IBM announced this morning that the company will spin off some of its lower-margin businesses into a new company and focus on higher-margin cloud services. On a call with investors, CEO Arvind Krishna acknowledged that the move was a “significant shift” in how IBM will operate, but he positioned it as the latest in a series of strategic divestitures spanning decades.

“We abandoned networking back in the '90s, we abandoned PCs back in the 2000s, we abandoned semiconductors about five years ago because they all didn't necessarily play a role in the integrated value proposition,” he said. Krishna became CEO in April 2020, replacing former CEO Ginni Rometty (who is now IBM's executive chairman), but the spin-off is the cornerstone of a years-long effort to bring some focus to the company's sprawling business model.

Cloudy with a chance of reaching the quarterly forecast.

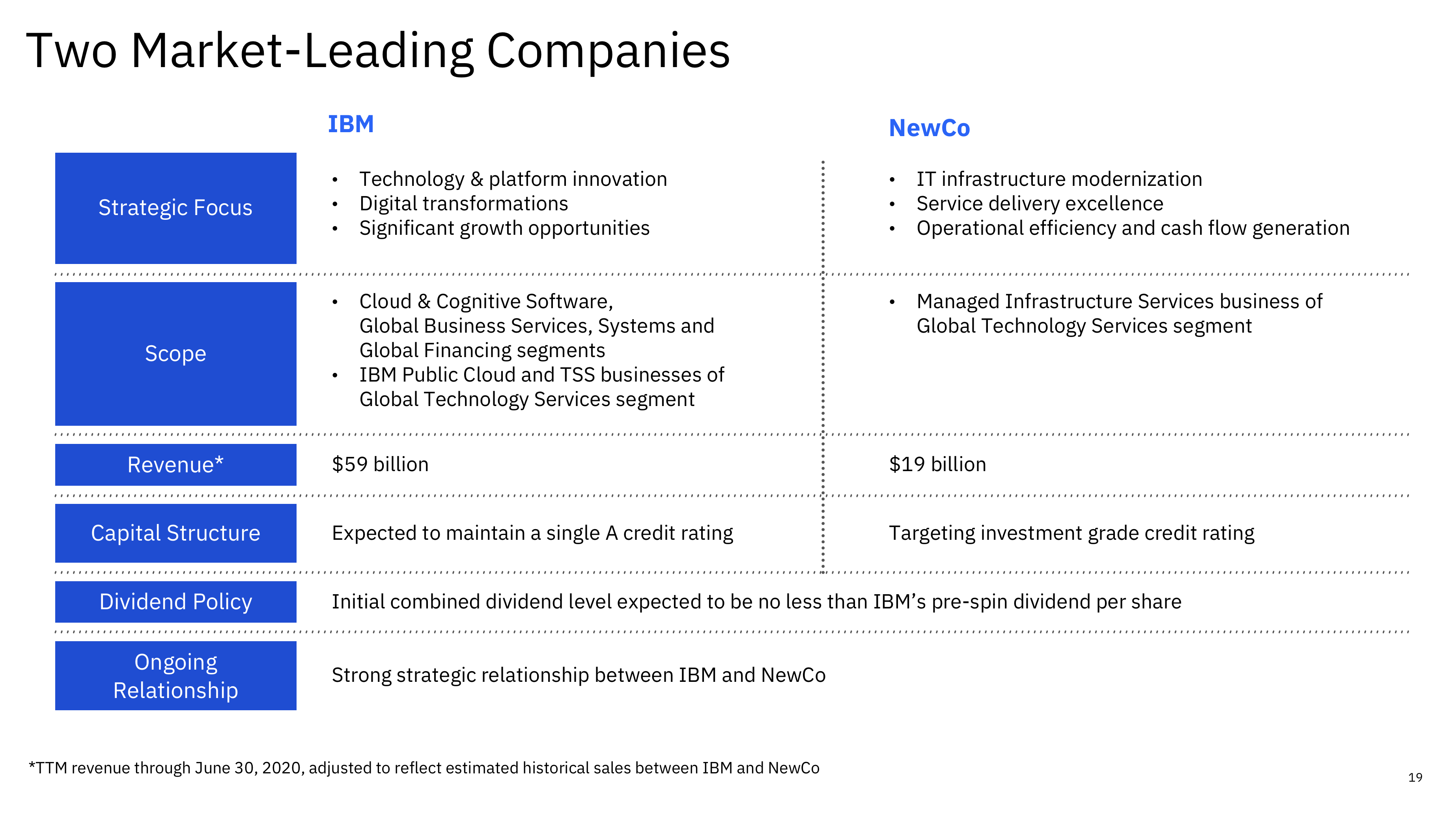

The new division does not yet have an official name and is called “NewCo” by IBM. marketing and investor relations materials. According to the allocation plan, press release states that IBM will “focus on its open hybrid cloud platform, which represents a $1 trillion market opportunity” and NewCo will “immediately become the world's leading provider of managed infrastructure services.” (That's because NewCo will start life owning all of IBM Global Technology Services' existing managed infrastructure customers, which means about 4,600 accounts, including about 75 percent of Fortune 100 companies.)

Reuters review The split is quoted by Wedbush Securities analyst Moshe Katri, who categorizes the managed infrastructure business as a business that IBM is wise to divest: “IBM is essentially divesting itself of a shrinking, low-margin business given the disruptive impact of automation and cloud technologies, masking stronger growth for the rest of the operation.”

Investors are reacting optimistically to news of the 109-year-old company's plans. IBM shares were up about 7 percent on the day at press time.