Some Canadian Jewelry brands are raising prices as a surge in gold demand fueled by investor concerns over a shaky economic outlook pushes market for this precious metal To record highs.

With confidence in the US dollar weakening and uncertainty weighing on the global economy, more investors are looking for a safe place to park their money. Therefore, they bought gold en masse, causing a sharp rise in market prices for it. jewelry manufacturers, who could then pass on the additional costs to their customers.

“There are certain products that we've already had to increase prices on,” said Melanie Old, a Vancouver-based company. jewelry designer whose eponymous online business is gilded jewelry with sterling silver base.

Gold prices rose to US$4,300 per troy ounce (the measurement used when weighing precious metals) in recent weeks after years of gradual increases. Old said thatsilver prices shoots too — and this combination is not sustainable for her business.

“We've seen a dramatic increase in both of the primary materials that we use, and I think that's having a major impact on jewelry designers and then in turn on the consumer base,” she explained.

The company now offers fewer fines jewelry — which buyers were increasingly moving away from due to its higher cost, Auld says, and focusing on moderately priced materials such as wood, leather and stone to create a more dimensional effect. jewelry it's trending now.

“I think there is always a way to use other materials and be creative with your projects,” Auld said. She does not foresee gold prices falling again.

Popular jewelry brands such as Mejuri and Melanie Auld say they are being forced to raise prices amid soaring prices for both gold and silver. Others, like Jenny Bird, are cutting costs to keep up. Gold has hit record highs in stock market futures as investors seek safety amid economic uncertainty.

Mejuri raises prices, others weigh options

Another famous Canadian jewelry the brand recently raised prices to account for the higher cost of gold.

Toronto jewelry Retailer Mejuri, which has become popular for selling rings, earrings and necklaces at relatively affordable prices, emailed its customers last month to inform them of the price increase.

The surge in gold and silver prices has “increased our costs,” Mejuri co-founder and CEO Noura Sakkiha wrote in an email. The company will “optimize our supply chain, improve sourcing and design with price in mind,” she added.

