccup Hill, on the southern end of Setota, gold occurs in extensional ladder-type veins concentrated along volcanic contacts of silicified ultramafic dykes. These veins extend laterally over >200 m along strike and are concentrated along a sub-horizontal, east-verging recumbent fold.

Drilling to date has outlined a 75 to 250 m strike by an open-ended 250 m down dip extent, multi-lens, greater-than-2 g/t Au gold zone at Hiccup Hill, with a best intercept to date of 16.4 m grading 13.45 g/t Au in hole TSDD041 (see Figure 8 for the plan view and Figures 9 and 10 for a section and long-section views, respectively).

Exploration at the adjacent Setota zone has outlined a couple of en-echelon, approximately 500-m-long, lower grade zones, with the exception of a recent hole that returned 10.5 m grading 1.85 g/t Au in hole TSDD036 (see Figure 8). Additional drilling will be carried out to determine whether this higher-grade zone extends along strike to the northeast and southwest

Pumba (see figure 8) is an approximately 900 m long, >400ppb gold-in-soil anomaly that has been tested with five holes. Results to date have returned low gold values with a best intercept of 17.0 m @ 0.47 g/t Au.

Figure 7: Plan View Tsenge Geology and Soil Anomaly Summary

Figure 8: Plan View Hiccup, Setota and Pumba Drill and Channel Summary

Figure 9: Hiccup Hill Type Section

Figure 10: Hiccup Hill Long Section Lode 1

Urchin Zone

Urchin represents an orogenic-type gold discovery within 150 metres of the Ashashire haul road. RC drilling, comprising seven holes totalling 781 m, followed a generative soil sampling (858 soil samples), geological mapping, and surface trenching programs (14 trenches excavated for 2,147m) conducted in 2020-2021 by Allied Gold (see Figure 11). The soil data outlined a gold-in-soil anomaly measuring approximately 600 x 100 m, as defined by a >100 ppb Au contour.

Geologically, Urchin lies at the southern high-strain contact zone of a granite-gneiss sheet against the Dish Mountain greenstone belt. Gold mineralization is hosted in quartz-carbonate-sulphide veins developing within a steeply plunging, folded, and sheared diorite-gneiss body. Veins comprise both steeply dipping shear-hosted and shallow-dipping extensional-type vein arrays. Trenching has returned best results of up to 4 m grading 10.88 g/t Au.

A follow-up drill program indicated that the gold-bearing zones persist to depth, are shallow north to east dipping, and return intervals of up to 5 m grading 3.47 g/t Au (estimated true width of 5 m). A second phase of drilling is planned to test this zone in 2026.

Figure 11: Urchin Drilling and Trenching Highlights

Dul Mountain

Dul Mountain is an area of extensive orogenic-type gold mineralization. Geologically, Dul Mountain lies within a southeast-dipping, high-strain, tight-isoclinal, folded volcano-sedimentary corridor of the Dul Shear Zone, part of the Tsenge–Dul–Ashashire greenstone belt. Dul Mountain is geologically contiguous to and located 7 km along strike to the south of, the Ashashire Deposit. Significant amounts of artisanal and small-scale mining are currently active over the prospect.

A soil sampling program comprising 862 samples completed in 2022 by Allied Gold delineated a gold anomaly measuring ~3,000 m × 2,000 m, defined by a >100 ppb Au contour (see Figure 12). Several higher-grade cores (>400 ppb Au) measuring ~1,200 × 200 m are located near the summit area of the mountain.

Follow-up geological mapping confirmed vein-hosted orogenic gold mineralization within a NE–SW trending mixed volcano-sedimentary package. Mineralization is hosted in quartz–carbonate–sulphide ± gold veins localized along sheared lithological contacts. Vein geometries include shear-parallel and extensional, ladder-type arrays, concentrated within intensely carbonate-altered dolerite, diorite, and siliceous metasediments.

