SEOUL — Cho Min Soo was working toward a PhD in computer science at one of South Korea's top universities when he stumbled upon his calling: creating the best lip gloss.

The 30-year-old sat down at his booth at Seoul Beauty Week, pulled out a stick from his brand Blup and gave his upper lip a dewy pink tint.

“Nobody trusts a founder who doesn’t use his own product,” he said, smacking his lips.

Joe is one of tens of thousands of entrepreneurs seeking to make a fortune from the seemingly insatiable global demand for beauty products from South Korea.

Following the lead of K-pop superstars, K-beauty has become a huge global business.

In August, fans of the South Korean import from Los Angeles flocked to KCON LA 2025 at the Los Angeles Convention Center. At the music and cultural festival, they saw the best K-pop idols and Queue for K-beauty at skin care stalls.

The three-day convention, which featured more than 350 booths and attracted more than 100,000 people from across Los Angeles and the country, was sponsored by South Korean health and beauty giant Olive Young, which plans to open its first U.S. store in Los Angeles early next year.

The secret to K-beauty's success lies in the unlikely alliance of large manufacturers and small entrepreneurs to develop and deliver a constant stream of new products to consumers and “skin influencers” who help them get the latest lotions.

Miyeon of South Korean girl group I-dle visited cosmetics brand Wakemake's pop-up store in Seoul last year.

(Chosunilbo JNS/ImaZins/Getty Images)

South Korean cosmetics, popular for offering unique and affordable products such as sunscreens that don't leave white marks and double as moisturizers, have dominated some social media platforms in recent years. Whether it's Kim Kardashian on Instagram or offerings from Walmart or Target, beauty-conscious consumers are constantly informed about ever-changing trends.

This online frenzy has pushed South Korea's cosmetics exports to over $10 billion. Last year, it toppled France—home of royal beauty brands such as L'Oréal and L'Occitane—as the largest cosmetics exporter to the United States.

Unlike South Korea's other major exports – semiconductors and automobiles – cosmetics exports are largely supported by smaller companies. Two-thirds of cosmetics exports last year came from small and medium-sized firms such as Blup, according to the Korea International Trade Association.

The hope was that anyone, with the right product and a little luck, could make a fortune from K-beauty. Since 2013, the number of registered cosmetics sellers in the country has increased sevenfold and last year exceeded 27 thousand.

The K-beauty trend took off in Los Angeles and across the country during the COVID-19 emergency, when people were cooped up at home, online, thinking about self-care and exploring alternatives to name-brand brands, said Sarah Chung Park, founder and chief executive of Landing International, a company based in Los Angeles, which connects K-beauty brands with American retailers.

“Thanks to COVID, TikTok really flourished and I think it was a way for people to discover K-beauty brands and then those brands showed up on Amazon and turned that virality into sales,” she said. “Almost every Korean brand has benefited from this.”

Cosmax is a major cosmetics manufacturer in South Korea. Above is the Cosmax building in Seongnam.

(Tina Xu / For The Times)

Most up-and-coming brands have a few manufacturers behind them, such as Kolmar and Cosmax.

The cosmetics makers behind many of the newest brands are largely invisible to everyday cosmetics consumers. Unlike other global players such as L'Oreal or Estée Lauder, Cosmax has never sold products directly under its own name, focusing almost entirely on original design research and production, or ODM.

Cosmax was founded in 1992 and has grown to become the largest ODM cosmetics manufacturer in the world, supplying 4,500 brands from its factories in South Korea, China, the United States and Southeast Asia. And while some of the best-known beauty brands are in decline or stuck in single-digit growth due to consumer fatigue, Cosmax reported record revenue of $1.7 billion last year, up 22% from 2023.

The company is a big reason why South Korean beauty startups have been able to take off so quickly, flooding global markets at a pace that competitors in other countries struggle to match. Cosmax accounted for about 26% of South Korea's total cosmetics exports last year.

“The company has a unique ability to quickly develop and bring new products to market while making money by supplying even the smallest brands,” said Lee Kyung-soo, the company's 79-year-old chairman and founder.

Lee Kyung-soo, 79, chairman of Cosmax, is pictured with his son, Lee Byung-joo, 46, the company's CEO.

(Tina Xu / For The Times)

“From the moment a brand comes to us with an idea, we can deliver it in just three to six months,” he said. “In other markets it could take a year to three years. They just can't compete with South Korea when it comes to speed.”

Few customers are too small for Lee, who has ensured that Cosmax fills custom orders of just 3,000 units. The company supplies billion-dollar-a-year companies as well as Blup, a three-person lip gloss startup.

