are returning to Canada, a welcome return after taking a break in the first half of the year.

Foreign ownership of Canadian debt reached a record high at the end of 2024, with non-residents controlling 39.5% of all available Canadian debt securities.

But the start of 2025 brought unrest when U.S. President

started a trade war that was initially aimed specifically at Canada and Mexico.

Foreign investors retreated and the cooling continued through the first half of the year.

Now there's evidence they're coming back, said Warren Lovely, strategist at National Bank of Canada.

“The geopolitical picture remains grim, but we have nonetheless witnessed a timely reunification between foreign investors and Canadian debt issuers,” he wrote.

COFER data, which breaks down the composition of official foreign exchange reserves, shows what reserve managers added to their holdings

in the third quarter after sales in the first half of the year.

The Canadian dollar's share of royalties fell from 2.83 percent in the fourth quarter of 2024 to 2.63 percent in the first and second quarters of 2025. In the third quarter, that share rose to 2.66 percent.

Lovely said the Canadian dollar represents only a small portion of total committed reserves, “however, the apparent return of 'official money' is welcome news.”

Statistics Canada's international trade data also shows renewed foreign interest in Canadian debt securities, the economist said.

“Non-resident investors, who collectively cooled pressure on Canadian government debt in the first half of the year, dipped back into the Government of Canada debt pool in the third quarter,” he said.

“This was welcome as any sales to foreign investors arithmetically reduce the amount domestic investors must receive/retain.”

Foreign investors took on $25 billion of Canadian government net debt in the third quarter, or about 60 percent of the amount available. In October alone, non-residents purchased another $20 billion.

The return is timely, Lovely said.

“Canada's governments are doing the hard work these days, directly supporting still-vulnerable economies and essentially picking up the slack left by cautious private sector participants,” he said. “This has led to a non-trivial budget deficit and the need for significant borrowing.”

All levels of government in Canada borrowed about $50 billion in the third quarter, equivalent to more than 6 percent of gross domestic product year-on-year, he said.

are the largest domestic buyers. Lovely said the $64 billion increase in their holdings of Government of Canada bills and bonds this year represents a nearly 60 per cent increase in outstanding federal debt.

“There is no shortage of public debt – now and in the future – so keeping all types of investors involved and involved would be prudent,” he said.

Register here to have Posthaste delivered straight to your inbox.

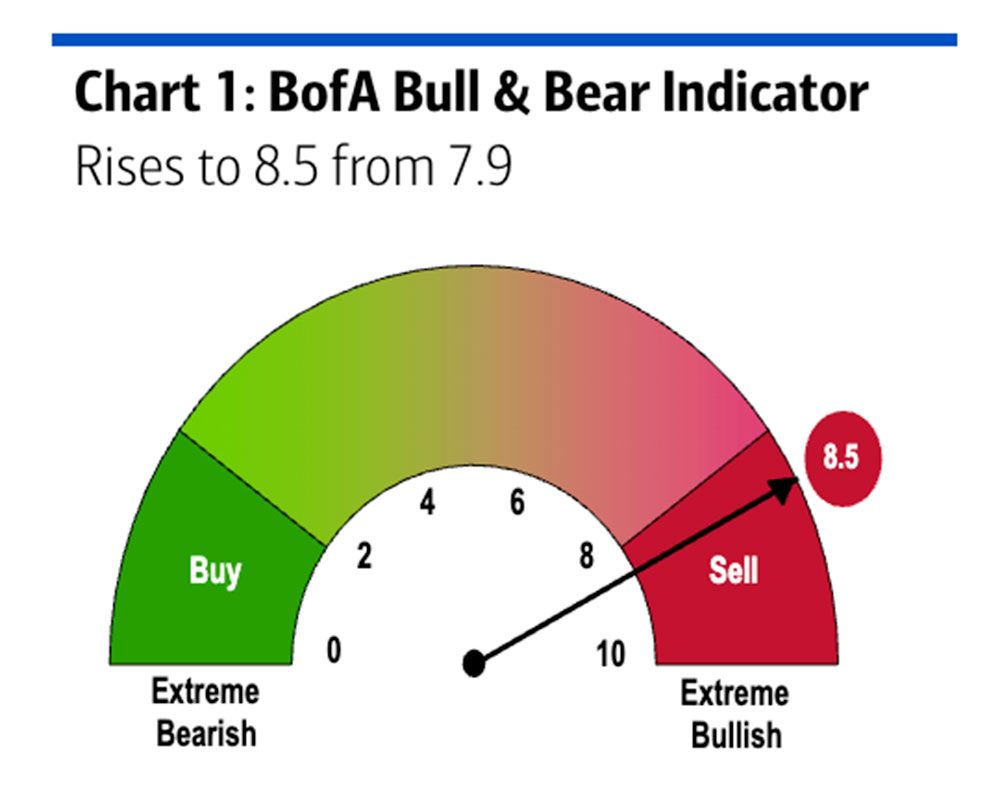

The sell signal was generated by the opposite Bull & Bear indicator from BofA. Bank of America rose from 7.9 to 8.5 last week, putting it in sell territory.

Anything above 8 is considered a bullish extreme.

Since 2002, 16 such sell signals have been followed by an average S&P 500 loss of 1.4 percent over the next three months.

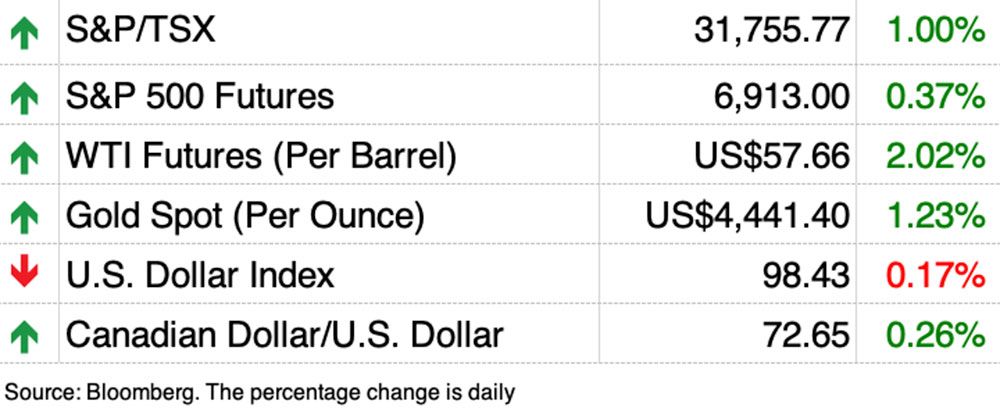

A survey of money managers by BofA showed the same bullish trend. Investor sentiment, as measured by cash levels, share allocations and global growth expectations, rose to 7.4, the highest level since July 2021.

Allocations to stocks and commodities were the highest since February 2022, and cash levels hit a record low of 3.3 percent.

According to BofA strategist Michael Hartnett, this level of optimism has only been seen eight times this century. Others include the mortgage bubble of the early 2000s and the post-COVID boom.

- Today's data: Price indices for industrial products and raw materials in Canada

- Falling property values worry borrowers

- How to Prepare for Your First Meeting with a Financial Planner

- How BP's 'edgy' chairman lost patience with his Canadian chief executive

Melody and Renzo, both in their early 30s, go to a financial planner for the first time. Their household income is $130,000 and their main goal is to save for a down payment on a house in Windsor, Ontario. FP Answers tells them what they should bring to the meeting, what questions to ask, and some tips on how to get the most out of their financial planning.

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by staff from the Financial Post, The Canadian Press and Bloomberg.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here