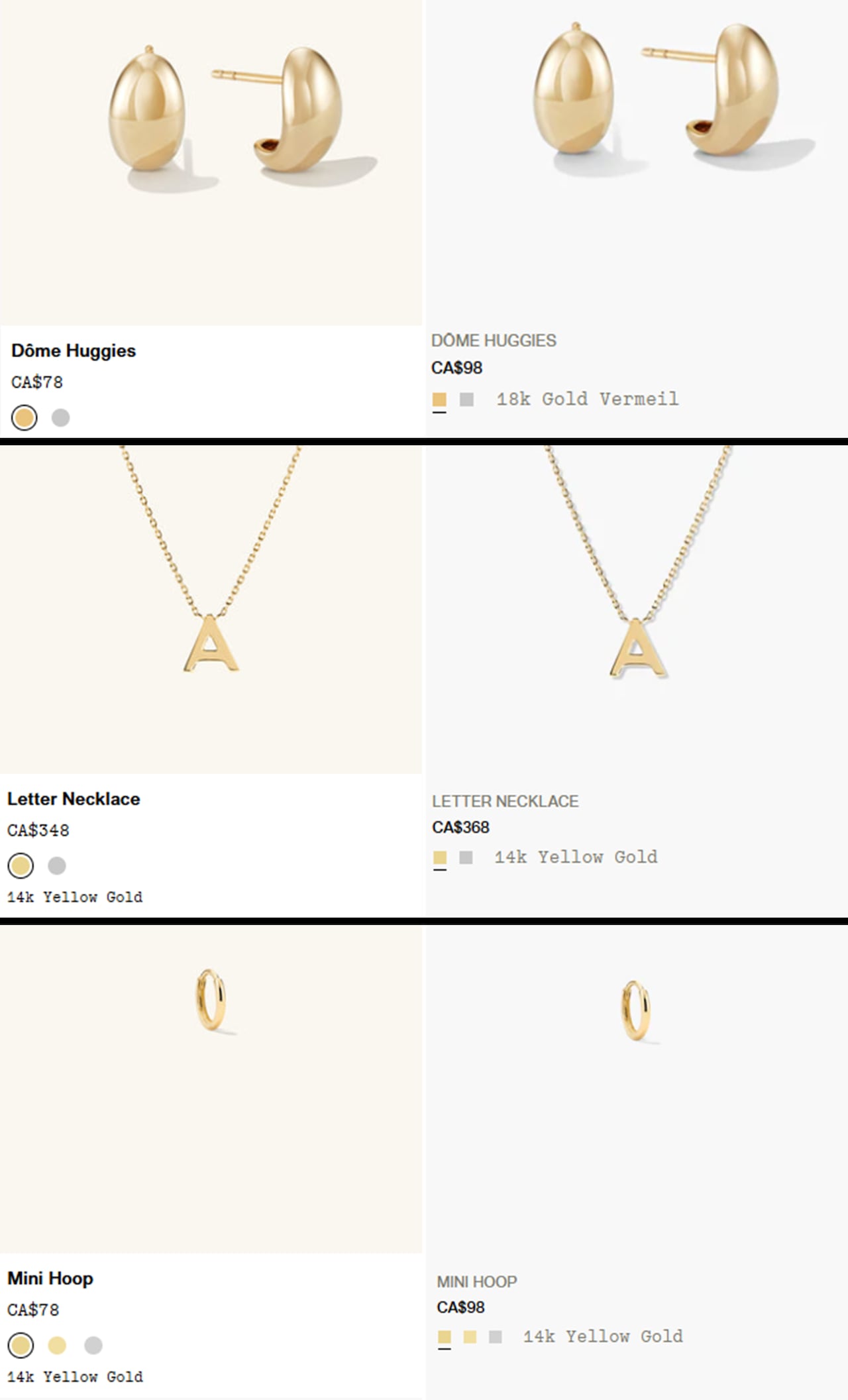

On September 29, the company raised prices, including on several of its bestsellers. A price comparison between August 3 and October 17, taken from the Wayback Machine, shows the difference.

For example, a brand letter necklace that originally retailed for $348 is now $368; the 14k yellow gold mini ring and 18k gold domed huggie earrings were $78 and are now both $98.

Meanwhile, the big American jewelry Retailers such as Signet, Pandora and Tiffany & Co. are expected to hike their prices or shift According to analysts, their production strategy by the end of the year, if they have not already done so.

Another jewelry Brands are taking a different approach at the moment. Online store in Torontor Jenny Bird According to Preeti Kapoor, the company's chief operating officer, it relies on supplier discounts and strategically timed deliveries to cope with higher costs.

“We're more focused on keeping the jewelry the way it is and the materials the way it is, and also focusing on other ways of our supply chain and our operating expenses to reduce costs and keep our profitability strong,” Kapoor told CBC News.

She added that she was confident Jenny Bird could withstand higher gold prices. “But I'm worried about a lot of businesses because this is the highest it's been in a very long time.”

Alinaka Ahluilia, jewelry the Toronto-based designer said she looks at different ways to control costs, including using lighter gold and embellishing her pieces with colored stones.

Demand for gold is not going away, she said, and the industry must adapt accordingly. But not everything is jewelry the market is equally feeling the pressure.

“We see that in the higher-end luxury jewelry market they are able to withstand price increases,” she said. “But it’s the mass market and wholesalers that are feeling the pinch.”

“It’s kind of like fire insurance.”

Gold has long been considered a safe haven asset during periods of economic uncertainty. The rise in prices began towards the end of the summer, but rose throughout much of the year as US President Donald Trump began imposing his tariff regime around the world.

“It's kind of like fire insurance. You don't expect your house to burn down, but you definitely want to have some insurance. And gold is insurance against a lot of the uncertainties that we have,” said John Ing, president and CEO of Maison Placements Canada, an investment banking firm in Toronto.

Gold has long been considered a safe haven for investors and is once again gaining their attention. Andrew Chang explains why gold is rising despite booming stock markets.

Most institutional investors follow gold futures, which are agreements to buy or sell assets at a set price in the future. This part of the investment market can influence the current price – also known as the spot price – of real gold, making it a more expensive purchase for jewelers.

“It's affecting the factory we buy from because their costs have gone up. And they need to make sure they're still making the same money they made yesterday and the day before,” Kapoor said. This is how costs are passed on to businesses and then to consumers.

Additionally, gold is a finite metal, and central banks have been buying it over the past few years. manyeating a piece of produce. jewelry the market is taking another piece of this pie; retail investors are also buying gold-related assets through exchange-traded funds, Ing said.

“So there is a lot of uncertainty and not much gold mining is going on. In fact, gold peaked two years ago,” he said. Like Auld, he doesn't see costs coming down.

“Historically, these are the ingredients that cost a lot more.”