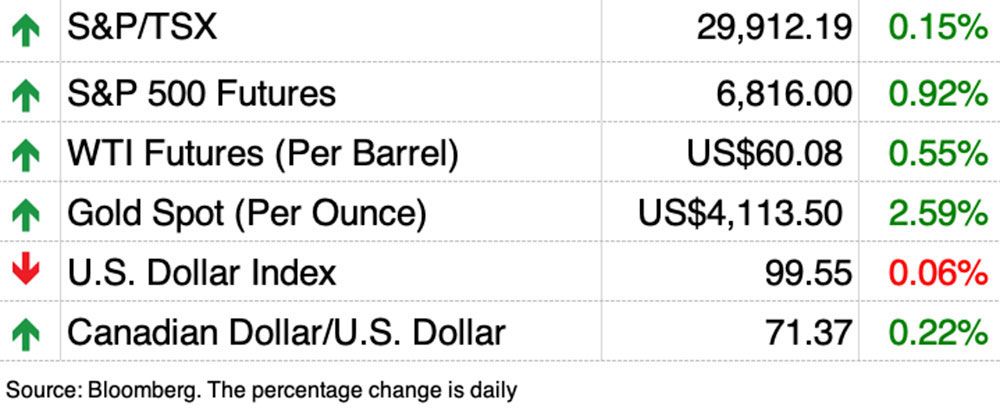

Markets got a boost today following news that US lawmakers are nearing an agreement that would end the longest government shutdown in American history – which is a good thing, because last week was a bad week.

Nasdaq, home of technology stocks which have fueled this year's meteoric bull run are down more than 3 percent, marking the worst start to the month since Liberation Day in April, when US President Donald Trump unleashed flurry of tariffs it shook the world and the markets.

Tech giants in the so-called The Magnificent Seven fell 3% after concerns grew that artificial intelligence-driven valuations were far outpacing fundamentals.

Investors have been pouring money into technology stocks, pushing the S&P 500's tech weighting to all-time highs.

Declining market breadth has been a challenge, said Sid Mokhtari, chief market strategist at CIBC Capital Markets.

In what could be a turbulent November, CIBC offers 10 of its best stock ideas.

Mokhtari said the number of sectors in the S&P 500 index with more than 60 percent of their constituents beating medium- and long-term averages has dropped to three over the past four months from six. And more stocks are hitting new 52-week lows versus highs.

However, more than 50 percent of companies in nine of 11 sectors have posted positive year-to-date returns, suggesting investors are in good shape so far but may be risk averse as the end of the year approaches, he said.

Seasonal trends can play into investors' hands. In November, he said, over the past 10 years, the average return of North American indices was more than 2 percent, and the percentage of positive results was 80 or higher.

“Buying the dip is the right strategy,” says the TSX.

Last month, CIBC's best ideas returned 7.28%, outperforming the TSX index. Year to date, their recommended equal-weight baskets have returned 48 percent, nearly 26 percent above the index.

The selection for November consists of 30 percent financial companies, 20 percent industrials and 10 percent each in utilities, information technology, healthcare and energy.

Financial highlights include Great-West Lifeco Inc., Manulife Financial Corporation. And Toronto-Dominion Bank. The industrial entities are AtkinsRealis Group Inc, formerly SNC-Lavalin, and Element Fleet Management Corp.

Quebecor Inc., Chartwell Senior Residences, Shopify Inc.Capital Power Corp. and NuVista Energy Ltd. are leaders from other sectors.

All stocks have CIBC ratings as Outperform, with the exception of Manulife, which is Neutral.

Potential returns range from a high of 23 percent for AtkinsRealis and 20 percent for NuVista to a low of 2 percent for Chartwell.

Introducing FP West: Energy Insider, a new exclusive newsletter from the Financial Post Western Bureau. Every Wednesday morning, go behind the closed doors of the oil field and get exclusive information from insiders. Register now.

Register here to have Posthaste delivered straight to your inbox.

