With

on the rise, Canadians floundering in debt are getting more of a helping hand from lenders looking to keep distressed consumers from going under and protect their bottom line and the economy.

That’s the assessment of Benjamin Tal, deputy chief economist at CIBC Capital Markets.

“We are seeing pre-emptive activity by lenders. Basically calling people and saying, ‘Let’s go have coffee and discuss your situation,'” he said during a podcast with CIBC chief economist Avery Shenfeld. “The economy is in a semi-recession, second-quarter growth was negative, third quarter was hardly above zero. One accident and we are in a

.”

One sign that lenders are stepping in is the ongoing rise in the number of proposals to renegotiate the terms of loans.

Such proposals have been “rising dramatically” over the past few years while bankruptcies have been “falling dramatically,” Tal said.

“It’s much better for the system; it’s much cheaper to have proposals than bankruptcies,” he said.

Fresh numbers on Canadian insolvencies, which include proposals and bankruptcies, back Tal up.

Proposals in Canada are up 41.2 per cent from 2019 and 8.2 per cent from September 2024, according to data released this week. Bankruptcies, meanwhile, fell 35 per cent below their pre-pandemic level.

Proposals account for approximately 76 per cent of total insolvencies.

Overall, insolvencies are up nearly 11 per cent compared with 2019 and have reached “levels not seen since the global financial crisis in 2009,” Charles St-Arnaud, chief economist with credit union Alberta Central, said in a note.

Provincially, insolvencies are “significantly higher” in British Columbia, Manitoba,

,

and Saskatchewan compared with 2019. St-Arnaud pointed to higher-than-average

levels in those provinces as the culprit.

There are other signs banks are stepping in to protect their loan books, Tal said.

Loan payment delinquencies in the 30-to-60-day range are dramatically up, he said, but they are stable in the 60-to-90-day range, whereas the normal trend would be for those numbers to rise as well.

“Again, there is this pre-emptive move by lenders to say, ‘Let’s try to deal with this situation before it becomes unsustainable,'” he said.

While bankers might be trying to hold the line, borrowing amongst Canadians with poorer debt profiles is nonetheless starting to deteriorate.

The 30-day delinquency rate among the subprime sector is up 13 per cent from 2019.

“This is the first signal I see that things are getting worse when it comes to credit quality,” Tal said.

He said he will also be keeping an eye on the rising rate of

and

delinquencies among

, which he said have jumped above 2019 levels.

“Clearly, there are some early signs of difficulties, but the numbers are not so significant to make me worry,” Tal said.

Both Tal and St-Arnaud think the

is currently resilient enough to help Canadians weather the economic storm of

.

“The labour market’s resilience, where the number of layoffs remains low, is also playing a crucial role, allowing borrowers to weather various shocks by adjusting their lending to mitigate the impact of higher interest rates on their regular payment,” St-Arnaud said.

CIBC estimates the

has peaked at 7.1 per cent. It fell to 6.9 per cent in October.

Tal said he expects consumer credit trouble to manifest in the “micro” economy, not the macro economy.

“My sense is financial institutions are already ready for this situation,” he said.

Introducing FP West: Energy Insider, a new subscriber-exclusive newsletter from the Financial Post Western Bureau. Get behind the oilpatch’s closed doors with exclusive insights from insiders every Wednesday morning. Sign up now.

Sign up here to get Posthaste delivered straight to your inbox.

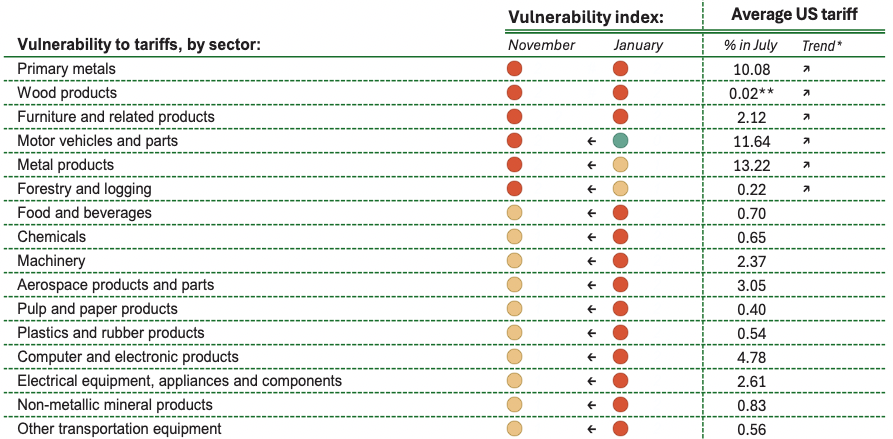

After Donald Trump’s inauguration, Desjardins Group compiled a list of 32 Canadian sectors to asses their vulnerability to U.S. tariffs.

Economists at Desjardins recently reviewed their list and found that some sectors they thought would be very vulnerable were less so, while others were more vulnerable than expected.

The chart above reflects the changes Desjardins made to its vulnerability index for a selection of the sectors. The assigned dots of red, yellow, and green stand respectively for “highly negative impact,” “to watch” and “likely limited impact.”

Initially, Desjardins expected there would be little impact on Canada’s auto sector given its integration with the United States and Mexico.

That’s not how things have played out.

“While Canadian auto parts manufacturers aren’t directly targeted, as long as they are compliant with the Canada-U.S.-Mexico Agreement (CUSMA), the uncertainty surrounding the automotive sector — combined with the sector-specific tariffs on steel and aluminum — is having a substantial impact,” Desjardins said in a note, resulting in a change in the motor vehicles and parts sector vulnerability to “highly negative impact” from “likely limited impact.”

It wasn’t all bad news as Desjardins upgraded the status of several other sectors including aerospace products and parts.

Florence Jean-Jacobs, principal economist, and analyst Samuel Turcotte, said aerospace “stands out” and has “proven more resilient than expected” as a result of multiple tariff exemptions.

Trump is threatening tariffs on other industries such as pharmaceuticals and semiconductors.

“This is compounded by the many uncertainties surrounding the 2026 CUSMA review,” Jean-Jacobs and Turcotte said.

- Today’s data: Canada manufacturing and wholesale sales.U.S. retail sales and business inventories.

- Today’s earnings: MDA Space Ltd., George Weston Ltd., Artis Real Estate Investment Trust

- The man behind nation-building nickel project has spent decades waiting for this moment

- Global automakers grab a bigger chunk of Canadian market in Trump’s trade war

- Tax experts share disappointment at finding tax policy changes buried in budget footnotes

When a long-term relationship ends, predictable routines vanish and emotional upheaval and stacks of paperwork often arrive at the same time. While emotional healing takes time and patience, so does re-establishing your finances.

are some practical steps from Mary Castillo that can protect your credit and lay a foundation for rebuilding your financial life.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here