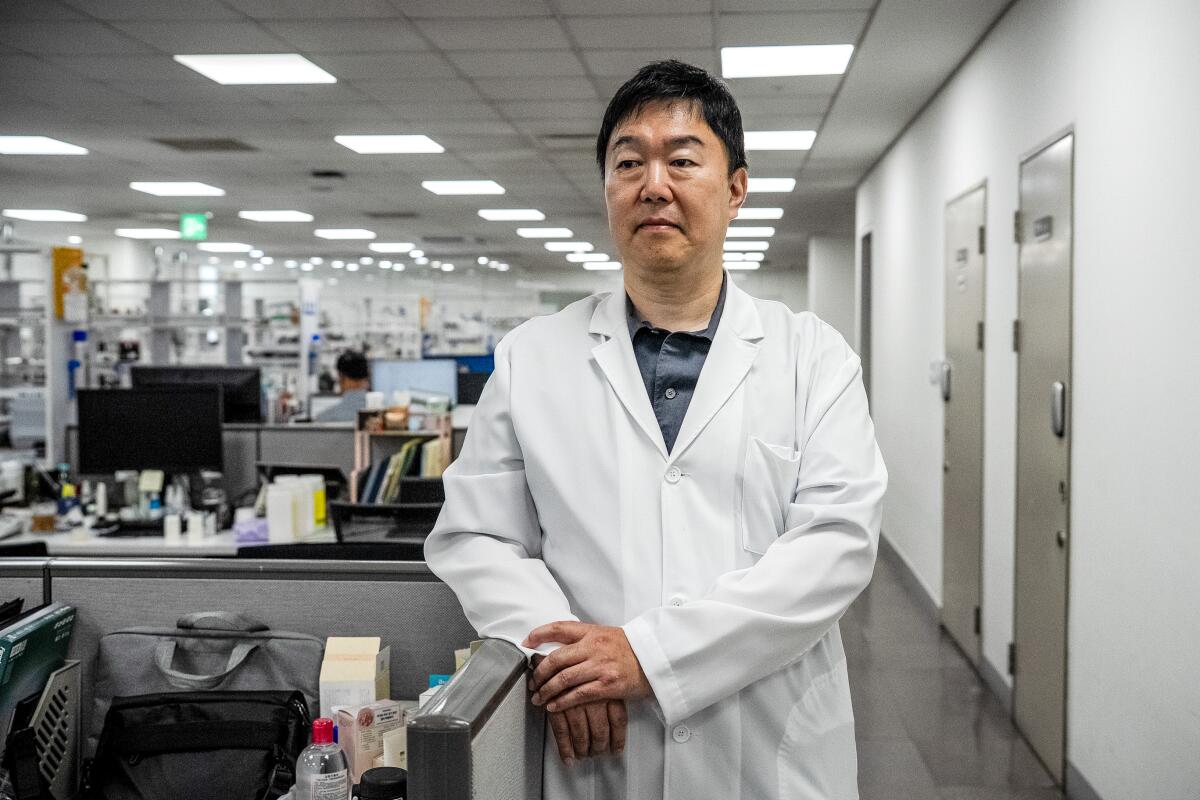

Kang Seung-hyun, senior managing director of Cosmax's research division, estimates the company launches about 8,000 new products annually. By the end of any year, each of the company's 1,100 beauty scientists will be working on developing 80 to 100 products, allowing Cosmax and its domestic peers to “carpet bomb the global market with new products,” in Kang's words.

Bottles of foundation in different shades are displayed on a shelf in a room displaying products produced by the company for brands, as well as new products developed by researchers, at the COSMAX building in Seongnam, Gyeonggi province, South Korea, Wednesday, August 20, 2025. (Tina Xu/For The Times)

Kang Seung-hyun, 54, senior managing director of a research and development center, stands in front of a portrait at the COSMAX office in Seongnam, Gyeonggi Province, South Korea, Wednesday, August 20, 2025. (Tina Xu/For The Times)

The list of Korean beauty trends that have become mainstream around the world is long: BB creams, ampoules, face masks and acne patches.

Having big manufacturers like Cosmax do the heavy lifting allows many people with little makeup experience to join K-beauty as a free for all. Among the beauty newcomers: the daughter of a controversial politician, a seafood merchant and a stationery manufacturer.

“Anyone can do it. The barrier to entry is not high at all,” said Lee Soon-young, founder of fruit cosmetics startup Kikiglow. “And right now the market is focused only on indie brands.”

With a start-up capital of just $20,000, beauty entrepreneurs will be able to receive their first batch of products from a well-known cosmetics manufacturer within a few months. E-commerce platforms like TikTok Shop allow them to sell products directly to consumers around the world. The only thing they need is the concept, experience and ability to use social media.

The Kikiglow booth in the conference room was filled with influencers, cameras in hand, lining up for free samples. Giving away products to as many influencers as possible in hopes that they will go viral is a big part of this game.

“People will stop coming once the samples run out,” Lee said.

Of course, stiff competition due to the constant flow of new popular products and more affordable options from China and other countries makes it difficult to differentiate, succeed and retain customers. Meanwhile, various tariffs imposed by the White House are making imports of some beauty products more expensive and less competitive in the United States.

The Cosmax logo adorns a wall inside the Cosmax building in Seongnam.

(Tina Xu / For The Times)

“Consumers used to stick with a brand for 10 years or so and become extremely loyal,” said BJ Lee, who runs Cosmax's U.S. business and is the founder's son. “But there are ups and downs in K-beauty. There are new brands coming out all the time, and people are constantly chasing new cool things.”

Last year, more than 8,800 beauty brands went out of business in South Korea, according to government data.

Amid such obstacles, Blup's advantage is that it can get lip gloss colors right by using artificial intelligence to analyze consumer preferences and skin tones.

The company expects to reach sales of about $100,000 by the end of the year and plans to expand in Japan, Joe said.

“I'm still not satisfied with where we are,” he said. “There are so many entrepreneurs who are disrupting this.”