Many Canadians

— not because they want to tour the world or bask on the beach — but because they have to, according to a new study.

Almost half of pensioners in

Manulife Group Retirement survey

this week they stopped working earlier than planned, at an average age of 59—and most of those early retirements were for reasons beyond their control. They either had health problems, needed to care for a loved one, or lost their job.

Only 15 per cent retired early because they had accumulated enough savings, raising concerns about how prepared Canadians are for what could become

.

“I was in good health until I lost my health,” said one retiree who participated in the survey. “Retirement is coming sooner than you think.”

Not only is retirement coming sooner, but Canadians are also living longer. Since 2023, life expectancy in Canada has risen by two years to 83, and the number of people over 100 has doubled since 2001, the study found. The number of centenarians worldwide is expected to increase by 800 percent by 2050.

Instead of the 20 to 30 “golden years” of earlier generations, today's workers are potentially looking at 40 years or more in retirement.

“Longevity is rewriting the rules of retirement, and as it increases, we are seeing more plan participants questioning whether their savings and investment strategies can support them throughout their retirement,” said Aimee DeCamillo, global head of retirement and wealth at Manulife Wealth & Asset Management.

This can be especially challenging in today's economy.

Financial pressures on Canadians have increased since the pandemic. The share of working Canadians who think their financial situation is fair or poor has risen from 33 per cent in 2020 to 41 per cent today, while the share who think their retirement savings are behind schedule has jumped from 35 per cent in 2021 to 48 per cent.

And Canadians' heavy debt load has made the idea of working longer hours increasingly popular, the study says. The share of working Canadians who want to retire later has risen from 26 per cent in 2020 to 35 per cent today, and in a global study by Manulife, between 40 and 50 per cent of workers across all markets said they plan to work in retirement.

“The unfortunate reality in North America is that only 16 percent of retirees surveyed work full-time or part-time,” the study said. “And the pensioners surveyed stopped working much earlier than they planned, mainly due to health problems or caring for a loved one.”

Manulife said many retirees in its research were surprised by how expensive the pension was and how quickly they were using up their savings.

More than 60 percent of early retirees have had to make lifestyle adjustments to reduce expenses, and 32 percent say they experience more financial stress in retirement than before.

Fewer Canadians who retired later had a formal pension plan, and 11 per cent had no income other than government pensions, compared with 6 per cent of those who retired on schedule.

“Plan ahead,” one Gen Xer said in the survey. “It’s here before you know it.”

Latest toy stores

Have you noticed that the Toys “R” Us store in your area has closed or may be for sale? Well, the Financial Post Western Bureau team did it too. They've put together a five-part series called “The Last Toy Stores,” which explores the changes in toy retail in Canada as the country's largest chain scales back its footprint. You can read the first part with a detailed description of the changes on the Toys “R” Us website, Hereand visit series home page at Financialpost.com every day this week for a new contribution.

Register here to have Posthaste delivered straight to your inbox.

Can you identify the subsidy?

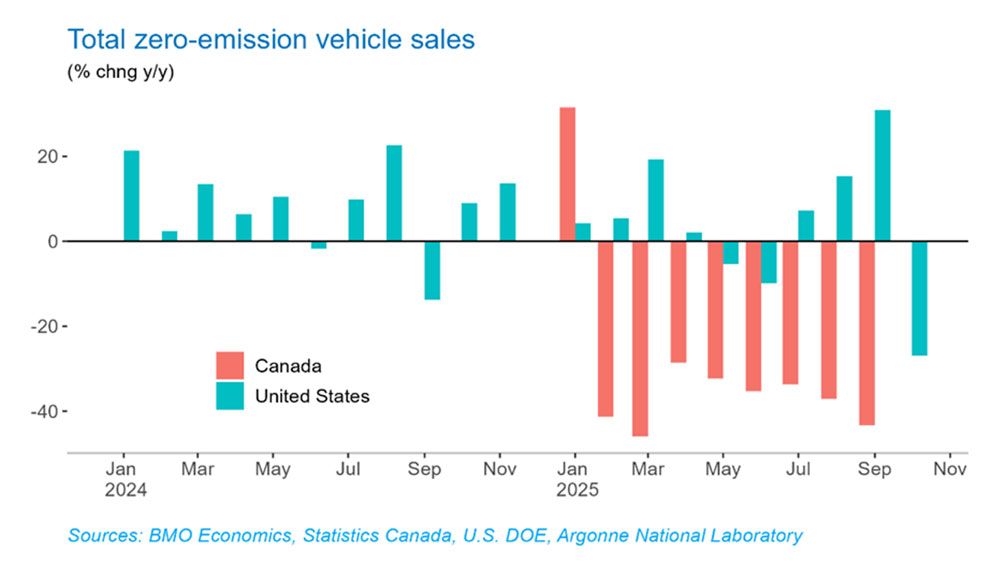

Today's chart shows

on both sides of the border highlights how important government assistance is to the electric vehicle industry.

Canada's incentive program, which offered $5,000 on new electric vehicles and $2,500 on plug-in hybrids, ended earlier than expected when it ran out of money in January.

The US program, started by former President Joe Biden and offering a $7,500 tax break, ended on October 1.

In the United States, sales rose 31 percent in the month before the subsidies ended and then fell 27 percent after it happened, said Eric Johnson, senior economist at BMO Capital Markets.

Sales in Canada fell sharply in February and are down an average of 37 percent over the past eight months.

“Affordability remains a key barrier as consumers focus on cost, and with many automakers scaling back EV plans, introduction of more affordable models will likely take longer,” Johnson said.

- Today's data: Canadian Industrial and Raw Materials Price Index, US Existing Home Sales

- Earnings: Walmart Inc., Intuit Inc.

- 'Ripple from the South': Canadian newcomers worry about dwindling job opportunities and US-like deportations

- Bank of Canada Deputy Governor Says Country's Affordability Crisis Is Linked to Productivity

- The successes and failures of a Canadian retail tycoon who built his career on a failed business.

Worried about leaving a big tax bill? This week, Family Finance looks at how to leave RRIFs, TFSAs, property and other wealth to your children while avoiding probate and minimizing taxes.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here

.jpg?w=150&resize=150,150&ssl=1)