Canada

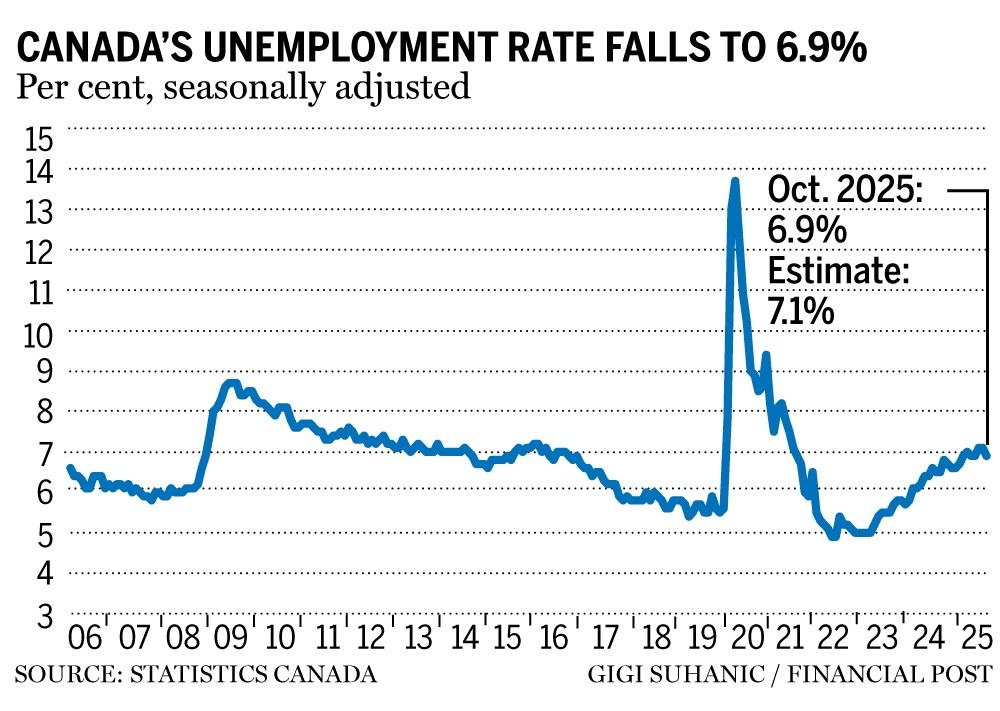

the number of jobs exceeded expectations

On Friday, with the economy adding 67,000 jobs, the unemployment rate fell two points to 6.9 percent. Economists predicted a loss of 5,000 jobs.

It is true that the job gains were part-time and the number of full-time jobs actually declined, but the private sector provided the growth and offset declines in the public sector and self-employment.

That was enough to convince economists that the Bank of Canada would hold off on rate cuts in December, and possibly longer.

CIBC Capital Markets said the real test of the economy's strength was yet to come given recent volatility in employment data. Job growth is expected to slow in the coming months, but with population growth slowing, the unemployment rate should fall through 2026.

“This is consistent with the Bank of Canada's current view that interest rates are low enough to support the economic recovery, and so we continue to forecast no further cuts,” CIBC economist Andrew Grantham said.

- Federal Finance Minister Francois-Philippe Champagne presents the Liberal budget at the Calgary Chamber of Commerce today

- Earnings: Barrick Mining Corp., Tyson Foods Inc., Occidental Petroleum Corp. Paramount Skydance Corp., MEG Energy Corp.

- Canada's largest oil pipeline is full – and Enbridge may green light 'expanded' capacity addition

- Canadian news publishers' lawsuit against OpenAI can proceed in Ontario, court rules

- Should Charlotte take out a $200,000 mortgage before retirement or sell her home and rent it out?

Charlotte is 56 years old, divorced three years ago and trying to decide when to retire. She would prefer to do this sooner rather than later, but she needs to decide whether to continue paying her $200,000 mortgage into retirement or sell her home and pay monthly rent that is more than her current combined mortgage and property tax payments. FP Answers has several factors for Charlotte to consider to help her make her decision.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister

can help you navigate a complex sector, from the latest trends to funding opportunities you won't want to miss. Plus check it out

for the lowest national mortgage rates in Canada, updated daily.

Financial post on YouTube

Visit Financial Post

for interviews with Canada's leading experts on business, economics, housing, the energy sector and more.

Today's Posthaste was written by Pamela Haven with additional reporting by Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, presentation, embargoed report, or proposal for this newsletter? Write to us at

.

Bookmark our site and support our journalism: Don't miss important business news – add financialpost.com to your bookmarks and subscribe to our newsletter Here