Suranjana TewariBusiness correspondent for Asia

Reuters

ReutersIn late September, the Dutch government invoked Cold War-era emergency legislation under which it took effective control of a Chinese chip company operating in the country.

The extraordinary move set off a chain of events that has rocked the global auto industry, already battered by U.S. tariffs and Chinese restrictions on rare earth exports.

In a statement to the Dutch parliament, the economy minister cited “serious shortcomings in management and action within Nexperia” that “pose a threat.”

The move allows the Dutch government to “block decisions if they are harmful or potentially harmful to the company's production” or to “Nexperia's future as a Dutch and European company and to preserve this important player in the European value chain,” the statement said.

The ministry told the BBC that the measure, which is in place for up to a year, does not constitute a takeover of the firm and that as a result of the measure the government has no legal control over Nexperia.

Beijing reacted furiously, accusing the Netherlands of political interference.

It imposed export controls and stopped supplying Nexperia chips from its Chinese facilities to Europe, while supplies of key materials needed to make chips in China were frozen.

The disruptions in the auto industry have exposed serious weaknesses in the global supply chain for chips vital to car production and opened another front of competition between the United States and China.

The Chinese government has granted an exemption from export controls. about chips for civilian use, but did not specify what they mean by this.

But Chinese authorities still want The Hague to withdraw its lawsuit against Nexperia.

“China welcomes the EU's continued influence to encourage the Netherlands to correct its wrong actions as soon as possible,” the trade ministry said in a statement on Sunday.

Nexperia's parent company Wingtech Technology did not respond to the BBC's request for comment.

Weaponizing supply chains

At the center of the dispute is a critical part of the global chip ecosystem.

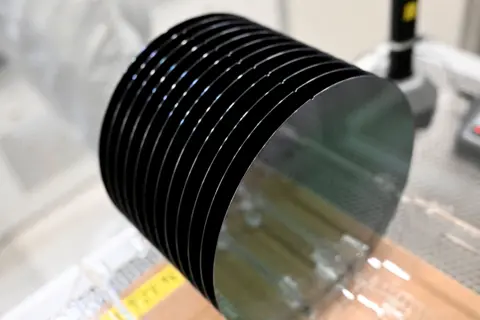

Nexperia makes what it calls “legacy” or “building block” semiconductors that are vital for everything from power steering and airbags to central locking systems. These aren't cutting-edge chips, but they're still essential.

Some cars contain hundreds of them, and Nexperia supplies chips to major automakers around the world.

About 70-80% of products are sent to China for processing, testing and packaging. Such dependence leaves automakers vulnerable to Beijing's control over supply chains.

“Automakers, stunned by the Nexperia mess, should hire new supply chain executives as they clearly have learned nothing from Covid… and over-reliance on [Chinese] supply chains,” wrote China watcher Bill Bishop in his newsletter Sinocism.

This highlights China's ability to disrupt global supply chains, much as it did with rare earth exports.

China could hold the West hostage by controlling an under-the-radar company like Nexperia, just as it does with critical minerals, according to Bill Echikson, a senior fellow in the technology policy program at the Center for European Policy Analysis. He adds that this is not just about digital sovereignty, but also about semiconductors.

However, Beijing faces a dilemma. It has positioned itself as a reliable partner in the face of Trump's tariff chaos, but cutting off supplies of critical products risks undermining that message.

“The narrative was [that, since] Trump came and caused chaos for everyone, perhaps there will be an opportunity for China and the EU to cooperate more closely,” said Tom Nunlist, deputy director of Trivium China.

It hasn't gone so well, he said, because the rare earth shortage shows how trapped Europe and other trading partners are between the US and China, and their ability to upend global trade, according to Mr Nunlist.

National Security

A Dutch court also suspended former Nexperia chief executive Zhang Xuezhen, who founded its Chinese owner Wingtech, citing mismanagement.

Wingtech shares are traded on the Shanghai Stock Exchange and are partly owned by the Chinese government.

It was added to the official US watch list in 2024, and in September of this year the so-called entity list was expanded to include any firm that is at least 50% owned by companies already on the list.

Earlier this year, U.S. authorities raised concerns about the chip company's executive, according to court documents released by Dutch authorities last month in connection with the government's handling of Nexperia.

The documents included evidence that Dutch authorities told Nexperia it could seek delisting from the US if there was a change in management because the “Chinese owner was causing problems.”

“It is almost certain that the CEO will have to be replaced to qualify for delisting,” Nexperia officials said, according to the documents.

Reuters

ReutersHague denies that its actions were a response to pressure from any foreign country, but says there is evidence that the company's CEO was moving its production facilities, financial resources and intellectual property to China.

Wingtech did not respond to requests for comment.

“I think Nexperia is simply emphasizing what is already true and making it even more true,” said Mr. Nunlist of Trivium China.

“Western countries don’t want Chinese investors investing in such strategic manufacturing assets, even legacy chips.”

Automakers on the brink

Experts say the incident is an example of the very real consequences of the breakdown in business and economic ties between the West and China.

“This is what separation actually looks like at the corporate level, and it's a huge mess,” Mr. Nunlist said.

European automotive suppliers have demanded clarity on the exemptions that will apply and said it creates additional bureaucracy at an already uncertain time.

Getty Images

Getty ImagesExperts say it may be possible to switch suppliers because rival chipmakers such as Infineon, NXP and Texas make similar chips.

But supply chains are not precisely planned, they develop organically, and these components are often made specifically for cars, says Trivium China's Mr. Nunlist.

“Companies cannot move instantly; there are incentives to keep supply chains in place, and it is extremely difficult and expensive to change the situation.”

A fragile truce

The incident comes as U.S. President Donald Trump and Chinese President Xi Jinping agreed to a one-year trade truce, an agreement that suspended some export bans and restrictions on rare earth elements.

But the Nexperia dispute suggests this newly negotiated agreement may be fragile.

However, according to Mr Nunlist, the US has no intention of sabotaging the deal and Europe does not have much leverage, especially in this supply chain weapons game.

“It's really politically difficult for both sides, and also for Europe because it doesn't want this to end up with processing capacity moving out of Europe,” Mr Nunlist said.

“As far as I understand, the leaders in Brussels did not know that the Dutch government was planning to take this step and were unhappy with it.”

China and the EU are still in urgent talks to lift export controls on both chips and rare earth metals.

Negotiations are ongoing with China to find “a strong, stable and predictable framework that will ensure a full recovery of semiconductor flows,” EU Trade Commissioner Maros Šefčović said in a message on X over the weekend.

But the episode has exposed vulnerabilities in key supply chains, and ties between China and the Netherlands, and in turn the European Union, are likely to remain under pressure until differences over Nexperia's ownership and operations are fully resolved.

This article was updated on 13 November 2025 to reflect the Dutch Ministry of Economic Affairs' statement that the move against Nexperia does not constitute a takeover of the company.