Canada

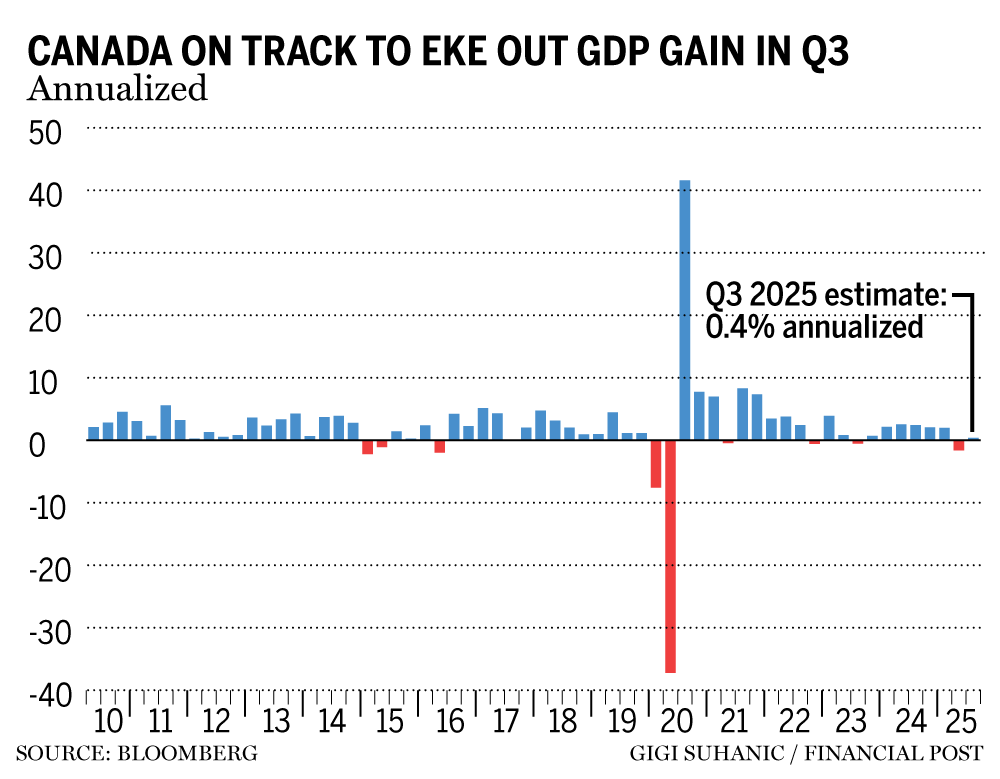

Growth of 0.4 per cent is expected in the third quarter, Statistics Canada said Friday, positioning the Canadian economy to avoid

GDP contracted 0.3% in August, led by a 0.6% fall in goods manufacturing and a 0.1% decline in services, the first such decline in six months. August data erased most of the gains achieved in July.

The transportation and warehousing sector recorded the largest monthly decline in the sector, led by

a flight attendant strike that resulted in 10,000 workers walking off the job and leading to flight cancellations.

Statistics Canada's preliminary estimates for September show the Canadian economy will grow by 0.1 per cent, but that figure is preliminary and will be updated at the end of November.

In the second quarter, GDP contracted by 1.6 percent. A decline in GDP for two consecutive quarters is considered a technical recession.

Charles Saint-Arnaud, chief economist at Alberta Central, said that while the economy no longer looks like it's getting worse, economic activity remains “anemic,” which could create more problems for Canada's labor market and the Bank of Canada.

“The longer economic activity remains weak, the more likely it is that we will see significant job losses,” he said in a note.

cut interest rates for the second time in a row on Wednesday, bringing the overnight rate down to 2.25 percent. Bank of Canada Governor Tiff Macklem said the central bank made the decision based on weak growth prospects for the Canadian economy and containing inflation pressures.

In its first forecast since the trade war with the United States erupted, the central bank forecast growth of 0.5% in the third quarter and expects the Canadian economy to avoid recession this year, although Macklem said weak growth “won't be pretty.”

The governor said the weakness of the Canadian economy is not only cyclical, but also structural and has put Canada on a permanent path of declining growth. Macklem also signaled that the bank could end its easing cycle if the economy performs according to its forecast.

Desjardins Group economic analyst LJ Valencia said the economic outlook remains uncertain given the uncertainty surrounding

Canada-United States-Mexico Agreement (CUSMA)

next year. However, Valancia doesn't see anything in Wednesday's data that would lead to a change in the central bank's intentions.

“There are limits to what rate cuts can achieve in the face of a structural economic shock,” Valencia said in the note. “Today's GDP data is broadly in line with the bank's latest forecast and therefore does not change the direction of monetary policy.”

Outside of transportation and warehousing, the wholesale trade sector contracted 1.2% in August after three straight months of gains. The autos and parts subsector led the decline, contracting 8.3% for the month.

Mining, quarrying and oil and gas production fell 0.7% in August, dragged down by lower drilling and drilling activity. Metal ore mining and coal production also declined during the month.

The manufacturing sector fell 0.5 percent, although primary metals production rose 3.7 percent during the month as production and processing of alumina and aluminum increased.

Retail trade grew 0.9 percent in August, with auto and parts sales leading the pack.

• Email: [email protected]