More Canadians moved into the variable

in 2025 to take advantage of their lower rates, but doing so in 2026 could be dangerous,

speaks.

“The recent enthusiasm for adjustable-rate mortgages may wane in 2026, especially if borrowers begin to expect another rate hike,” Hendrix Vachon, chief economist at Desjardins, said in the report.

Canadians generally prefer five-year fixed-rate mortgages, but he said variable options have been “gaining in popularity since 2024,” estimating they made up 38 per cent of new mortgage financing in October and 32 per cent of total mortgages outstanding, according to Bank of Canada data.

A Rates.ca report released Thursday said interest in variable mortgages is growing “steadily” based on November funding requests submitted through a mortgage aggregator.

The interest rate on adjustable-rate mortgages was 3.97 percent at the end of October, compared with 4.21 percent for all insured residential mortgages and 4.39 percent for residential mortgages with terms of five years or longer, according to

.

This is a big turnaround for variable rates, Vachon said.

Since the pandemic, variable mortgage rates fell to a low of 1.5 per cent and then soared to a high of 7.48 per cent when the Bank of Canada began raising rates.

cope with rising inflation.

Unlike fixed mortgages, variable mortgage rates are just that: variable. Mortgage rates are set based on the prime rate, with most people able to negotiate a discount that remains the same over the life of the mortgage, even if the rate changes with the prime rate.

But Vachon said the situation could shift to variable rates, so borrowers could find themselves on the wrong side of the ledger.

“For 2026, the outlook for variable rates is currently less favorable,” he said.

The Bank of Canada recently said it has finished cutting rates for the foreseeable future, with markets and economists increasing their bets that the central bank's next move will be to raise them.

Desjardins' latest forecast called for two 25 basis point rate hikes in 2027 and no hikes in 2026, but markets are betting on one rate hike at the end of 2026.

Estimates of the long-term neutral rate, where borrowing levels neither stimulate nor constrain the economy, are set at 2.75 per cent, 50 basis points above the Bank of Canada's current benchmark lending rate of 2.25 per cent.

If variable-rate mortgages become more expensive, Vachon says, more borrowers will likely opt for three- to five-year mortgages, which have overtaken the five-year option in popularity.

“Before the pandemic, mortgages with these terms typically made up less than 20 percent of all mortgages, before exceeding 50 percent in 2024,” he said. “Right now they're still about 40 percent.”

At this point, it's not surprising that more Canadians are opting for an adjustable rate mortgage, given that

This is such a hot topic.

Dissatisfaction with issues such as the overall cost of living and housing affordability is part of the reason for the plummeting ratings of most premiers, according to an Angus Reid Institute poll released on Thursday.

“Provincial governments are perceived to be doing a poor job on issues such as healthcare,

and housing affordability, which have been among the top concerns for residents of the province over the past three years,” Angus Reid said in the released survey.

Register here to have Posthaste delivered straight to your inbox.

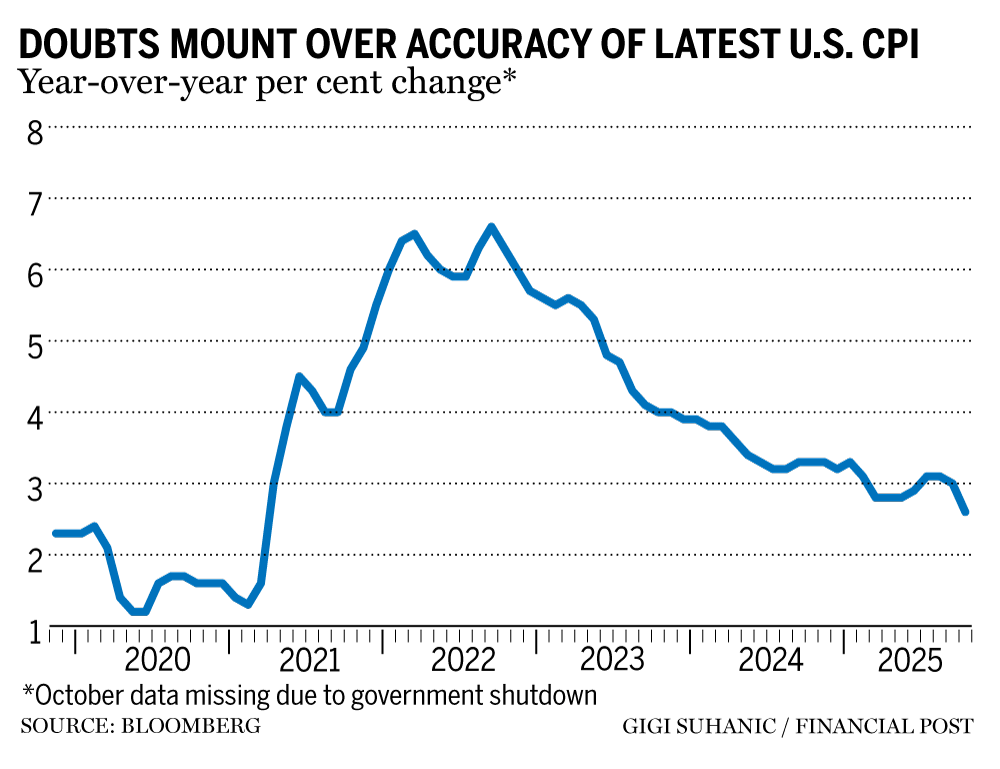

After long-awaited government data showed core U.S. inflation fell to a four-year low in November, economists agreed on at least this much: Something was wrong.

In a report undermined by a record-long government shutdown, inflation in several categories that had long remained resilient appeared to have all but evaporated. Chief among them was housing costs, which make up about a third of the consumer price index, but other categories such as airline tickets and clothing fell markedly. — Bloomberg

- Today's data: Retail sales in Canada for October; US Home Construction Starts and Building Permits in September, Existing Home Sales in November, New Home Sales in October, University of Michigan Consumer Sentiment.

- Earnings: Carnival Corp., Winnebego Industries Inc.

- Welcome to the K-shaped economy: Canadians look back on Trump's 'brutal' and 'great' year of trade war

- Atlantic Canada changes mining policy to attract investment

- Oil markets could face 'super glut' but new pipeline access in Canada offers shelter from storm

Interested in energy? FP West's subscriber-only newsletter, Energy Insider, brings you exclusive reporting and in-depth analysis of one of the country's most important sectors.

Are you worried about whether you will have enough money for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you struggling to make ends meet? Write to us at

with your contact information and the nature of your problem, and we will find some experts to help you write a story about family finances (we won't mention your name, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus, check him out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Gigi Suchanichwith additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here