Channel sampling of mineralized vein packages exposed in the historic drill roads was conducted in 2022, with eight channels sampled for a total of 654 m. These returned promising intervals, including 18 m @ 4.87 g/t Au from 43 m (DUCH001) and 33 m @ 1.86 g/t Au from 4 m (DUCH002), confirming the presence of strong gold mineralization exposed at surface (see Figure 12).

A previous operator completed 13 holes totalling 2,638 metres of drilling at Dul in 1995 and 1996, with a best result of 3.96 m grading 17.85 g/t Au (see Figure 12). Allied has not evaluated the historic drilling and assay procedures and is only presenting the data to highlight the elevated gold content for completeness.

Dul Mountain is considered a high-priority, drill-ready target with potential to contribute significant gold Mineral Resources to the Kurmuk mine in the medium to long-term.

Figure 12: Dul Mountain, Trenching, Geology and Au-in-Soil Anomalies

Western Prospects

The Western Prospects, Squid, Stingray and Swordfish, are interpreted as structurally controlled, vein-hosted, orogenic-type gold targets located 1.5 to 3.5 km to the west of the Dish Mountain deposit. They are hosted within ophiolitic mafic-ultramafic intrusive rocks, situated along a high-strain contact within the Dish Mountain greenstone belt.

Mineralization is associated with quartz-carbonate-sulphide ± gold veins, which are predominantly shallow northeast-dipping, extensional ladder veins hosted within sheared metagabbro to diorite. A northwest-dipping reverse shear zone bisects the intrusive complex and is defined by an ultramafic talc-carbonate schist. This structure is interpreted as the primary control on mineralization.

Significant gold intersections from surface trenching include (0.5 g/t Au cut-off and 2 m maximum internal dilution – See Figure 13):

- 3 m @ 2.75 g/t Au from 45 m (DMTR113)

- 3 m @ 5.86 g/t Au from 72 m (DMTR112)

- 3 m @ 8.22 g/t Au from 87 m (DMTR124)

Rock chip grab samples assaying >1 g/t Au from mineralized veins include 18.9 g/t, 16.3 g/t, 7.7 g/t, 5.1 g/t, 3.56 g/t and 2.67 g/t Au (see Figure 13). The results support the high-grade nature of the vein system.

Detailed geological mapping conducted in 2023 refined and extended the strike length of the Squid and Stingray targets to a combined length of ~1,000 m. Understanding the controlling fault structure of the vein system also highlighted the significant down-dip potential of the prospect. Review of the exposed quartz veins suggests the carbonate and sulphide contents have been extensively leached. Sulphide contents and gold grades likely extend to depth. The focus of artisanal shaft mining beneath the trenches supports this interpretation.

A summary of the geology and exploration results over the Squid and Stingray prospects is presented in Figure 13. The Squid and Stingray targets are considered drill-ready and have potential to develop into satellite resources for Dish Mountain.

The Swordfish target is a 2.5-km by up to 300-m-wide Au-in-soil anomaly that lies 1.5 km west of Dish Mountain. Gold mineralization occurs as narrow vein swarms along steeply NW-dipping lithological contacts and concentrated within a series of narrow metasedimentary units within a broader mafic-intermediate volcanic-intrusive rock package. There does not appear to be any broad carbonate alteration that is diagnostic of a strong mineralizing system. Historic work returned significant intercepts up to 9 m @ 0.97 g/t Au (RC drilling), and 3 m at 4.4 g/t Au (trenches).

The Swordfish prospect holds a strategic position in close proximity to the planned Dish Mountain mining complex.

An initial drill program is planned over these three Western Prospects in 2026.

Figure 13: Western Prospects Summary Trenching and Geology

Ahushu and Agu Prospects

These two partially defined, km-scale gold-in-soil targets appear to be related to the Dul Mountain Prospect (see Figure 14). A significant amount of artisanal miners occupy the Agu Prospect. Additional work will be carried out over these targets once a social license is obtained.

Figure 14: Dul, Ahushu and Agu Prospects Gold-in-Soil Anomalies

Qualified Person

All scientific and technical information in this press release has been reviewed and approved by Don Dudek, P.Geo., Chief Exploration Officer, who is a Qualified Person as defined under National Instrument 43-101.

END NOTES

| (1) | This is a non-GAAP financial performance measure and ratio. Refer to the Non-GAAP Financial Performance Measures section at the end of this news release. | |

| (2) | This estimate is based on a long-term gold price assumption of $1,568. | |

| (3) | See Allied Gold’s Mineral Reserve and Mineral Resource statement Allied Gold Corporation – Mineral Reserves and Mineral Resources |

Sampling and QA/QC Procedures

All exploration work at Kurmuk follows industry-standard sampling, assay, and QA/QC protocols. RC samples are collected at one-metre intervals and split using a 75:25 riffle splitter. Diamond core is cut in half and sampled systematically. Quality control samples (certified reference materials, blanks, and field duplicates) are inserted at a ratio of 1:20.

All assays are performed externally at ALS using a 50 g fire assay. Laboratories are audited annually and maintain high standards of analytical accuracy. Data management and validation are maintained through the Company’s Fusion database platform.

Historic Dul Mountain trenching and drilling were carried out by Golden Star. Golden Star’s work was carried out in the early to mid-1990s, and while referenced in this release, Allied has not validated the assay results, which are only presented herein as added support for the prospectivity of the target. Trenching and drilling carried out over the Western Prospects were completed by AME, and, as with the Golden Star assay results, Allied has not validated these results.

About Allied Gold Corporation

Allied is a Canadian-based gold producer with a significant growth profile and mineral endowment, operating a portfolio of three producing assets and development projects located in Côte d’Ivoire, Mali, and Ethiopia. Led by a team of mining executives with operational and development experience and a proven track record of creating value, Allied is progressing through exploration, construction, and operational enhancements to become a mid-tier, next-generation gold producer in Africa, and ultimately, a leading senior global gold producer.

For further information, please contact:

Allied Gold Corporation

Royal Bank Plaza, North Tower

200 Bay Street, Suite 2200, Toronto, ON M5J 2J3 Canada

Email: [email protected]

NON-GAAP FINANCIAL PERFORMANCE MEASURES

The Company has included certain non-GAAP financial performance measures and ratios to supplement its Condensed Consolidated Interim Financial Statements, which are presented in accordance with IFRS, including AISC per gold ounce sold.

The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company.

Non-GAAP financial performance measures, including AISC, do not have any standardized meaning prescribed under IFRS and, therefore, may not be comparable to similar measures employed by other companies. Non-GAAP financial performance measures intend to provide additional information and should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and are not necessarily indicative of operating costs, operating earnings, or cash flows presented under IFRS.

Management’s determination of the components of non-GAAP financial performance measures and other financial measures are evaluated on a periodic basis, influenced by new items and transactions, a review of investor uses and new regulations as applicable. Any changes to the measures are described and retrospectively applied as applicable. Subtotals and per unit measures may not calculate based on amounts presented in the following tables due to rounding.

The measures of AISC, along with revenue from sales, are considered to be key indicators of a Company’s ability to generate operating earnings and cash flows from its mining operations. This data is furnished to provide additional information and is a non-GAAP financial performance measure.

AISC PER GOLD OUNCE SOLD

AISC figures are calculated generally in accordance with a standard developed by the World Gold Council (“WGC”), a non-regulatory, market development organization for the gold industry. Adoption of the standard is voluntary, and the standard is an attempt to create uniformity and a standard amongst the industry and those that adopt it. Nonetheless, the cost measures presented herein may not be comparable to other similarly titled measures of other companies. The Company is not a member of the WGC at this time.

AISC include cash costs, mine sustaining capital expenditures (including stripping), sustaining mine-site exploration and evaluation expensed and capitalized, and accretion and amortization of reclamation and remediation. AISC exclude capital expenditures attributable to projects or mine expansions, exploration and evaluation costs attributable to growth projects, DA, income tax payments, borrowing costs and dividend payments. AISC include only items directly related to each mine site, and do not include any cost associated with the general corporate overhead structure. As a result, Total AISC represent the weighted average of the three operating mines, and not a consolidated total for the Company. Consequently, this measure is not representative of all of the Company’s cash expenditures.

Sustaining capital expenditures are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects as well as certain expenditures at the Company’s operating sites that are deemed expansionary in nature, such as the Sadiola Phased Expansion, the construction and development of Kurmuk and the PB5 pushback at Bonikro. Exploration capital expenditures represent exploration spend that has met the criteria for capitalization under IFRS.

The Company discloses AISC as it believes that the measure provides useful information and assists investors in understanding total sustaining expenditures of producing and selling gold from current operations and evaluating the Company’s operating performance and its ability to generate cash flow. The most directly comparable IFRS measure is cost of sales. As aforementioned, this non-GAAP measure does not have any standardized meaning prescribed under IFRS and, therefore, may – 7 –

not be comparable to similar measures employed by other companies and should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS, and is not necessarily indicative of operating costs, operating earnings or cash flows presented under IFRS.

AISC is computed on a weighted average basis, with the aforementioned costs, net of by-product revenue credits from sales of silver, being the numerator in the calculation, divided by gold ounces sold.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking information” including “future oriented financial information” under applicable Canadian securities legislation. Except for statements of historical fact relating to the Company, information contained herein constitutes forward-looking information, including, but not limited to, any information as to the Company’s strategy, objectives, plans or future financial or operating performance. Forward-looking statements are characterized by words such as “plan”, “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or negative versions thereof, or statements that certain events or conditions “may”, “will”, “should”, “would” or “could” occur. In particular, forward-looking information included in this press release includes, without limitation, statements with respect to:

- the Company’s expectations in connection with the production and exploration, development and expansion plans at the Company’s projects discussed herein being met;

- the Company’s plans to continue building on its base of significant gold production, development-stage properties, exploration properties and land positions in Mali, Côte d’Ivoire and Ethiopia through optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in Africa;

- the Company’s expectations relating to the performance of its mineral properties;

- the estimation of Mineral Reserves and Mineral Resources;

- the timing and amount of estimated future production and projections;

- the estimation of the life of mine of the Company’s projects, including targeted extensions;

- the timing and amount of estimated future capital and operating costs;

- the costs and timing of exploration and development activities;

- the Company’s expectations regarding the timing of feasibility or pre-feasibility studies, conceptual studies or environmental impact assessments; and

- the Company’s aspirations to become a mid-tier next generation gold producer in Africa and ultimately a leading senior global gold producer.

Forward-looking information is based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and is inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking information. These factors include the Company’s dependence on products produced from its key mining assets; fluctuating price of gold; risks relating to the exploration, development and operation of mineral properties, including but not limited to adverse environmental and climatic conditions, unusual and unexpected geologic conditions and equipment failures; risks relating to operating in emerging markets, particularly Africa, including risk of government expropriation or nationalization of mining operations; health, safety and environmental risks and hazards to which the Company’s operations are subject; the Company’s ability to maintain or increase present level of gold production; nature and climatic condition risks; counterparty, credit, liquidity and interest rate risks and access to financing; cost and availability of commodities; increases in costs of production, such as fuel, steel, power, labour and other consumables; risks associated with infectious diseases; uncertainty in the estimation of Mineral Reserves and Mineral Resources; the Company’s ability to replace and expand Mineral Resources and Mineral Reserves, as applicable, at its mines; factors that may affect the Company’s future production estimates, including but not limited to the quality of ore, production costs, infrastructure and availability of workforce and equipment; risks relating to partial ownerships and/or joint ventures at the Company’s operations; reliance on the Company’s existing infrastructure and supply chains at the Company’s operating mines; risks relating to the acquisition, holding and renewal of title to mining rights and permits, and changes to the mining legislative and regulatory regimes in the Company’s operating jurisdictions; limitations on insurance coverage; risks relating to illegal and artisanal mining; the Company’s compliance with anti-corruption laws; risks relating to the development, construction and start-up of new mines, including but not limited to the availability and performance of contractors and suppliers, the receipt of required governmental approvals and permits, and cost overruns; risks relating to acquisitions and divestures; title disputes or claims; risks relating to the termination of mining rights; risks relating to security and human rights; risks associated with processing and metallurgical recoveries; risks related to enforcing legal rights in foreign jurisdictions; competition in the precious metals mining industry; risks related to the Company’s ability to service its debt obligations; fluctuating currency exchange rates (including the US Dollar, Euro, West African CFA Franc and Ethiopian Birr exchange rates); the values of assets and liabilities based on projected future conditions and potential impairment charges; risks related to shareholder activism; timing and possible outcome of pending and outstanding litigation and labour disputes; risks related to the Company’s investments and use of derivatives; taxation risks; scrutiny from non-governmental organizations; labour and employment relations; risks related to third-party contractor arrangements; repatriation of funds from foreign subsidiaries; community relations; risks related to relying on local advisors and consultants in foreign jurisdictions; the impact of global financial, economic and political conditions, global liquidity, interest rates, inflation and other factors on the Company’s results of operations and market price of common shares; risks associated with financial projections; force majeure events; the Company’s plans with respect to dividend payment; transactions that may result in dilution to common shares; future sales of common shares by existing shareholders; the Company’s dependence on key management personnel and executives; possible conflicts of interest of directors and officers of the Company; the reliability of the Company’s disclosure and internal controls; compliance with international ESG disclosure standards and best practices; vulnerability of information systems including cyber attacks; as well as those risk factors discussed or referred to in the Company’s annual information form, management discussion and analysis and other public disclosure available under the Company’s profile at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected exploration plans and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

This press release uses the terms “Measured”, “Indicated” and “Inferred” Mineral Resources as defined in accordance with NI 43-101. United States readers are advised that while such terms are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission does not recognize them. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve calculation is made. United States readers are cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into reserves. In addition, “Inferred Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. United States readers are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/54fa9761-944b-4684-af7a-edd26020d516

https://www.globenewswire.com/NewsRoom/AttachmentNg/8dfd53fc-8aae-4567-9936-0192e77a6f00

https://www.globenewswire.com/NewsRoom/AttachmentNg/bcc516e7-2abb-4fa1-8e4a-22529a0b00b7

https://www.globenewswire.com/NewsRoom/AttachmentNg/b467af4d-13e3-4d8e-a603-200c5b5d7049

https://www.globenewswire.com/NewsRoom/AttachmentNg/cfbb2686-2b8a-43d2-ac42-f650722c1abf

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc7814ba-235c-4223-afd0-04ee771bda5a

https://www.globenewswire.com/NewsRoom/AttachmentNg/58e0dfc1-4c65-4a9d-be7b-9f0180133d6d

https://www.globenewswire.com/NewsRoom/AttachmentNg/53f1e194-d494-46c5-9a61-af6e2791da61

https://www.globenewswire.com/NewsRoom/AttachmentNg/98a63592-d938-4312-b4a9-f07b31ea26aa

https://www.globenewswire.com/NewsRoom/AttachmentNg/7115b3dd-cb22-49ae-b207-7f134474f340

https://www.globenewswire.com/NewsRoom/AttachmentNg/5822eba9-37a1-4c41-92b8-94ab6c78bf0d

https://www.globenewswire.com/NewsRoom/AttachmentNg/b1ddcac9-f114-4203-9210-18ceb76b43a5

https://www.globenewswire.com/NewsRoom/AttachmentNg/606ae8b5-4450-499b-a892-7696f4b7be62

https://www.globenewswire.com/NewsRoom/AttachmentNg/650aaa4d-dfea-434e-820b-fa991e8a225b